Table of Contents

SMC and ICT trading is focused on Order Blocks and their types. Among other types, one of them is Vacuum Block. Market movements are not straight forward to understand. Vacuum Block represent area of price area where market move in one direction. Market often retraces to fill the gaps before continuing its original movement.

This article explores core concept of Vacuum Block, its formation in bullish and bearish market structure, reasons for the formation of Vacuum Block, and trading with bullish and bearish vacuum blocks.

Understanding ICT Vacuum Block

Michael Huddleston describes different types of Order Block in his ICT Teaching. ICT Vacuum Block refers to a price gap created due to high volatility events. These events can be economic data releases, geopolitical events. Vacuum Blocks are also created because of session, day or week opening. These vacuum gaps forms when the market opens significantly higher or lower then previous close. This scenario leaves a vacuum of liquidity.

Vacuum Blocks indicates a lack of equilibrium between buyers and sellers in that price range. These gaps are important for smart money traders because often retraces to the gaps for future price action. Markets are inherently drawn to rebalance liquidity and fill inefficiencies. This makes the vacuum block important zone on interest.

Vacuum blocks created during weekly or daily openings are common in forex and stock markets due to weekend news or session-specific volatility. These gaps reflect rapid repricing as markets adjust to new information, leaving a temporary imbalance.

For Traders, these blocks present high-probability trading opportunities. Price retracement to the zone makes them attractive areas for entries and exits. Traders often wait for the price to retrace to the zone and then enter in a trade aligned with higher timeframe market structure. Recognizing and leveraging these blocks can significantly enhance a trader’s strategy and success.

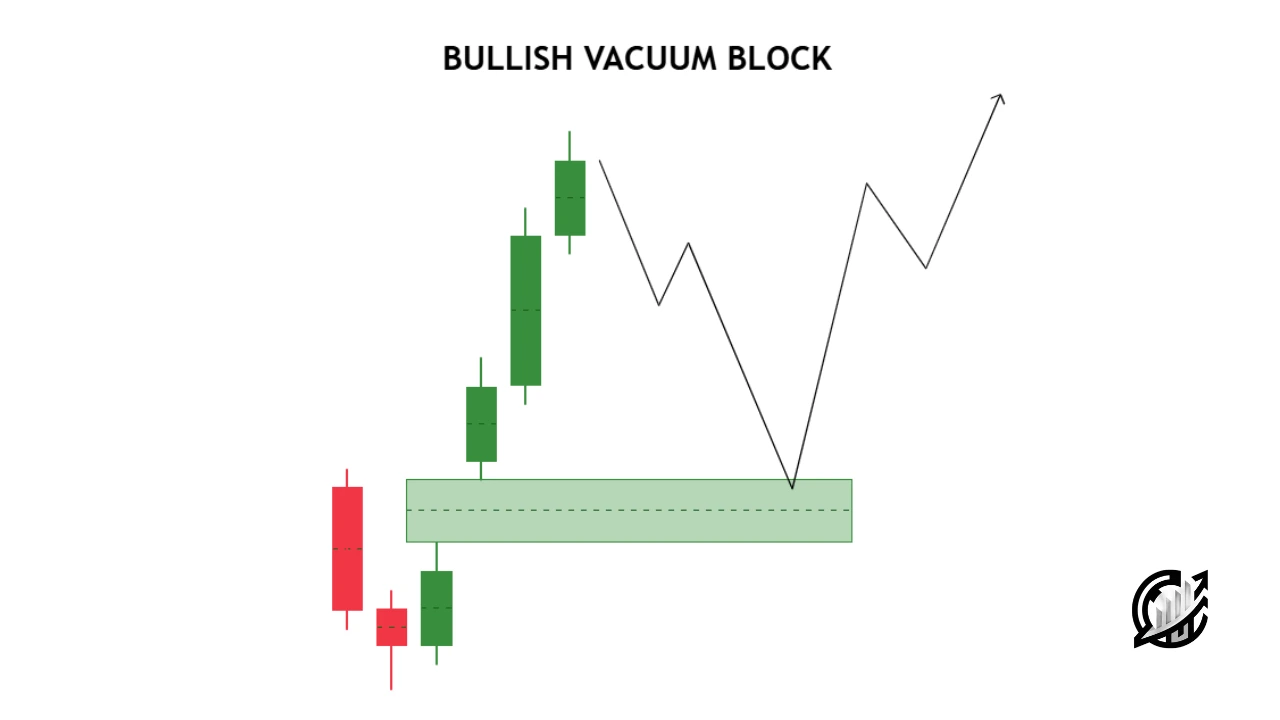

Bullish ICT Vacuum Blocks

In ICT, Bullish Vacuum Block forms when the price opens above the current market price. This opening above the price leaves a gap behind. High-volatility events like economic data releases or geopolitical development causes the gaps to form. The bullish vacuum blocks represent a liquidity void created as price moves so quickly that no trades occur within the gap.

This upside gapping is common during session, week or daily opening. In forex, gapping occurs if there is news before the market closes. The gapping indicates strong bullish momentum. This leads to an imbalance between buyers and sellers. Market retraces to seek equilibrium. These gaps become attractive zone for potential retracement before continuing in the direction of the original trend. Price retracement to the unfilled gaps provides an opportunity for traders and investors to capitalize on the gap-fill process.

Trading with Bullish Vacuum Block

Trading with ICT Vacuum blocks requires the following steps:

- Here lies the important fundamental analysis. First step is the understanding of events and their impact on bullish market. Start by analyzing the event that caused the gap. If the event has a long-term bullish continuation, it strengthens the case for bullish continuation.

- Wait for the price to retrace into the vacuum block. Price often rebalances the equilibrium and fill the liquidity void.

- Identify the 50 percent of the Vacuum Block. This level is known as consequent encroachment level.

- When reaches to the 50 percent of the bullish vacuum block, switch to a lower timeframe and look for bullish confirmation signals. Mostly, we wait for the ICT Market Structure Shift (MSS) or ICT inversion Fair value Gap (IFVG).

- Once market reversal is confirmed on lower timeframe, plan and execute trade with a stop loss placed below the low of the vacuum block to protect against adverse moves. Your take profit is near the swing highs or other liquidity areas.

This is the structured approach of trading with bullish vacuum blocks. Traders can trade effectively with bullish vacuum blocks align their positions with the higher timeframe market structure.

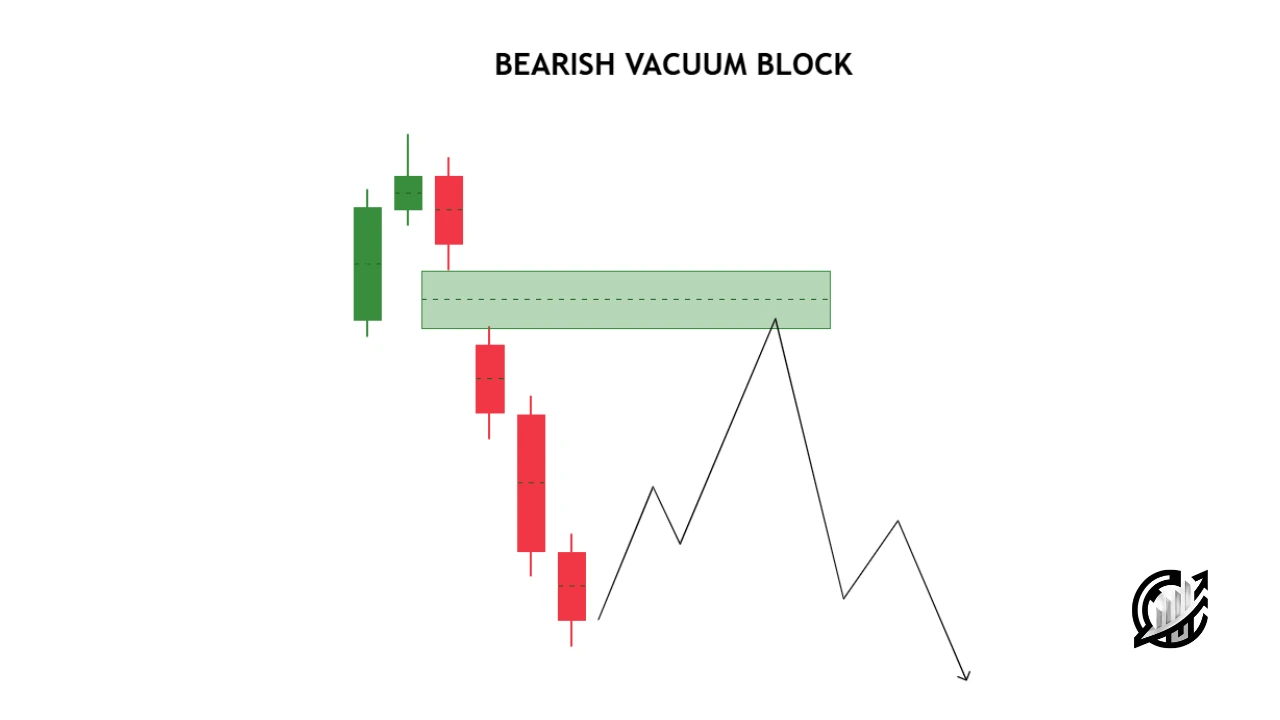

Bearish ICT Vacuum Blocks

In ICT, Bearish Vacuum Block forms when the price opens below the current market price. This opening below the price leaves a gap behind. High-volatility events like economic data releases or geopolitical development causes the gaps to form. The bearish vacuum blocks represent a liquidity void created as price moves down so quickly that no trades occur within the gap.

This downside gapping is common during session, week or daily opening. In forex, gapping occurs if there is news before the market closes. The gapping indicates strong bearish momentum. This leads to an imbalance between buyers and sellers. Market retraces to seek equilibrium. These gaps become attractive zone for potential retracement before continuing in the direction of the downtrend trend. Price retracement to the unfilled gaps provides an opportunity for traders and investors to capitalize on the gap-fill process.

Trading with Bearish Vacuum Block

Trading with ICT bearish Vacuum blocks requires the following steps:

- Here lies the important fundamental analysis. First step is the understanding of events and their impact on bearish market. Start by analyzing the event that caused the gap. If the event has a long-term bearish continuation, it strengthens the case for bearish continuation.

- Wait for the price to retrace into the vacuum block. Price often rebalances the equilibrium and fill the liquidity void.

- Identify the 50 percent of the Vacuum Block. This level is known as consequent encroachment level.

- When reaches to the 50 percent of the bearish vacuum block, switch to a lower timeframe and look for bearish confirmation signals. Mostly, we wait for the ICT Market Structure Shift (MSS) or ICT inversion Fair value Gap (IFVG).

- Once market reversal is confirmed on lower timeframe, plan and execute trade with a stoploss placed above the high of the vacuum block to protect against adverse moves. Your take profit is near the swing highs or other liquidity areas.

This is the structured approach of trading with bearish vacuum blocks. Traders can trade effectively with bearish vacuum blocks align their positions with the higher timeframe market structure.

Final Note

Like other types of Order Blocks, trading with ICT Vacuum Blocks requires patience, understanding of market structure, and technical confirmation. It is advised to mark the 50% of the vacuum block. Price often does not fill the complete vacuum block. That is the reason 50% is the most visited area in FVGs and Order Blocks. Like other concepts, it is confirmed using ICT market structure shift by shifting in lower timeframes.

As you know trading carries significant risk and not suitable for all investors. Some time gaps remain unfilled. So, there is no guarantee that market all the time fill the voids. Market conditions can change unexpectedly. Use proper risk management and do not rely on any single strategy. Seek professional advice before investing or trading in the market.

FAQs

What is an ICT Vacuum Block?

An ICT Vacuum Block is a gap that is created because of high-volatility events and are also created because of session, day or week opening. These gaps are the voids represent absence of either buyers or sellers. Market often revisit to fill the pending orders.

What is a bullish Vacuum Block?

Bullish Vacuum Blocks form when the price opens above the current market price. This opening above the price leaves a gap behind. This gap can act as a magnet for price. Price often revisit the bullish vacuum block just like price visit a fair value gap. The purpose remains the same. Market collect the pending liquidity for trend continuation.

What is a bearish Vacuum Block?

Bearish Vacuum Blocks form when the price opens below the current market price. This opening below the price leaves a gap behind. This gap can act as a magnet for price. Price often revisit the bearish vacuum block just like price visit a fair value gap. The purpose remains the same. Market collect the pending liquidity for trend continuation.

I’m Aatiq Shah, a dedicated forex and crypto market practitioner with three years of hands-on experience. Currently, I’m working as a Financial Manager. My journey in the world of finance has equipped me with the skills and knowledge needed to navigate the complexities of the forex and crypto markets.