Table of Contents

Technical analysis often starts with analyzing market structure. A bearish market moves by creating lower lows and lower highs. Correct identification of lower lows (LLs) and lower highs (LHs) significantly impact market analysis.

This article explores understanding of bearish market structure, and identification of lower lows and lower highs.

Understanding Bearish Market Structure

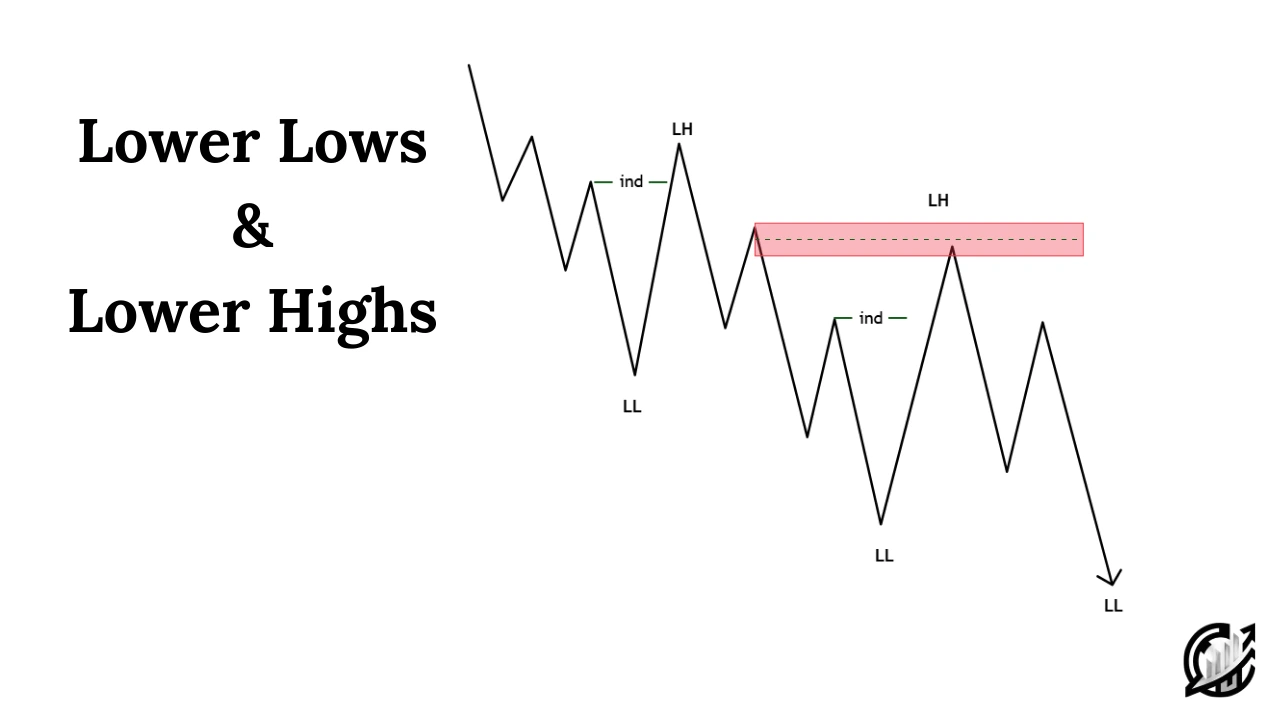

Bearish market is composed of lower lows and lower highs. Lower lows are the lowest points of a price movement. Every lowest point of price movement is lower than the previous low. Lower high is the last highest point of a price retracement which is lower than the previous high. In bearish market analysis, these two elements are combined to understand selling pressure and market pessimism.

According to SMC market analysis, bearish market creates lower lows but not all of them are considered as structural lows. There is a concept of inducement involved. In order to identify a valid lower low, one must have to identify an inducement level. Market must sweep liquidity above the inducement level. This confirms the structural low of a bearish market.

Next is to wait for the price to break the structural low. In SMC terms, it is known as Break of Structure. This denotes bearish trend continuation. However, if market is weak and breaks the recent lower high, this is considered as Change of Character (CHOCH). This represents shift of interest from bearish to bullish.

Identification of Lower Low (LL)

In bearish market structure, price action forms lower low. It is important to note that not all swing lows within a price downward impulse are valid structural lows (lower lows). Price must sweep liquidity above the inducement level.

Inducement is a level of liquidity. This can be recent minor swing highs within a bearish price move. Institutions use these levels to trap early traders. Like in bearish trend, inducement occurs when price retraces to trap traders into premature positions. There is a notion that this trap confirms the lower low. In order to find a valid lower low, you should follow the following steps:

- When price breaks a previous lower low and creates a new lowest point of price, this is a time to mark minor swing highs in recent price leg. Recent pullback can be the inducement zone we are looking for. However, there are other levels like equal highs, order blocks or any visible highs can be the inducement zones. These are the levels where liquidity is resting.

- When price form a swing low after a break of structure, we often expect price retracement. In retracement, price retraces upward and sweeps the liquidity resting above the inducement level.

- The last swing low formed before the inducement sweep is now confirmed as the valid lower low. This level represents structural strength.

- When price breaks below the valid lower low, this confirms the bearish trend continuation.

Inducement sweep in each price leg confirms strength and validity of lower low and filters out false breakouts. This improves the reliability of market structure analysis.

Identification of Lower High (LH)

In Bearish market structure, retracements are common part of downtrend. Price forms lower highs as part of bearish market structure. However, like lower low, not all higher swing highs are lower high. In order to confirm a lower high, the following points should be considered:

- After the inducement sweep, swing low becomes a valid lower low. It is advised to monitor the subsequent price movement. Price must forms swing high.

- After the formation of swing high, price must move downward and break below the previous lower low.

- The swing high is seen as a valid lower high. This level represents a structural point of resistance within the bearish trend.

Internal liquidity sweep is often considered as strong signal for bearish momentum.

Importance of LLs and LHs

Lower Lows and Lower Highs are used to identify downtrend in the market. If trend is identified accurately, these patterns are used to identify opportunities during retracements and capitalize on the downward momentum.

Another aspect is digging out market sentiments from lower lows and lower highs. When sellers dominate, price creates lower lows. This happens when price breaks its structure to the downside. This reflects strong bearish momentum.

Traders often use the previous lower high as stoploss level. This helps in managing risk during the trade taken when price reaches to its Order block zone. If price break above the last lower high, it may suggest trend reversal.

Identification of Structural Low and High after CHOCH

Change of Character refers to a shift in market structure. It indicates trend reversal. So, how would you identify lower lows and lower highs in a new emerging bearish trend. If your prior trend is bullish, CHOCH indicates trend reversal from bullish to bearish.

After a bearish change of character, it is crucial to confirm first lower high for new bearish trend. Following the CHOCH, the price often leaves liquidity at specific levels. These are the inducement levels where early traders are trapped.

Secondly, price forms a swing low below the previous bullish market structure. This swing low acts as a potential candidate for the first structural lower low. In the price leg there is an inducement to sweep. This inducement sweep confirms a valid structural lower low. This lower low is the foundation of the new bearish structure.

Lastly, as the trend progresses price is expected to decline and break the valid lower low. Each break of structure should be accompanied by an inducement sweep to confirms subsequent lower low.

Final Note

In SMC structure trading it is crucial to identify confirmed lower lows and lower highs. Inducement sweeps and structural confirmations enhances structure analysis and trade accuracy. Remember, structure analysis in trading is combined with trading strategies. However, no strategy guarantees success because markets are influenced by unforeseen events. Always combine technical analysis with risk management to minimize potential losses.

Trading forex, stocks, and cryptocurrencies involves significant risk and may not be suitable for all investors. Market volatility can lead to substantial losses. Never risk more than you can afford to lose. It would be better to take professional advice before making trading and investment decision.

Frequently Asked Questions (FAQs)

What is Lower Low (LL) in Trading?

A Lower Low in an asset occurs when the price creates new low by breaking the previous low. This indicates bearish momentum. Remember, not all lows are structural. We must collect confirmation in the form of inducement sweeps and Break of structure.

What is Lower High (LH) in Trading?

A lower high forms when price retraces but does not move above the previous high before making a new lower low. This confirms continued bearish momentum after a break of structure.

How does inducement help confirm a valid lower low?

Liquidity traps help us in marking confirmed lower low. Inducements are liquidity traps that the market sweeps before confirming a valid LL. A valid lower low is marked when price forms a swing low, then retraces to sweep inducement, and finally breaks structure to the downside.

I’m Abdullah Shah, a content writer with three years of experience in crafting engaging and informative content. My background in market analysis complements my work, allowing me to create content that resonates with audiences. I’m also a seasoned practitioner in the forex and crypto markets, with a strong foundation and deep interest in finance. My passion for the financial world drives me to produce content that is both insightful and valuable for those interested in understanding market trends and financial strategies.