Table of Contents

Standard Deviation itself is a statistical tool used to measure variability of price movement from its mean price. Standard Deviation is used for analyzing volatility and understanding how far price deviates from its typical behavior over a specific timeframe. SMC and ICT Traders use this differently. They use Standard Deviation Projections to identify high-probability trade setups.

This article explores understanding of ICT Standard Deviation Projection, their values and their anchoring, and use in bullish and bearish market.

Understanding of Standard Deviation Projection

In SMC and ICT trading, Standard Deviation Projections are a powerful tool for identification of potential retracement or reversal zones by aligning them with Fibonacci setting on a price chart. This involves projecting standard deviation levels onto an impulsive price move (the manipulative directional leg in price action) to predict areas on chart where the price is likely to react.

To apply the projections, Fibonacci tool is anchored to the high and low of the impulsive price move. Key projection levels are 1, 0, -1, -2, -2.5, and -4. These projection levels represent deviation expansion from the mean price action. These levels often align with the areas of liquidity pools, Fair Value Gaps, or PD Arrays.

When price reaches maximum expansion levels, a reaction in price action is observed. It happens either in the form of reversal towards equilibrium or a continuation with fading momentum. Overlapping Standard Deviation Projection with PD Arrays add confluence and enhances the accuracy of trade setups.

This approach not only helps pinpoint retracement zones but also used to predict price behavior. This makes it effective tool in ICT’s trading arsenal for smart money trading. However, it is advised not to trade alone with this tool. It would be better to use this tool as confluence with their existing strategy. It is used for take profit levels.

Measurement Settings of STDV Projections

Fibonacci retracement tool is widely used on trading platforms. However, its setting often requires modification for ICT Standard Deviation Projections. To align with STDV Projections, the levels must be adjusted to 1, 0, -1, -2, -2.5, and -4. These levels represent specific price deviations based on the impulsive price leg. These are customized levels help in identifying key zones for retracement, reversals, or expansions.

Rest of the things in settings are inferior like color and fonts. These setting of fib tool provide better visual clarity, and helps in distinguishing between potential reaction zones and deeper retracement areas.

Anchoring STDV Projections

Standard Deviation projections are used in both bullish and bearish scenarios. It is crucial to anchor the fib levels accurately in order to ensure reliable standard deviation projections.

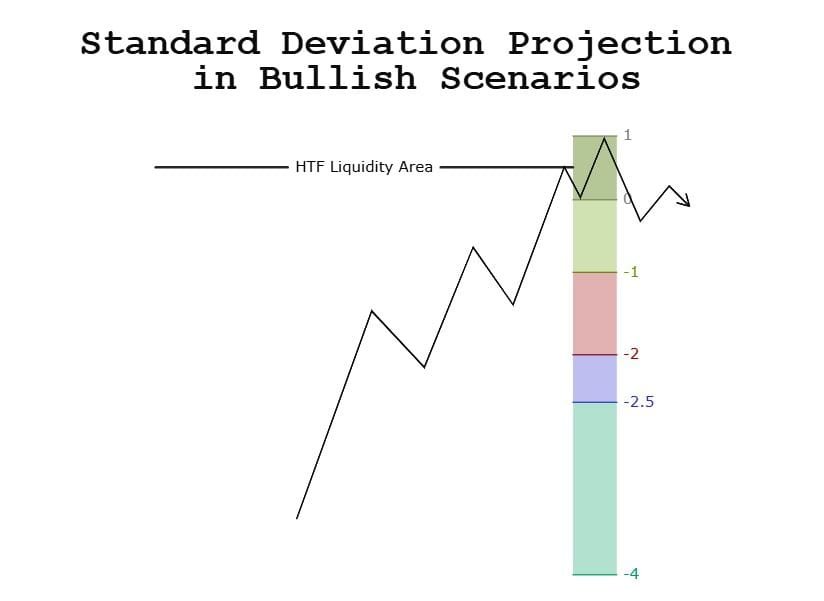

STDV Projections in Bullish Scenarios

In a bullish market, price forms higher highs and higher lows. This signals upward momentum. To identify key retracement or reversal zones, we have to locate the manipulative price move. It is the swing that swept liquidity before the market reversed or shifted structure (Change in state of delivery or MSS)

When price sweeps liquidity, especially on higher timeframes like above swing highs or equal highs, it traps traders on the wrong side of the market. This sweep of liquidity is known as the manipulation leg and considered as important for Fibonacci anchoring. On smaller timeframes, manipulative price leg from swing low to high is important. Fibonacci tool is anchored from the high of the manipulative leg to its low.

This setup allows traders to anticipate retracements or reversals at critical levels. These critical levels are -1, -2, or beyond. This must align with institutional order flow and PD Arrays like Order blocks or FVGs. By anchoring correctly, traders can trade with confluence between standard deviation projections, and liquidity concepts. This increases the precision of trade setups.

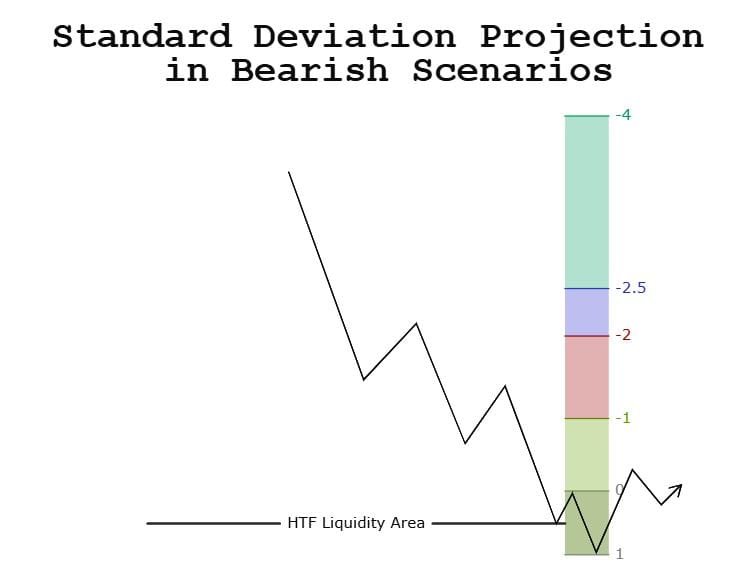

STDV Projections in Bearish Scenarios

In a bearish market, price forms lower lows and lower highs. This signals downward momentum. To identify key retracement or reversal zones, we have to locate the manipulative price move. It is the price swing that swept liquidity before the market reversed or shifted structure (Change in state of delivery or MSS)

When price sweeps liquidity, especially on higher timeframes like below swing lows or equal lows, it traps traders on the wrong side of the market. This sweep of liquidity is known as the manipulation leg and considered as important for Fibonacci anchoring. On smaller timeframes, manipulative price leg from swing high to low is important. Fibonacci tool is anchored from the low of the manipulative leg to its high.

This setup allows traders to anticipate retracements or reversals at critical levels. These critical levels are -1, -2, or beyond. This must align with institutional order flow and PD Arrays like Order blocks or FVGs. By anchoring correctly, traders can trade with confluence between standard deviation projections, and liquidity concepts. This increases the precision of trade setups.

Uses of Standard Deviation Projection in ICT Trading

STDV projection in ICT Trading is a valuable measurement tool that can serve as a key element in identifying high-probability trading setups. STDV projection measurements offer statistical framework for anticipating price behavior and adds confluence to existing trading strategies. This discussion focuses on the -2, -2.5 and -4 levels as area of interest.

Key Level of STDV Projections

When price moves to the -2 to -2.5 standard deviation range, this zone often marks areas of potential retracement or reversal. These levels aligns with the idea of price moving to extremes relative to its average behavior.

There can be the case when price reaches to this zone but shows signs of slowing momentum, this indicates potential reversal or retracement back toward equilibrium. This can be confirmed with price action. It is advised to look for sign of rejection, such as wicks, bullish engulfing or bearish engulfing candlesticks or other reversal patterns on lower timeframe to confirm a reaction.

However, there is also a possibility that price can displace and close below the -2.5 level. This signals the likelihood of further expansion. The next area of interest is the max expansion level.

Max Expansion

When price reaches the max expansion level, ICT Traders are advised to pause and re-evaluate the market

First thing in this re-evaluation is the use of premium and discount tool. Measure the most recent price swing using the premium and discount tool. We wait for the price to retrace to the equilibrium point.

Second thing is looking for its alignment with PD Array. We have to mark FVGs, OBs or liquidity areas that aligns with these levels. This provides further confluence for identification of potential reaction zones.

Final Note

Like ICT Optimal Entry, Standard Deviation Projections are a powerful tool in ICT Trading. These projections offer confluence in trading strategy and helps in identification of high-probability retracement or reversal zones. Like other ICT tools, this cannot be used alone in trading. Mostly, these projections are used for take profits levels.

Trading in financial markets carries significant risk and may not be suitable for all investors. This article is mere interpretation of STDV Projection and cannot contain a trading advice. If you are trading, do not use the capital that you cannot afford to lose. Seek professional advice before trading or investing.

Frequently Asked Questions (FAQs)

What is Standard Deviation Projection in ICT Trading?

STDV Projections helps traders identify potential retracement or reversal zones by measuring price deviation from the mean. This projection tool is used alongside other ICT tools for better entries and exits.

How are standard deviation levels are applied in trading?

Key projection levels are 1, 0, -1, -2, -2.5, and -4. Levels like -2, -2.5, and -4 are used as areas of interest. When approaches these levels, traders watch for potential retracements or reversal. On the other hand, if price displaces through these levels, further expansion or reactions are expected.

Why manipulation price swing is important for STDV Projections?

This is because the manipulation price swing sweeps liquidity before reversing. This leg is crucial for anchoring the Fibonacci tool to draw standard deviation projections.

Which timeframe is best for using STDV Projections?

It depends on the type of trading. Mostly, these projections are used for scalping and day trading. 15-min chart is used for finding key liquidity areas and 3-min or 1-min is used for finding manipulative price swing.

I’m Aatiq Shah, a dedicated forex and crypto market practitioner with three years of hands-on experience. Currently, I’m working as a Financial Manager. My journey in the world of finance has equipped me with the skills and knowledge needed to navigate the complexities of the forex and crypto markets.