Table of Contents

In trading, order flow refers to the examination of actual purchase and sell orders in the market, which sheds light on the goals of different players in the market. Through the analysis of order flow from investors, traders, and institutions, traders are able to determine the sentiment of the market and anticipate future price fluctuations. Although this method’s origins are in floor trading, it has developed with electronic markets to provide more accurate and instantaneous transactional data analysis.

Understanding Order Flow in Trading

Order flow is the flow of orders in financial markets, driven by traders, investors, institutions, and other participants. Buying or selling of these orders impact market structure, momentum, and price direction. Order flow is important to understand because it shows where big players in the market are making transactions and how it affects the dynamics of the market as a whole examination of transactional information.

The ICT (Inner Circle Trader) Order Block is a fundamental idea in order flow analysis. An order block is a region on the chart where large buy or sell orders from institutional traders have caused a shift in the momentum of the market. These blocks show the areas that institutions are most likely to protect their positions or re-enter. There’s usually a large reaction when price retraces into these order blocks, giving traders a chance to follow institutional moves.

Another way to spot order flow is to look for candlestick patterns that deviate from the main market trend. These counter-trend movements frequently happen as a result of price manipulation by major market participants or institutions, which generates liquidity and encourages retail traders to open positions. The market usually proceeds in the direction of the major trend, reflecting the underlying institutional purpose, after sufficient liquidity has been accumulated.

Order flow is essentially a representation of the constant struggle between sellers and buyers, in which institutions are vital players. Trading professionals can more accurately predict price fluctuations and match their trades with the main forces in the market by examining order flow and recognizing important structures such as ICT Order Blocks.

Ideas from Institutional Order Flow

An institutional idea called “market order flow” shows the “footprints” of big financial institutions and experienced traders, or smart money. These players can’t execute their big orders all at once because they have a lot of capital. Rather, they gradually accumulate holdings, particularly in the wake of a rally’s retracements.

These institutions can add to or modify their positions when the price pulls back without significantly affecting the market. The reason “order flow” candlesticks appear during these retracements is that they show the slow but steady inflow of smart money into the market, setting up the next trend move.

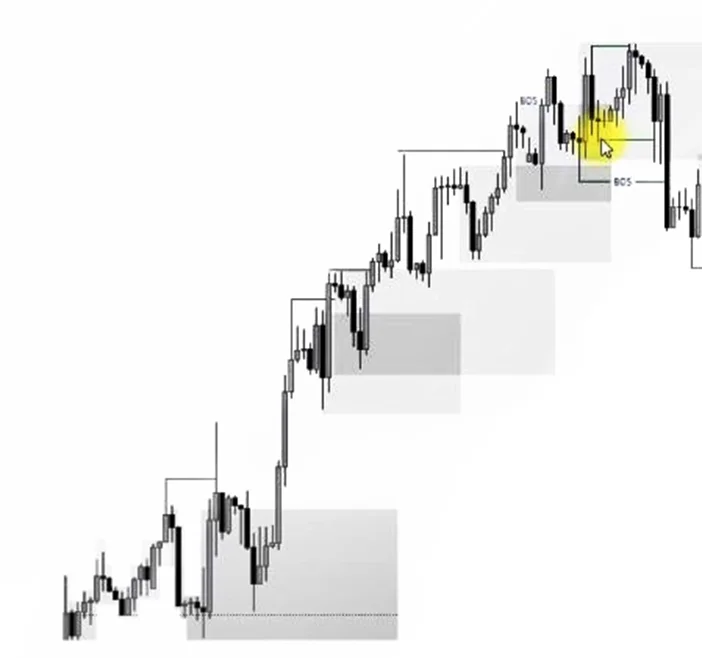

Identification of Bullish ICT Order Flow

The bearish candlesticks (pullback) that emerge during a bullish trend just before a break of structure takes place are referred to as bullish order flow. The bearish candlesticks indicate a brief pullback, during which smart investors are building up their investments in hopes of further gains.

These declines serve as a crucial area of price support and indicate a possible buying opportunity for traders. The price validates the support given by the bearish retracement candlesticks and confirms the continuance of the bullish order flow as it breaks the previous high and starts its upward journey.

If there is a single bearish candle pullback in a bullish order flow scenario, that single candle can be identified as the order flow. If pullback is comprised of multiple candlesticks, all the pullback candlesticks are referred to as order flow zone This sector is a good representation of where smart money is probably establishing positions.

Order Flow zone is of interest to traders because it provides support for possible buy entries, and traders believe that after the retreat is over, the price will resume its bullish trajectory. The order flow zone turns into a crucial stage for upcoming market responses.

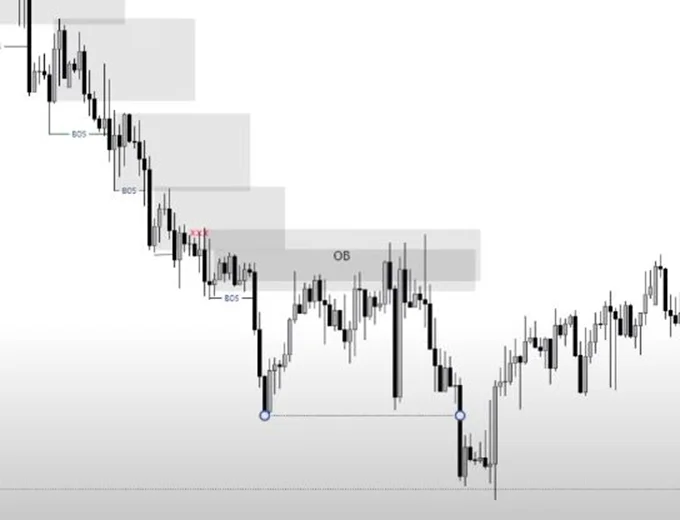

Identification of ICT Bearish Order Flow

Bearish Order Flow is the bullish candlesticks (pullback) that appear before a break of structure during a bearish trend. These bullish candlesticks indicate brief upward movements, which give institutions the opportunity to build up sell positions even as the general market trend continues to decline. As a possible resistance zone where price is likely to pause before continuing its bearish trend, this pullback area is crucial for traders.

If there is only one candlestick as pullback, that candle can be referred to as bearish order flow. However, if there are multiple bullish candlesticks, all of them are referred as bearish order flow zone. This zone is representative of a larger institutional activity region where smart money is probably setting up to take advantage of additional downward volatility.

Trading with ICT Order Flow

ICT and SMC traders trade with order flow with the confluence of other ICT and SMC concepts.

Market structure analysis is the backbone of SMC and ICT trading. With the whole context in mind, traders wait for the opportunity by looking at Order Blocks and Order Flow. Order Flow zones are important when there is a proper break of structure. Order Flow zone occurs before a break of structure.

ICT trading concepts emphasizes on Liquidity areas. Order flow often seeks out these liquidity pools to induce retail traders into the market. It allows traders to execute large trades and accumulates more assets for future benefit.

Within the Order Flow zone, there is order block where institutions previously placed large buy or sell orders. Order Block levels are important for institutions because they often use them to accumulate orders.

Impulsive price swings often result in imbalances. Price often retraces to fill the gaps. Confluence of the Order flow and FVGs can results in better results. According to ICT, the London Open and New York Open are two important times of the trading day when institutional traders are most active. Through the combination of order flow and these kill zones, traders can time their moves to coincide with the movements of smart money during times of high volume.

Final Note

Although, ICT trading concepts provide much deeper insights related to trading, but it does not guarantee success in trading. As a trader you must follow risk management strategies and place stop-loss in you trading,

I’m Aatiq Shah, a dedicated forex and crypto market practitioner with three years of hands-on experience. Currently, I’m working as a Financial Manager. My journey in the world of finance has equipped me with the skills and knowledge needed to navigate the complexities of the forex and crypto markets.