Table of Contents

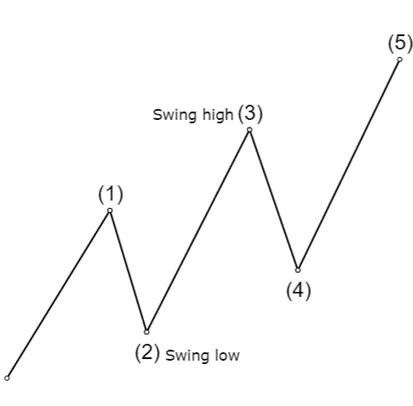

Analyzing market structure confuses a beginner trader. It is because sometime we amalgamate different strategies together which results in incorrect analysis. Identifying a swing high and swing low is the most significant step of market structure analysis.

Swing High and Swing Low

A swing high is a price point on chart from where the price reaches a peak and then begins to decline. For a swing high to be valid, it should be confirmed by subsequent price action. Price should move lower after reaching the swing high. Swing highs can act as resistance levels. When the price returns to this level, it may struggle to break above it.

A swing Low is a price point in a market where the price reaches a trough and then begins to rise. For a swing low to be valid, it should be confirmed by the next move. It means that price must move higher after reaching the swing low. Swing low can act as a support level. When price returns to the level, it is the possibility that price will struggle to break below it.

We also look for other ICT confirmations. A swing high and low are formed after a break of structure. Change of character changes the direction of the market.

Formation of Swing Low

Formation of the swing low takes place through the following steps:

- Price begins to decline from a higher level. This temporary decline is also known as corrective phase in an uptrend.

- The price continues to drop until it reaches a point where it starts to stabilize or reverse direction.

- To be considered a valid swing low, this trough must be surrounded by higher prices on both sides. In other words, the price at the swing low should be lower than the prices just before and after it.

- After reaching the swing low, the price begins to rise. This upward movement indicates that the market might be reversing or experiencing buying interest at this level.

- Crossing the previous swing high results in Break of structure (BOS) and results in a new impulse move and continuation of the trend.

The formation of swing low is the almost same but the difference is that the continuation of trend and break of structure in swing low and short-term corrective phase high is considered as swing high.

Candlestick Identification of Swing low

In candlestick identification of swing low, a trader performs the following steps:

- First step includes the identification of the lowest point in the current price range. The low of the candle should be lower than the lows of the surrounding candle.

- Check and compare the low of the candlestick with previous candlesticks. The low of the candlestick must be lower than the previous candlesticks.

- Check and compare the low of the candlestick with subsequent candlestick. The candlesticks do not cross the low of the lower candle.

By following these steps, you can accurately identify swing lows and make informed trading decisions based on market trends and price action.

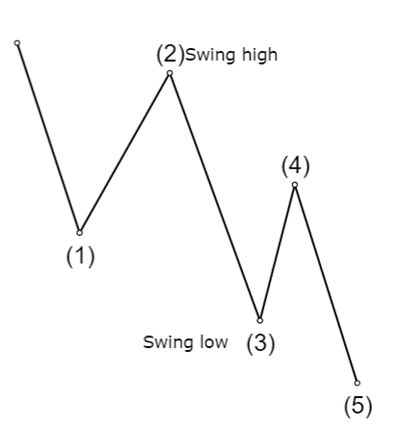

Formation of Swing High

Formation of swing high takes place through the following steps:

- After creating a lower low in corrective phase, price begins to rise from the lower level. This results in upward movement.

- The price begins to rise from a lower level, creating an upward movement. This rise should be significant enough to form a noticeable peak or high point in the chart.

- To be considered a valid swing high, this peak must be surrounded by lower prices on both sides. In other words, the price at the swing high should be higher than the prices just before and after it.

- After reaching the swing high, the price begins to decline. This downward movement indicates that the market might be reversing or experiencing selling pressure at this level.

- Break of structure results in a new swing high and continuation of the trend.

Candlestick identification of Swing high

To identify a swing high using candlesticks, you need to observe specific candlestick patterns and price action that indicate the peak has likely formed and a reversal is occurring. In candlestick identification, a trader performs the following tasks:

- Look for a candlestick that has reached a higher price level compared to the preceding candlesticks. This candlestick’s high should be the highest point in the recent price action.

- The candlestick immediately following the identified high should have a lower high. This indicates that the upward momentum is slowing down. The candlestick immediately preceding the identified high should have a lower high as well, establishing that the identified candlestick is the highest point (local maximum) in that sequence.

- Subsequent candlestick do not cross the high of the swing high candle and close lower than the swing high candle.

ICT context of Swing high and swing low

One of the major concepts of ICT is the analysis of market structure. Swing highs and swing lows are analyzed to understand overall market structure and potential trading opportunities.

- In ICT, swing highs help determine the market’s supply levels (order blocks) in a downtrend and the current trend’s strength. In an uptrend, higher swing highs indicate that the market is bullish and shows strength. Conversely, a failure to create new swing highs might signal a weakening trend or potential reversal.

- Swings lows are important because it helps in identifying potential order block during an uptrend. In a downtrend, lower swing lows suggest a bearish market. A failure to create new swing lows can indicate a weakening downtrend or a potential trend reversal.

- ICT traders pay attention to swing highs and lows to identify potential liquidity pools.

- These are levels where ICT trader look for market manipulation and false breakouts. Proper recognition of the false breakouts can help traders avoid getting trapped.

- Use of the swing highs and lows helps trader to map out price action and analyze the footprints of institutional traders.

Traders often make mistakes and use the foundational concepts alone. A trading decision must be filtered from various aspects.

Final Note

Trading involves significant risk and may not be suitable for all investors. Swing highs and lows provide insights into market trends and potential opportunities but should not be solely relied upon for decision-making. Always perform thorough research and consider your financial situation and risk tolerance before trading. Seek professional advice if necessary. Remember, past performance is not indicative of future results.

Frequently Asked Questions (FAQs)

What is a Swing High?

A swing high is a peak in the price chart where the price reaches a high point and then begins to decline. It is identified by comparing the high of a specific candlestick to the highs of the surrounding candlesticks, which should be lower.

What is a Swing Low?

A swing low is a trough in the price chart where the price reaches a low point and then begins to rise. It is identified by comparing the low of a specific candlestick to the lows of the surrounding candlesticks, which should be higher.

Why are Swing Highs and Swing Lows important in trading?

Swing highs and swing lows are critical for understanding market trends, identifying support and resistance levels, and making informed trading decisions. They help traders determine entry and exit points, as well as set stop-loss orders.

I’m Abdullah Shah, a content writer with three years of experience in crafting engaging and informative content. My background in market analysis complements my work, allowing me to create content that resonates with audiences. I’m also a seasoned practitioner in the forex and crypto markets, with a strong foundation and deep interest in finance. My passion for the financial world drives me to produce content that is both insightful and valuable for those interested in understanding market trends and financial strategies.