Table of Contents

In SMC trading, having a confirmed Order Block gives an edge in trading. Single Candle Order Block represents a critical zone where institutional pending orders are waiting to be executed. SCOB is a zone provide accurate entry and exits.

This article explores its understanding, formation in bullish and bearish market scenario, and trading with SCOB.

Single Candle Order Block (SCOB)

In trading, right decision-making is quite confusing step. Sometime our directional bias is correct but it is difficult to find accurate entry points for trade execution. Success in trading is highly dependent on executing trades on right time. For this purpose, we try to spot liquidity sweeps on candlestick chart. These are the levels where market reacts strongly and decide its new direction.

A Single Candle Order Block is highly effective tools in this case. SCOB is represented by a single candlestick which sweeps liquidity of previous candlestick. This candlestick, mostly with long wick, indicates institutional activity and confirms a potential reversal in price direction. Although this is not a major sweep of liquidity but when price re-approaches the area again, market reacts strongly in smart money intended direction.

There are two advantages if SCOB is applied for trade entries: minimizing risk and maximizing reward. Single candle order block defines a precise zone for entry. Trades can place tight stop-loss orders above or below the block (depending upon market structure).

Bullish Single Candle Order Block (SCOB)

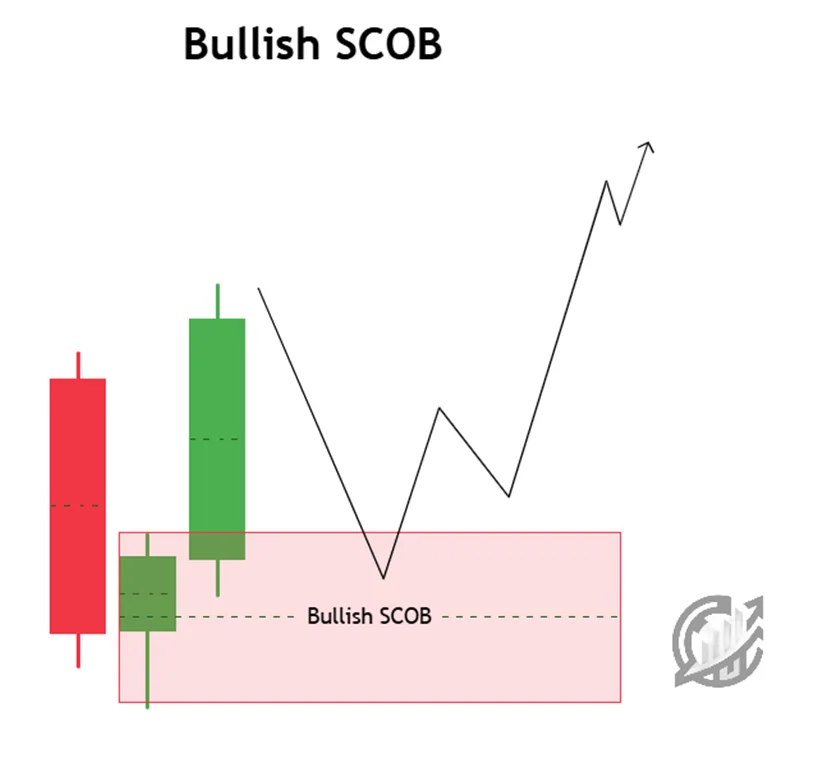

A Bullish Single Candle Order Block appears in strong bullish market. Bullish SCOB is used to identify potential bullish reversals. This provides trades high-probability entry points at critical price levels. In bullish market, SCOB forms when candlestick breaks the low of candle.

Identification of Bullish SCOB

Bullish SCOB is a single candle but its formation requires three candlesticks. Bullish SCOB forms in the following way:

- First candlestick forms at a bullish point of interest. It doesn’t matter whether market closes with long or short wick. If it forms near an imbalance (fair value gap), this indicates institutional market activity and presence of liquidity near this level.

- Second Candle is decisive candlestick for Bullish SCOB. This is a confirming candlestick for institutional involvement. It sweeps the low of the first candlestick. This sweep triggers stop-loss orders. If it closes above the low of first candlestick, it signals the presence of buying pressure.

- Third candlestick provides final confirmation of the bullish SCOB. Third candlestick must close above the high of the second candle. This candle is a strong bullish candlestick reflect strong bullish momentum. This validates the middle candlestick as the Bullish Single Candle Order Block.

This is the simple criteria for identifying Bullish SCOB. Simply, we wait for market retracement into the zone and look for strong market reaction.

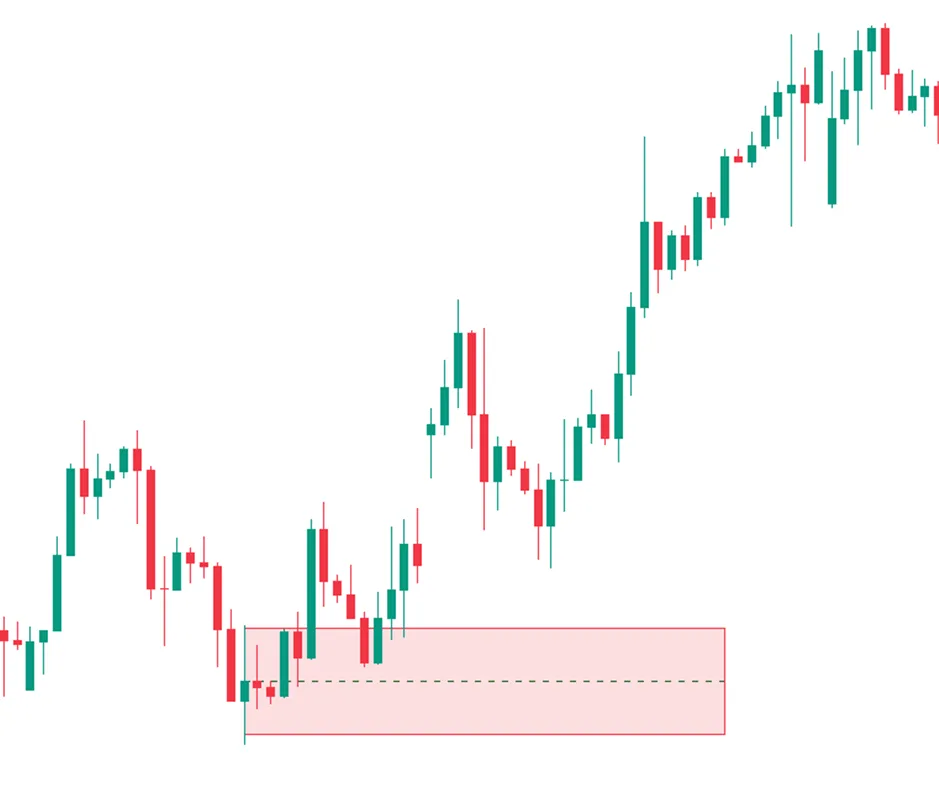

Trading with Bullish SCOB

Trading with Bullish Single Candle Order Block is a strategy used to minimize risk. It is one of the Smart Money trading strategies, that is why never consider it a complete trading model. You can combine other SMC and ICT concepts in order to strengthen the trading strategy.

Trading with Bullish SCOB starts with its identification. Analyze the three candles properly and combine with overall market structure. Close of third candlestick confirms the formation of Bullish SCOB.

Secondly, mark the bullish SCOB. For better understanding, you can highlight the middle candle as Bullish SCOB. You can also draw boundaries of candle by highlighting its high and low. This highlighted zone is remembered as Bullish SCOB.

Thirdly, wait for price retracement to the zone. It is universal for all financial assets that market retraces after every uptrend. You must wait for the price to retrace to the marked bullish SCOB. Never chase the price by trading outside this zone.

Additionally, you can check for various other confluences. It is common advice by market practitioners that trade with trend. With Bullish SCOB, we find bullish trade setups. That is the reason that your trade must align with bullish market structure. Bullish market moves by creating higher highs and higher lows.

Lastly, enter the trade. Upon successful retracement to that zone, find bullish candlestick patterns for perfect entries. You can also shift in lower timeframe and find Market Structure Shift (MSS) and place your entries accordingly. Your trades must have a proper stop-loss below the Bullish SCOB. Your targets must be logical like near-by liquidity zones.

Bearish Single Candle Order Block (SCOB)

A Bearish Single Candle Order Block appears in strong bearish market. Bearish SCOB is used to identify potential bearish reversals. This provides high-probability entry points at critical price levels. In bearish market, SCOB forms when candlestick breaks the high of candle.

Identification of Bearish SCOB

Bearish SCOB is a single candle but its formation requires three candlesticks. Bearish SCOB forms in the following way:

- First candlestick forms at a bearish point of interest. It doesn’t matter whether market closes with long or short wick. If it forms near an imbalance (fair value gap), this indicates institutional market activity and presence of liquidity near this level.

- Second Candle is decisive candlestick for Bearish SCOB. This is a confirming candlestick reflecting institutional involvement. It sweeps the high of the first candlestick. This sweep triggers stop-loss orders. If it closes below the low of first candlestick, it signals the presence of selling pressure.

- Third candlestick provides final confirmation of the bearish SCOB. Third candlestick must close below the low of the second candle. This candle is a strong bearish candlestick reflect strong bearish momentum. This validates the middle candlestick as the Bearish Single Candle Order Block.

This is the simple criteria for identifying Bearish SCOB. Simply, we wait for market retracement into the zone and look for strong market reaction.

Trading with Bearish SCOB

Trading with Bearish Single Candle Order Block is a strategy used to minimize risk. It is one of the Smart Money trading strategies, that is why it is never considered as a complete trading model. You can combine other SMC and ICT concepts in order to strengthen the trading strategy.

Trading with Bearish SCOB starts with its identification. Analyze the three candles properly and combine with overall market structure. Close of third candlestick confirms the formation of Bearish SCOB.

Secondly, mark the bearish SCOB. For better understanding, you can highlight the middle candle as Bearish SCOB. You can also draw boundaries of candle by highlighting its high and low. This highlighted zone is remembered as Bearish SCOB.

Thirdly, wait for price retracement to the zone. It is universal for all financial assets that market retraces after every downtrend. You must wait for the price to retrace to the marked bearish SCOB. Never chase the price by trading outside this zone.

Additionally, you can check for various other confluences. It is common advice by market practitioners that trade with trend. With Bearish SCOB, we find bearish trade setups. That is the reason that your trade must align with bearish market structure. Bearish market moves by creating lower lows and lower highs.

Lastly, enter the trade. Upon successful retracement to that zone, find bearish candlestick patterns for perfect entries. You can also shift in lower timeframe and find Market Structure Shift (MSS) and place your entries accordingly. Your trades must have a proper stop-loss above the bearish SCOB. Your targets must be logical like near-by liquidity zones.

Final Note

Order Block trading is highly recommended. These are the zones of institutional interest. This works only when Order Blocks are applied with precision and discipline. Single Candle Order Block can provide success in trading but requires thorough understanding, patience, and confluence with other technical factors like market structure and liquidity zones.

Trading carries significant risk and not suitable for all investors. SCOB and past price action helps but does not guarantee success in trading. That is the reason the reason there is nothing perfect in trading. It is advised not to trade with the money that you cannot afford to lose.

FAQs

What is a Single Candle Order Block (SCOB)?

In smart money trading, SCOB is a single candlestick that forms at a key price level. These levels can be a zone of liquidity, key swing highs or lows, or support or resistance areas. This singular candle represents institutional activity and confirms a potential reversal in price direction.

How to identify a Bullish SCOB?

Bullish SCOB must fulfill the requirement. Firstly, the first candle closes at a bullish area of interest with a wick. Secondly, the next candle sweeps the low of the first candle and closes above it. Lastly, the third candle closes above the high of the second candle.

How to identify a Bearish SCOB?

Bearish SCOB must fulfill the requirement. Firstly, the first candle closes at a bearish area of interest with a wick. Secondly, the next candle sweeps the high of the first candle and closes below it. Lastly, the third candle closes below the low of the second candle.

I’m Aatiq Shah, a dedicated forex and crypto market practitioner with three years of hands-on experience. Currently, I’m working as a Financial Manager. My journey in the world of finance has equipped me with the skills and knowledge needed to navigate the complexities of the forex and crypto markets.