Table of Contents

There are different types of Order Blocks within an ICT Dealing Range. ICT emphasizes on each of the OB and explains their importance in Smart Money Trading. One of the types is ICT Rejection Blocks. This type of Order Block is different from other types. Rejection Blocks are formed at major swing highs and major lows. These Order Blocks forms after raid on liquidity.

This article explores a core concept of ICT Rejection Blocks, its formation in bullish and bearish market, and trading with Rejection Blocks.

Understanding ICT Rejection Blocks

It is a powerful tool of price action. Concept of ICT Rejection Blocks is rooted in the principles of institutional order flow and liquidity manipulation and sweep. Rejection Block is identified when price sweeps a key liquidity level. Liquidity resides above or below major high and low. This raid on liquidity results in long rejection wicks and shift in market structure.

Formation of rejection block begins with price targeting liquidity pools above swing high or below swing lows. This move is often driven by algorithms seeking to trigger stop losses or attract breakout traders into the market. Following the sweep, price sharply reverses, leaving a long rejection wick as evidence of rejection from the institutional level. The body of the candle closes significantly away from the wick’s extreme, confirming the rejection. These rejection candles are often referred to as Institutional Funding Candles. This rejection zone then acts as a sensitive area where price may revisit, providing high-probability trade setups.

A rejection block is validated by a shift in market structure. This Shift in market structure signals the change of intention from institution.

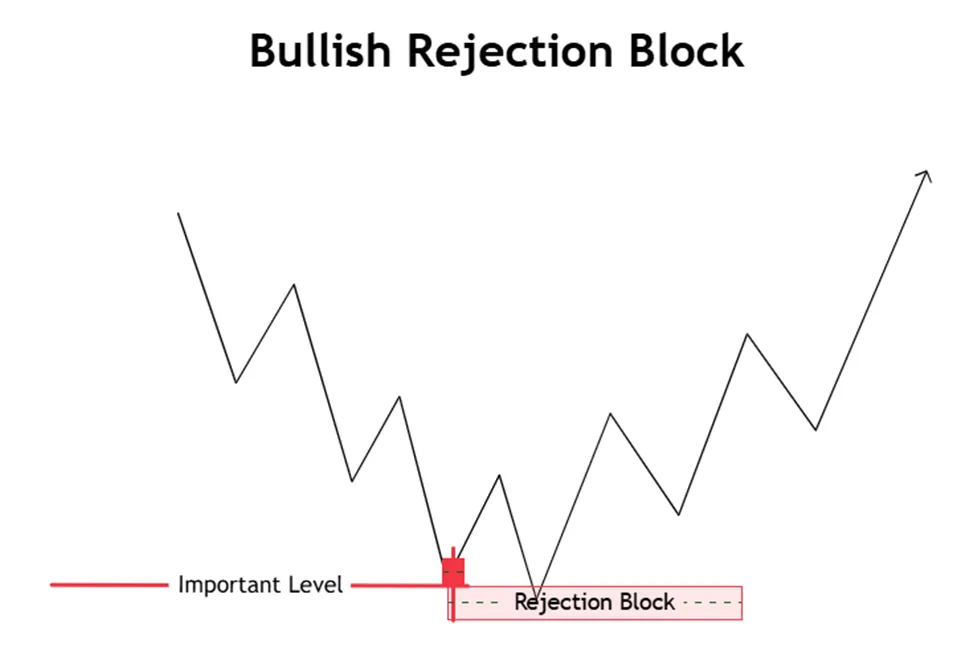

Bullish ICT Rejection Blocks

A Bullish ICT Rejection block highlights the precise momentum and potential reversal to the upside after the market sweeps liquidity below significant low. Concept of Bullish Rejection is rooted in the principle that price action is driven by institutional algorithms that hunt liquidity. The liquidity is the resting liquidity below swing lows, equal lows or other support levels. Bullish Rejection Blocks are clear representation of institutional interest in reversing the price direction to the buy side.

Bullish Rejection Blocks forms when price breaks below a previous low and then close the high of the candlestick. This results in long wick in a candlestick. This wick represents liquidity hunt. The long lower wick of a candlestick indicates strong buying pressure. This long lower wick shows that institutions and smart money absorbed the selling pressure and reversed the price upward.

This concept is validated when the market shifts structure to the upside. Market Structure Shift is the clue that indicates reversal of trend. The rejection block then serves as a high-probability entry point when revisited.

Trading with Bullish Rejection Block

Trading with Rejection Block requires the following steps:

- When price retraces to the bullish rejection block, particularly below the body of the candle, this creates an opportunity for buyers to enter at discounted levels. Upon observing a rejection or confirmation (confirmation can be gathered by aligning with market structure), a buy trade can be executed

- Risk management is crucial to plan. Your stop-loss should be 10 to 20 pips below the low of the rejection wick. This is a safe entry pattern. It gives you the room for minor volatility.

- Your initial targets include the nearest liquidity zones. These zones can be the recent highs or fair value gaps. If your trade is aligned with higher timeframe market structure, you can extend your targets with premium zones on higher timeframes.

Bullish Rejection works effective when aligned with higher timeframe market structure and bullish bias. This setup leverages institutional behavior and allowing traders to align with the smart money for high-probability trades.

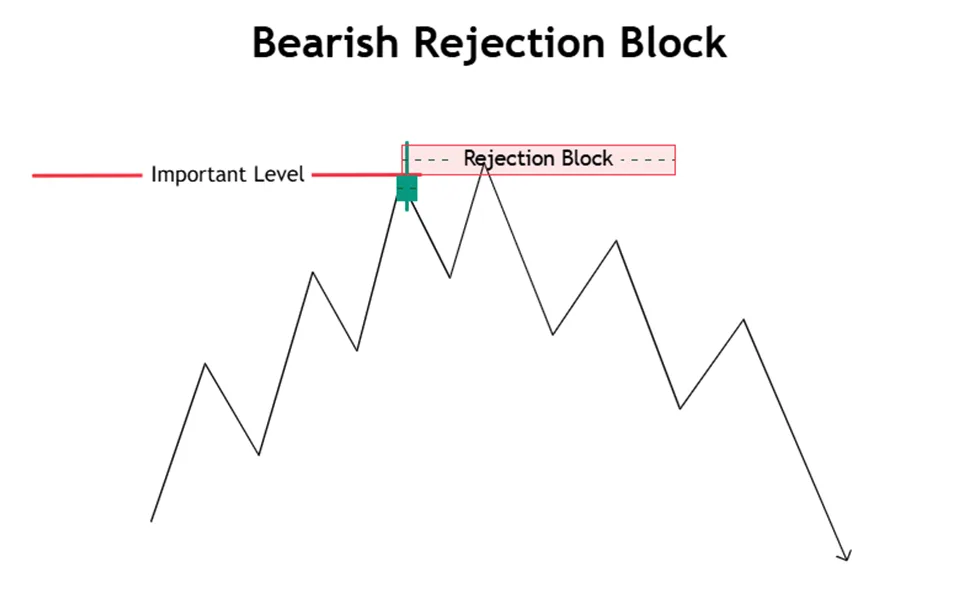

Bearish ICT Rejection Blocks

A Bearish ICT Rejection block highlights the precise momentum and potential reversal to the downside after the market sweeps liquidity above significant highs. Concept of Bearish Rejection is rooted in the principle that price action is driven by institutional algorithms that hunt liquidity. The liquidity is the resting liquidity above swing highs, equal highs or other resistance levels. Bearish Rejection Blocks are clear representation of institutional interest in reversing the price direction to the sell side.

Bearish Rejection Blocks forms when price breaks above a previous high and then close the low of the candlestick. This results in long wick in a candlestick. This wick represents liquidity hunt. The long upper wick of a candlestick indicates strong selling pressure. This long lower wick shows that institutions and smart money absorbed the buying pressure and reversed the price downward.

This concept is validated when the market shifts structure to the downside. Market Structure Shift is the clue that indicates reversal of trend. The rejection block then serves as a high-probability entry point when price retraces to the zone.

Trading with Bearish Rejection Block

Trading with Rejection Block requires the following steps:

- When price retraces to the bearish rejection block, particularly above the body of the candle, this creates an opportunity for seller to sell at premium levels. Upon observing a rejection or confirmation (confirmation can be gathered by aligning with market structure), a sell trade can be executed

- Risk management is crucial to plan. Your stop-loss should be 10 to 20 pips above the high of the rejection wick. This is a safe entry pattern. It gives you the room for minor volatility.

- Your initial targets include the nearest liquidity zones. These zones can be the recent lows or fair value gaps. If your trade is aligned with higher timeframe market structure, you can extend your targets with discount zones on higher timeframes.

Bearish Rejection works effective when aligned with higher timeframe market structure and bearish bias. This setup leverages institutional behavior and allowing traders to align with the smart money for high-probability trades.

Final note

Using ICT Rejection Blocks provide structured approach to trading ICT Liquidity Sweep and institutional order flow. Like, other trading concepts, this strategy gives an edge but sometime fails. This can be validated by using other ICT concepts like Market structure shift, FVGs, etc.

Financial markets carry significant risk that is why no signal concept or strategy guarantee consistent success in trading. It is advised to trade with the capital that you can afford to lose. Past performance can help in understanding future price behavior but does not guarantee success in trading. Seek professional advice before engaging in live trading.

FAQs

What is an ICT Rejection Block?

ICT Rejection Block is a price action setup where price sweeps liquidity. In Rejection Block, price sweeps liquidity, forms a long wick, and shift market structure. This long wick represents institutional rejection. This long wick is a key area where price may revisit before continuing in the direction of the rejection.

What is a Bullish Rejection Block?

A Bullish Rejection Block forms after a liquidity sweep below old lows, creating a long lower wick. Price shifts market structure to the upside. This confirms bullish intent.

What is a Bearish Rejection Block?

A Bearish Rejection Block forms after a liquidity sweep below old highs, creating a long upper wick. Price shifts market structure to the downside. This confirms bearish intent.

What is the success rate of ICT Rejection Blocks?

No strategy guarantees 100% success. However, with proper risk management and confluences, rejection blocks offer high-probability setups. Success depends on market conditions, trader discipline, and execution.

I’m Aatiq Shah, a dedicated forex and crypto market practitioner with three years of hands-on experience. Currently, I’m working as a Financial Manager. My journey in the world of finance has equipped me with the skills and knowledge needed to navigate the complexities of the forex and crypto markets.