Table of Contents

In highly volatile markets, traders take advantage of large jumps in asset prices. They capitalize on large movements. Gap up opening or gap down opening helps them to catch large price movements. In ICT trading, New Day Opening Gaps are useful because it can act as magnet for price. Price often reaches to fill the pending orders. One of the reasons for its importance is that these zones act as supply or demand zones.

This article explores understanding of ICT NDOG, its identification, importance and formation in bullish and bearish market scenarios.

Understanding of ICT New Day Opening Gap (NDOG)

In ICT Trading, we cannot ignore the importance of timing. Time-based trading gives an edge in trading and keep us disciplined in trading journey. New Day Opening Gap refers to the price gap between the closing price at 5:00 PM and the opening price at 6:00 PM (New York time). This occurs in forex market because Foreign Exchange Market halts trading for one hour daily from Monday through Thursday.

As far as the market closing is concerned, forex trading halts for the weekend. Any Gap observed when the market reopens on Monday is called ICT New Week Opening Gap (NWOG). Remember, these gaps are, either in bullish or bearish market, reference points for traders, As an ICT Trader, we can employ other ICT concepts when it comes to trading these gaps.

Identification of New Day Opening Gap (NDOG)

Trading with ICT NDOG requires careful its careful identification and in-depth understanding ICT concepts. It can be identified in the following way:

- Mark the 5:00 PM closing price. This represents the last traded price before the stop of trading in forex market.

- Mark the 6:00 PM opening price. This indicates the first traded price when the market reopens.

- Lastly, highlight the gap. You can use tool provided in charting software. This is the zone of NDOG.

Its identification is quite simple. However, its trading may confuse you. Be simple in your trading and try to use this as reference point. If you find the New Day Opening Gap on Higher timeframe, then switch your analysis to lower timeframe like 15 min or 5 min for actionable trading.

Importance of NDOG

Like regular imbalances in the form of BISI and SIBI, NDOGs are also considered as area of price imbalance or inefficiency. Market often revisits these areas to fill the gaps and establish fair value of an asset. This makes the asset attractive for liquidity and potential trading opportunities.

New Day Opening Gaps are aligned with concept of Fair Value Gaps. Remember, FVG is also imbalance in the market so the logic remains the same. These are the zone where price revisit and seek equilibrium. These gaps are magnet for price action.

One of the reasons for its importance is that NDOGs provides traders with strong areas of supply and demand. These areas can be a strong area of rejection, accumulation, or continuation. Well, it depends upon price action and market sentiment.

Trading with ICT NDOG

Effective trading with NDOG requires to follow the following steps:

- Identify the formation of New Day Opening Gaps. It forms from Monday through Friday.

- Identify the consequent encroachment of NDOG. It is the 50 percent areas of NDOG. It is crucial to draw because sometime market reverse from 50% area.

- Identify a clear directional bias. It can be extracted by using daily bias concept in ICT trading. Along with this, market structure analysis helps in determining the directional bias.

- NDOG sometime act as support or resistance zone. Lastly, it is indispensable to take confirmations by using lower timeframes. Market structure shift (MSS), Break of Structure (BOS), or Change of Character (CHOCH) near NDOG adds validity to the trading setup.

Formation of NDOG in Bullish Market

In Bullish Market, there are two Scenario for NDOG. New Day Opening Gap with price above it. Second is when price is below the NDOG. Now, it seems confusing but it is quite simple. In bullish market, in both scenarios, we expect market to continue bullish trend.

If price is above the New Day Opening Gap (NDOG) and your bias is bullish, we wait for the price to retrace to NDOG. Story never ends there. For bullish trend confirmations, it is advised to shift in lower timeframe (where structure is seen as bearish) and look for reversal signal in the form of Market Structure Shift (MSS) or Change of Character (CHOCH).

If price is below the New Day Opening Gap (NDOG) and your bias is bullish, we wait for the price to test the NDOG and close above the it. For bullish trend confirmations, it is advised to wait for the break of NDOG. After that shift in lower timeframe and wait for trend continuation pattern in the form of Break of Structure and retracement to the FVG or Order Block. You can target higher timeframe liquidity.

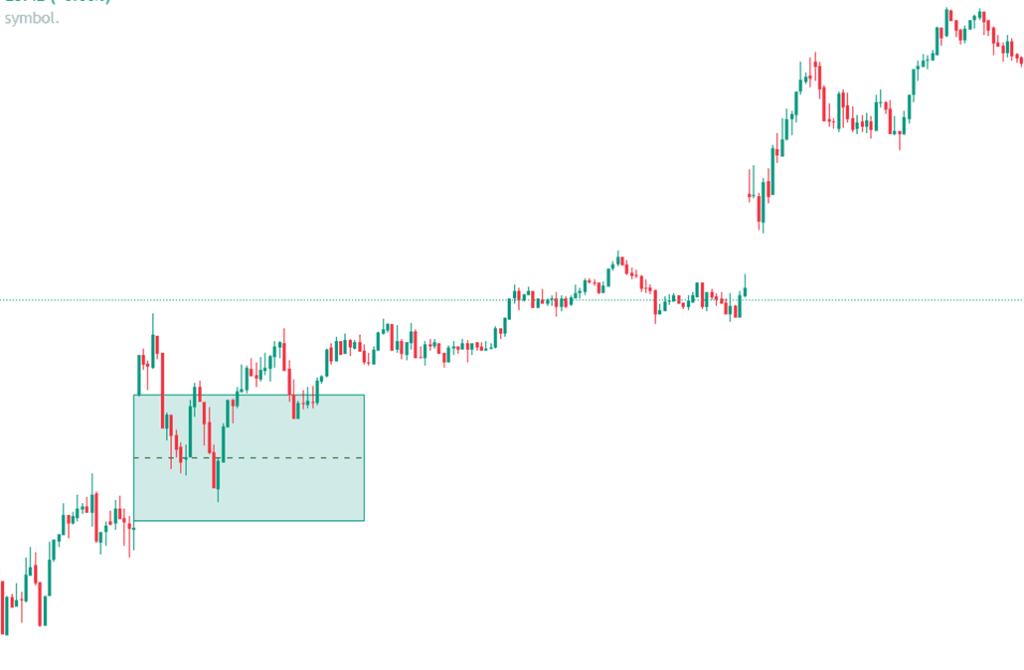

Here is the example of NDOG in Bullish market:

Here, the price is above the NDOG and then retraces before trend continuation.

Formation of NDOG in Bearish Market

In Bearish Market, there are two Scenario for NDOG. New Day Opening Gap with price below it. Second is when price is above the NDOG. Now, it seems confusing but it is quite simple. In bearish market, in both scenarios, we expect market to continue bearish trend.

If price is below the New Day Opening Gap (NDOG) and your bias is bearish, we wait for the price to retrace to NDOG. Story never ends there. For bearish trend confirmations, it is advised to shift in lower timeframe (where structure is seen as bullish because of HTF retracement) and look for reversal signal in the form of Market Structure Shift (MSS) or Change of Character (CHOCH).

If price is above the New Day Opening Gap (NDOG) and your bias is bearish, we wait for the price to test the NDOG and close below the it. For bearish trend confirmations, it is advised to wait for the break of NDOG. After that shift in lower timeframe and wait for trend continuation pattern in the form of Break of Structure and retracement to the FVG or Order Block. You can target higher timeframe liquidity.

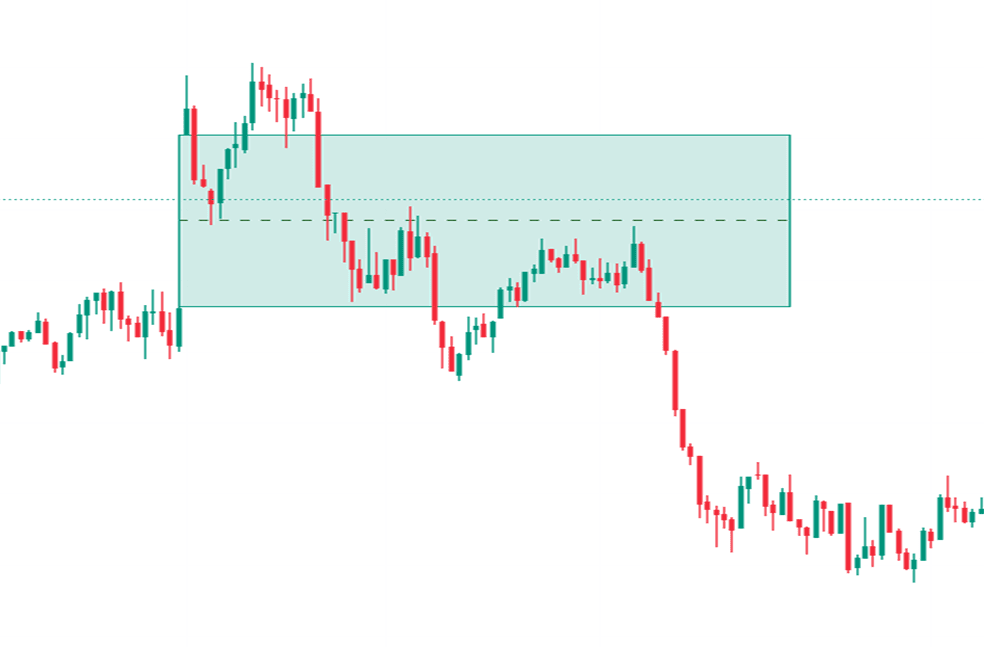

Here is the example of NDOG in Bearish market:

Here the price is above the NDOG. Market breaks it and test 50 percent of NDOG.

Final Note

The NDOG is a powerful tool for understanding price imbalances and predicting price movements. This approach to ICT trading helps in identification of high-probability trade setups based on price imbalances. Remember, this method enhances precision but it is not without risks. It is recommended to use proper risk management strategies before trading live markets.

Trading with New Day Opening Gap (NDOG) provides opportunities in financial markets but may not be suitable for all traders. Remember, past performance of price action helps uncover price behavior but does not guarantee future results. It is advised not to trade with the money you cannot afford to lose.

Frequently Asked Questions (FAQs)

What is an ICT New Day Opening Gap (NDOG)?

The NDOG is simply a price gap formed between 5:00 PM New York closing price and the 6:00 PM New York opening price in forex markets. NDOG represents a key area of price imbalance or inefficiency that traders can use as a reference for potential price movements.

Why are NDOGs are important?

Like Fair Value Gaps (FVGs), NDOGs act as a magnet for price. Price often retraces to these gaps and fill the pending orders to achieve fair value. These are the zone also serve as supply and demand zones for liquidity and price rejection.

How to identify a New Day Opening Gap?

To identify this, we mark the closing price at 5:00 PM and opening price at 6:00 PM New York time. This highlighted area between two levels on chart are referred to as NDOG.

Can NDOGs be used in both bullish and bearish market?

Yes, these gaps are formed in both bullish and bearish markets. If your bias is bullish, Price above the NDOG acts as support, while below it, the NDOG becomes a draw on liquidity. If your bias is bearish, Price below the NDOG acts as resistance, while above it, the NDOG becomes a draw on liquidity.

I’m Abdullah Shah, a content writer with three years of experience in crafting engaging and informative content. My background in market analysis complements my work, allowing me to create content that resonates with audiences. I’m also a seasoned practitioner in the forex and crypto markets, with a strong foundation and deep interest in finance. My passion for the financial world drives me to produce content that is both insightful and valuable for those interested in understanding market trends and financial strategies.