Table of Contents

Predicting the next move is a crucial task in financial market. There are numerous strategies and concepts are used to predict continuation or reversal of a trend. SMC and ICT traders look for supply and demand zone within ICT dealing range. Bullish and Bearish Order Block are the one kind of supply and demand levels.

This article explores its importance, key features, Bullish and Bearish order blocks, and additional factors used in ICT and SMC analysis.

Understanding of ICT Order Blocks

ICT and SMC trading approaches revolves around looking for institutional activity. It is indispensable for smart money trader to look for whether institutions are buying or selling. Order Block (OB) represents a price zone where large institutions have placed huge numbers of buy and sell orders.

Order Block is a candlestick or a series of candlestick that marks a region where institutional traders have accumulated orders before a significant market movement. OBs can be found in both uptrend and downtrend. Normally OBs are identified in bearish market as the last bullish candle before a sharp move down. This is known as bearish order block. In uptrend, last bearish candle before a sharp move up. This is known as Bullish Order Block.

A sharp trader must identify institutional footprints. They wait for the price to mitigate the order blocks in order to buy or sell in the market. It helps trader to align with smart money and profit from large price movements.

Feature of ICT Order Blocks

The following are the features in order to understand the function within smart money trading strategies:

- Institutional Activity: On Candlestick price chart, order blocks are zones where institutions have place huge number of orders. SMC and ICT trader marks the important zones for their trading. In ICT approach to trading, these are the zones where larger number of pending orders are waiting to be executed. These zones matter for retailer because their small orders do not move the market. So, the try to align their trading with large players.

- Imbalances: Immediate price movement often creates imbalances in the market. ICT refers to the zones as Fair Value Gap. OB after FVG are considered as more reliable one. It is because ICT and SMC trader believes that immediate price movement leads to unfilled order in the market. This causes the market to retraces to the zones and fill the orders before deciding its major market movement.

- Reversal or Continuation: The most important part of ICT and SMC trading is identification of reversal or continuation. It is the most critical part of Order Block trading. If market hits an order blocks and reverses, this can be an indication that the area is used to change the direction of market (known as change of character). Sometime after retracement, market continue its prior trend.

- Price reaction at the OB: Once the price reaches an Order Block, the reaction is crucial. Traders normally find entries in smaller time-frames.

Recognizing institutional activity helps in trading logically. Order Blocks are based on market inefficiencies created by institutional activity. It provides clearer zones for placing stop losses and profit targets.

Bullish Order Block

A Bullish OB is a concept in smart money trading that highlights areas where large institutions have placed significant buy orders. It leads to a sharp bullish price movement. It is a key signal for retail traders looking to follow institutional footprints. To identify a valid bullish OB, specific conditions must be met to ensure that the zone reflects institutional buying pressure and provides a high-probability trade setup.

- A valid Bullish OB typically identified with two candles. First candle is a bearish candle and the second candle is bullish. The second helps in identifying order block in ICT dealing range. When second candle traded through the high of the lowest candle, the order block is validated. Numerous traders wait for the price to trade the lowest candle low. This action is considered as liquidity grab and a validity point for SMC traders.

- The second candle closes above the last bearish candle. This represents a shift in market sentiment. This indicates entry from institutional buyers.

- A valid Bullish OB is accompanied by an imbalance or fair value gap. Fair Value Gap can form in both higher time-frame and lower time-frame. Some traders believe that FVGs in Lower time-frame are more reliable. ICT and SMC approach to trading believes that market retraces to these FVGs to collect pending orders.

- Finally, to confirm a bullish order block, there must be a structure shift in lower time frames. This means that the market must display signs of a change in trend from bearish to bullish on smaller time frames (e.g., 1-minute, 5-minute charts). A structure shift typically involves a Break of Structure (BOS) or a Change of Character (CHOCH), where price breaks previous lows or highs, signaling that the bearish momentum has ended, and bullish momentum has taken over.

It is recommended to Identify Order Block carefully. Remember its accuracy is dependent upon Market Structure. If there is Flaw in market structure, there must be a flaw in OB identification. Bullish order block cannot be a random candlestick pattern. OB within ICT dealing range is combination of Bullish and Bearish Order candlesticks.

Bearish Order Block

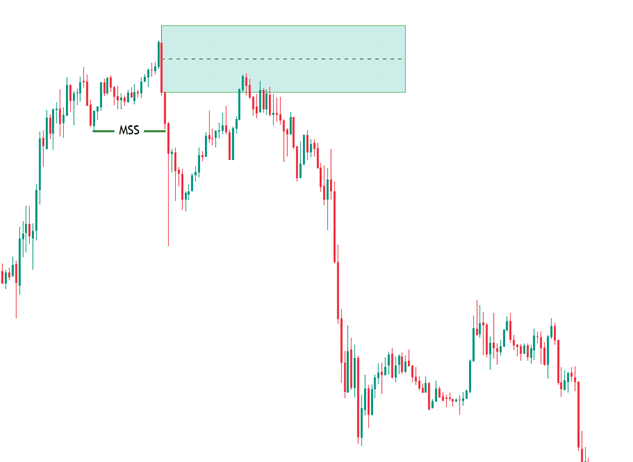

A Bearish OB is a concept in smart money trading that highlights areas where large institutions have placed significant sell orders. It leads to a sharp bearish price movement. It is a key signal for retail traders looking to follow institutional footprints. To identify a valid Bearish OB, specific conditions must be met to ensure that the zone reflects institutional selling pressure and provides a high-probability trade setup.

- A valid Bearish OB typically identified with two candles. First candle is a bullish candle and the second candle is bearish. The second helps in identifying order block in ICT dealing range. When second candle traded through the low of the recent highest candle, the order block is validated. Numerous traders wait for the price to trade the highest candle high. This action is considered as liquidity grab and a validity point for SMC traders.

- The second candle closes below the last bullish candle. This represents a shift in market sentiment. This indicates entry from institutional sellers.

- A valid Bearish OB is accompanied by an imbalance or fair value gap. Fair Value Gap can form in both higher time-frame and lower time-frame. Some traders believe that FVGs in Lower time-frame are more reliable. ICT and SMC approach to trading believes that market retraces to these FVGs to collect pending orders.

Finally, to confirm a bearish order block, there must be a structure shift in lower time frames. This means that the market must display signs of a change in trend from bullish to bearish on smaller time frames (e.g., 1-minute, 5-minute charts). A structure shift typically involves a Break of Structure (BOS) or a Change of Character (CHOCH), where price breaks previous swing lows or highs, signaling that the bullish momentum has ended, and bearish momentum has taken over.

Final Note

SMC and ICT Order Block concept are powerful concepts. These concepts provide institutional footprints related to buying and selling zones. However, using the concept alone is not recommended. There are other ICT tools that can be combined with trading strategy. Our understanding of market structure should be clear and accurate.

Trading financial markets involves significant risk. So, using OB or any other concept in trading does not guarantee success. Traders should ensure they fully understand the risks and consider seeking advice from financial professionals.

Frequently Asked Questions (FAQs)

What is an Order Block in trading?

On a Price Chart, an Order Block (OB) is a supply or demand zone where institutional trader place their buy or sell orders. Price often retraces to these zone before continuing in smart money intended direction. These areas are considered as areas of high trading interest.

How market structure helps in identification of valid Order Block?

It is crucial to identify valid order block for trading. Understanding of Market structure helps in confirming the validity of an order block. A shift in market structure (valid BOS or CHOCH) indicates a potential reversal or continuation of the trend. Order Block in the zone is considered as valid.

Can Order Blocks be used in all markets?

Remember, we use different strategies to decode institutional behavior. That is why concept of Order Blocks can be used in all financial markets (Forex, commodities, stocks, and crypto etc.)

I’m Aatiq Shah, a dedicated forex and crypto market practitioner with three years of hands-on experience. Currently, I’m working as a Financial Manager. My journey in the world of finance has equipped me with the skills and knowledge needed to navigate the complexities of the forex and crypto markets.