Table of Contents

In traditional market analysis, support and resistance are key psychological levels. It is considered that market must respect support and resistance areas. It is considered that there are buyers (in support area) who takes the price higher, and there are sellers (in resistance area) who takes the price lower. If price broke one of the levels, it moves in that direction. There are limitations to the concepts. Smart Money Concept (SMC) introduces supply and zone which are more flexible and logical. This article explores Supply and demand zones with respects to SMC and how to trade those zones.

Supply and Demand Zones

The concept of supply and demand is equally important in forex and other financial markets. Traders use the law of supply and demand in the financial market to trade with logic and confidence. It leads to make profits from market imbalances.

A supply zone is a price area where selling pressure overcomes buying pressure, leading to a drop in price. This typically happens after a significant upward move. Traders consider these zones as potential areas where price may reverse or pause, providing opportunities to enter short positions.

Supply zones are usually found after a bullish trend. These zones are marked by a sharp move down which could be the cause of institutional selling.

A demand zone is a price area where buying pressure overcomes selling pressure, leading to a rise in price. This typically happens after a significant downward move. Traders look at these zones as potential areas where price may reverse or pause, providing opportunities to enter long positions.

Demand zone zones are found after a strong bearish trend. These zones are marked by a sharp uptrend move indicating strong buying pressure which could be the result of strong selling pressure.

Supply and Demand Zones and SMC (Smart Money Concept)

Smart Money Concepts is a trading approach that focuses on understanding the behavior of institutional traders. SMC traders believe that large financial institutions control the market and that their buying and selling activities create supply and demand zones. By analyzing these zones, SMC traders aim to predict market movements and trade accordingly. Following are the key SMC principles:

- Understanding of the market structure is the crucial step in recognizing Key supply and demand zones.

- Order blocks are areas where institutional trader place huge orders, often causing significant price movements. SMC identifies these order blocks as potential supply and demand zones.

- SMC traders consider liquidity areas, such as stop-loss clusters and pending orders, as potential targets for institutional traders.

- Imbalances occur when there is a sudden, strong move in one direction, leaving a price gap. Order blocks with imbalances are considered as strong order blocks.

Supply and demand zones in SMC trading are powerful tools for identifying potential market reversals. By understanding the behavior of institutional traders and incorporating SMC principles, traders can develop strategies that align with the flow of “smart money” in the market.

Factors to consider with Supply and Demand Zones?

It is important to understand that supply and demand zones for ranging and trending market differs. SMC market structure helps in identifying key zones during a trending market. In SMC, identification of supply and demand zones incorporate the following things:

Break of Structure (BoS)

When price breaks through a significant level (prior high or low) of market structure, it is referred to as Break of structure. Break of structure is a sign of continuation of current trend. It is used to identify the direction of the market.

In an uptrend market, break of structure is the break of previous swing high and creates new higher high. On the other hand, in downtrend, break of structure is the break of previous swing low and creates new lower low. BoS in general suggest that the current trend is likely to continues.

Change of Character (CHOCH)

A Choc refers to a shift in market structure that indicates a potential reversal in the trend. It occurs when the market, which has been making higher highs and higher lows (in an uptrend) or lower lows and lower highs (in a downtrend), suddenly breaks the previous trend structure and forms a new structure in the opposite direction.

In an uptrend, price breaks previous higher low, this is considered as a reversal sign. In downtrend, price breaks previous lower high, this is considered as a potential sign of reversal.

Imbalance (Fair Value Gap)

In SMC and other institutional strategies, Fair value gap is considered as important point. It validates multiple things including supply and zones. Imbalance refers to a situation where there is an uneven distribution of buying and selling activity in the market, leading to a significant and rapid price movement.

Identification of Supply and Demand Zone (SMC)

Supply zone is the area where there are pending order to be executed. These pending orders left there because from there prices fall so abruptly leading to imbalances. The supply zone become the point of interest for traders and will be useful in a bearish trend.

Supply zones after a break of structure:

As we know, break of structure is a continuation of the trend. In this case it is a continuation of a downtrend. For identification, we perform the following task:

- The supply zone is often located just before a strong move downward. This is the area where selling pressure initially overcome buying pressure.

- Beware of the inducement zone.

- Wait for a retest of price to the supply zone. Price may retrace upward towards the supply zone. During the retest, traders look for bearish signs like bearish candlestick patterns (bearish engulfing or hanging man like candlestick patterns).

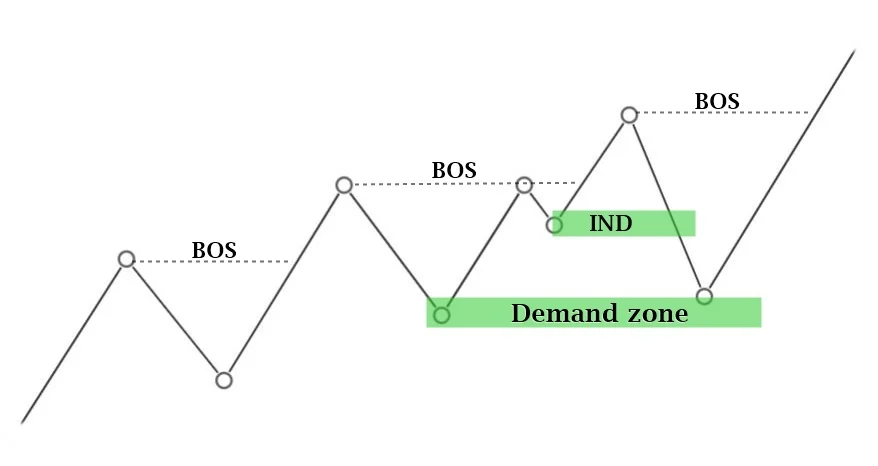

Demand zone after a break of structure:

In an uptrend, break of structure is a continuation of the trend. In this case, it is a continuation of an uptrend. For identification, we perform the following task:

- The demand zone is often located just before a strong upward move. This is the area where buying pressure initially overcome selling pressure.

- Beware of the inducement zone.

- Wait for a retest of price to the demand zone. Price may retrace downward towards the demand zone. During the retest, traders look for bullish signs like bullish candlestick patterns (rejection wick or engulfing pattern).

Concluding remarks:

It is important to remember that no strategy is 100% in trading market. So, manage you risk/reward ratio and do not risk all of your capital on the single strategy. In summary, understanding supply and demand zones, along with concepts like Break of Structure (BOS) and Change of Character (CHOCH), is essential for effective trading. Supply zones indicate potential resistance areas after a BOS, while demand zones highlight potential buying opportunities. Identifying and utilizing these zones helps traders make informed decisions, capitalize on trend continuations, and manage reversals effectively.

What is a supply and demand zone in trading?

A supply zone is a price area where selling pressure exceeds buying pressure, leading to a price drop. It is identified after a significant upward move and represents potential resistance.

A demand zone is a price area where buying pressure exceeds selling pressure, leading to a price drop. It is identified after a significant downward move and represents potential support.

How to identify a supply zone after a Break of Structure (BOS)?

To identify a supply zone after a BOS, look for the last significant rally before the BOS occurred. Mark the highest point before the sharp downward move as the upper boundary and the lowest point before the drop as the lower boundary. Watch for price retracement to this zone for potential selling opportunities.

What is a Break of Structure (BOS)?

A Break of Structure (BOS) happens when the price breaks through a previous high or low, indicating a continuation of the current trend. In an uptrend, it is when the price creates a higher high, and in a downtrend, it is when the price creates a lower low.

What is imbalance in trading?

Imbalance refers to a situation where the market experiences a rapid, one-sided price move, leaving gaps or inefficiencies on the chart. These gaps are areas where buying or selling pressure was unfulfilled, and the price often retraces to fill these gaps.

How to use supply and demand zones when trading options?

When trading options, supply and demand zones help identify key price levels where buying or selling pressure is strong. A supply zone indicates potential resistance where selling might increase, while a demand zone suggests support where buying might occur. By identifying these zones, traders can time their entry and exit points, choosing option strategies that align with expected price reversals or breakouts for more effective risk management.

I’m Abdullah Shah, a content writer with three years of experience in crafting engaging and informative content. My background in market analysis complements my work, allowing me to create content that resonates with audiences. I’m also a seasoned practitioner in the forex and crypto markets, with a strong foundation and deep interest in finance. My passion for the financial world drives me to produce content that is both insightful and valuable for those interested in understanding market trends and financial strategies.