Table of Contents

In Smart Money Trading, liquidity is one of the most important and influential concepts. It allows traders to think out of the box. Trading financial markets requires deep understanding of price action and an open mind which flexibly accept the ups and downs of financial market. In Financial Markets, liquidity is the fuel that move the market. Liquidity Void represent areas on a candlestick chart where little to no trading activity occurs.

This article explores understanding of ICT Liquidity Void, its formation in bullish and bearish Market, and trading with ICT liquidity void.

Understanding ICT Liquidity Void

The term “Liquidity Void” is used by Michael Huddleston in his ICT mentorship. ICT Liquidity Void focuses on market inefficiencies (Fair Value Gaps) and institutional order flow. In order to get clarity of the concept, break down the two words: Liquidity refers to the availability of buyers and sellers willing to transact at specific price, while void refers to the absence of activity. Together, this presents a market condition where price move in one direction and leaves an area of imbalances due to absence of opposite orders.

Liquidity void forms when price breaks out of a consolidation phase. When market breaks above or below, institutions and smart money moves the price rapidly without retracement. This move is a strong directional move and candlestick of that move has no or little wicks. It is composed of two or more candlesticks with two or more Fair Value Gaps. The one side strong move leaves the other side nearly absent.

These voids are significant because market seeks to balance over time. Imbalance caused by liquidity void often attract price back to the area. The retracement to the area fills the inefficiency. This retracement of price provides opportunities for traders to anticipate entries. Potential buy and sell entries depend upon advanced market structure and break of major structure levels (Break of structure, Market structure shift, and Change of Character).

ICT Bullish Liquidity Void

A bullish Liquidity void forms when price break out of a consolidation phase and moves strongly upward. This move is a strong bullish displacement move (contain at least 2 to 3 strong bullish candlesticks with little or no wicks) where price surges in one direction due to the dominance of buyers and absence of sellers. This imbalance, created by this sharp move, leaves a void on the chart. This is known as bullish ICT liquidity void.

This phenomenon reflects market inefficiency because price fails to trade at intermediate levels due to insufficient opposing sell orders. It is the institutional orders or market event (news or geopolitical events) that creates such imbalances. This moves the price to the buy side.

How ICT Bullish Liquidity Void forms?

When price break out of a consolidation range, the absence of sell-side liquidity during the breakout allows buyers to dominate. After that price moves rapidly to the upside by creating large bullish candles with little to no retracement. This imbalance signals that market left unfilled sell-side orders.

In Bullish Market Structure, the price often retraces into the void to fill this imbalance before resuming its upward trend. Market retraces in order to rebalance itself by attracting opposing orders to the voided area.

Trading with an ICT Bullish Liquidity Void

Trading with Bullish liquidity void required confluence of other ICT concepts. In order to trade effectively with liquidity, one must understand ICT market structure. If the market is bullish, the void acts as a support zone. ICT trader can look for buying by shifting in lower timeframe. The following are the steps to trade a bullish liquidity void:

- Look for the market structure. Market structure must be bullish by creating higher highs and higher lows.

- Locate the liquidity void. Look for the imbalance within a displacement move.

- Wait for the price to retrace to the liquidity void.

- Shift in lower timeframe and wait for shift in structure. This is the confirmation within a void.

- If market shift its structure, you can execute trade with stoploss below the void. Your profit target will be the swing high or any other liquidity area.

This is a structure approach of trading with liquidity void. Bullish liquidity void serves as a support zone in an uptrend. Market structure is the base of trading any ICT or any other concept. By aligning with the market structure, trader can capitalize on market moves.

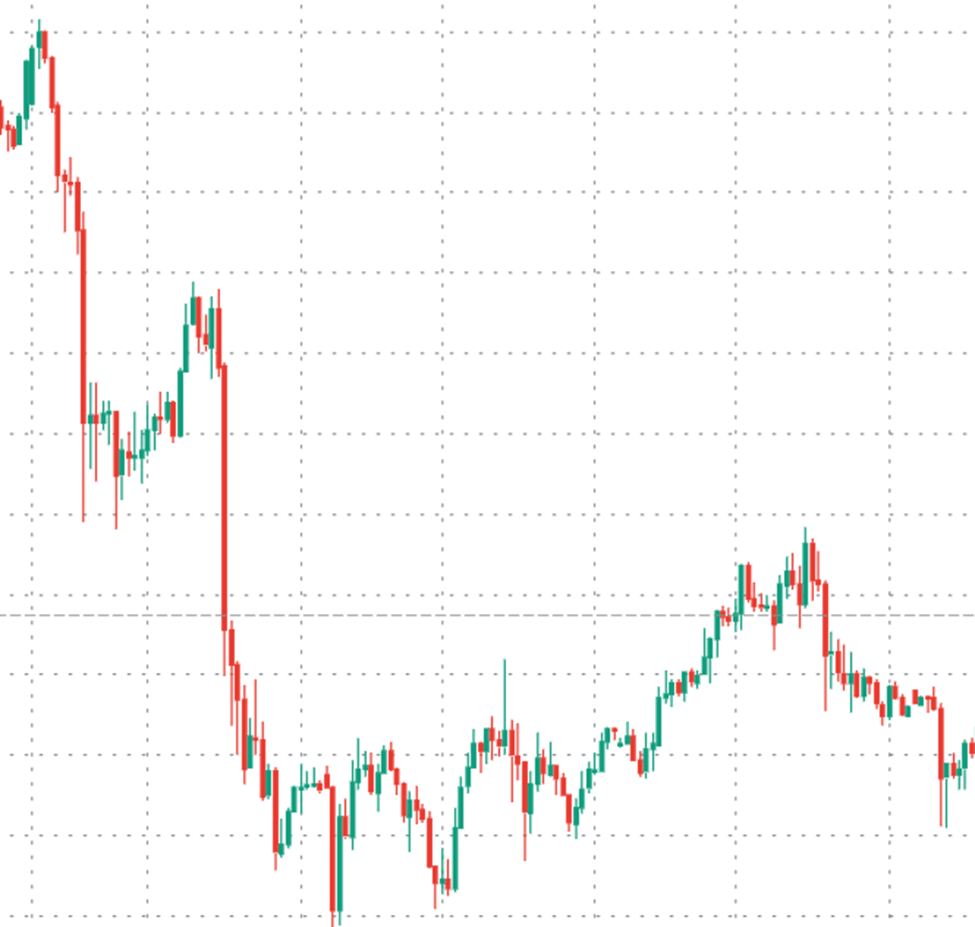

ICT Bearish Liquidity Void

A bearish Liquidity void forms when price break out of a consolidation phase and moves strongly to downside. This move is a strong bearish displacement move (contain at least 2 to 3 strong bearish candlesticks with little or no wicks) where price surges in one direction due to the dominance of sellers and absence of buyers. This imbalance, created by this sharp move, leaves a void on the chart. This is known as ICT bearish liquidity void.

This phenomenon reflects market inefficiency because price fails to trade at intermediate levels due to insufficient opposing buy orders. It is the institutional orders or market event (news or geopolitical events) that creates such imbalances. This moves the price to the sell side.

How ICT Bearish Liquidity Void forms?

When price break out of a consolidation range, the absence of buy-side liquidity during the breakout allows sellers to dominate. After that price moves rapidly to the downside by creating large bearish candlesticks with little to no retracement. This imbalance signals that market left unfilled buy-side orders.

In Bearish Market Structure, the price often retraces into the void to fill this imbalance before resuming its downward trend. Market retraces in order to rebalance itself by attracting opposing orders to the voided area.

Trading with an ICT Bearish Liquidity Void

Trading with Bearish liquidity void requires confluence of other ICT concepts. In order to trade effectively with liquidity, one must understand ICT market structure. If the market is bearish, the void acts as a resistance zone. ICT trader can look for sell entries by shifting in lower timeframe. The following are the steps to trade a bearish liquidity void:

- Look for the market structure. Market structure must be bearish by creating lower lows and lower highs.

- Locate the liquidity void. Look for the imbalance within a displacement move.

- Wait for the price to retrace to the liquidity void.

- Shift in lower timeframe and wait for shift in structure. This is the confirmation within a void.

- If market shift its structure, you can execute trade with stoploss above the void. Your profit target will be the swing low or any other liquidity area.

This is a structure approach of trading with liquidity void. Bearish liquidity void serves as a resistance zone in an downtrend . Market structure is the base of trading any ICT or any other concept. By aligning with the market structure, trader can capitalize on market moves.

Final Note

Whether its bullish or bearish liquidity void, it offers high-probability trade setups in the financial market. By recognizing areas of imbalances created by displacement moves, traders can capitalize on retracements that fill these voids before the trend continues. Like other ICT trading concept, it requires a deep understanding of market structure and ICT daily bias.

Like other strategies and concepts, this does not guarantee success in financial markets. Trading involves substantial risk. Past price action does not guarantee future price movements. Never trade with the money that you cannot afford to lose. Liquidity voids are not guaranteed to fill. Always use proper risk management strategies to protect your capital.

Frequently Asked Questions (FAQs)

What is a liquidity void?

A liquidity void is a market imbalance where price moves rapidly in one direction, leaving untraded price levels due to the absence of opposing orders. These areas often act as magnets for price to retrace and fill.

What causes a liquidity void?

Liquidity voids are caused by displacement moves, typically triggered by institutional activity, large orders, or significant news events. These moves overwhelm the opposing side (buyers or sellers), resulting in sharp price imbalances.

Are liquidity voids reliable for trading?

While they are valuable tools, liquidity voids require skill in analysis and risk management. They are most effective when combined with other tools like market structure and institutional concepts.

I’m Aatiq Shah, a dedicated forex and crypto market practitioner with three years of hands-on experience. Currently, I’m working as a Financial Manager. My journey in the world of finance has equipped me with the skills and knowledge needed to navigate the complexities of the forex and crypto markets.