Table of Contents

ICT trading is a disciplined approach focused on confident and logical trading. Its ultimate focus on market structure and liquidity allows traders to find trades confidently and logically. In market structure, dealing range allows traders to look for institutional footprints and how they operate in the market.

This article focuses on ICT dealing range, its key elements, identification and strategies that we can use in uptrend and downtrend.

Understanding ICT Dealing Ranges

ICT dealing range is simply a price range between swing low and swing high. Within the range, institutions are focused on accumulation and distributions campaigns. They have the data to track where the majority of liquidity sits within the swing high and swing low.

Institutions and smart money use these ranges to manipulate retail traders. They manipulate price action, drive liquidity hunts and influence major price movements. Market mainly moves between the ranges to balance fair value gaps or hunts liquidity by breaking equals highs and equal lows within the ranges.

Smart money trader and Institutions are aimed at building positions at specific levels of premium and discount zones of a dealing range. In ICT, traders look for fair value gaps and order blocks to be filled. The most important thing is multi-timeframe structure analysis. They verify their entries on lower timeframe structure. This requires understanding of how institutions move price within the dealing range.

Understanding Key Elements of a Dealing Ranges

Normally, in structure mapping, we mark swing high and swing low in prevailing trend. In ICT, it is one of the components of dealing ranges. Dealing ranges are established by selecting swing high and swing low. After break of structure, price creates new higher levels.

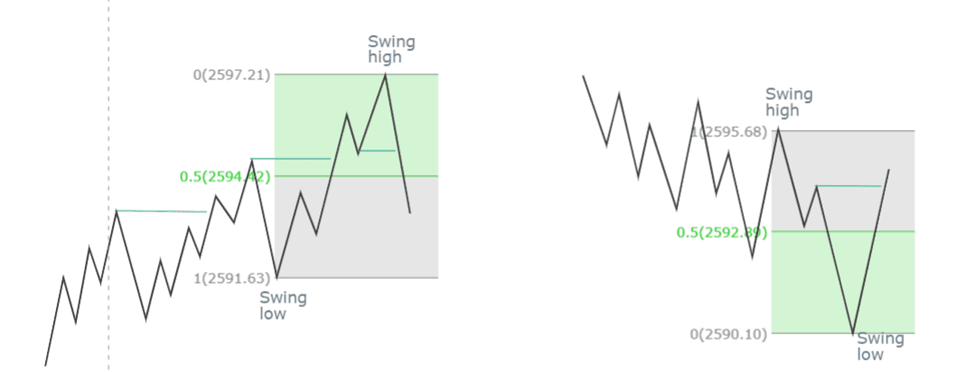

In ICT trading, dealing range is divided into premium and discount zones. ICT Fibonacci levels are drawn and determined by 50% level as the equilibrium level of the range. In an uptrend, discount zone is below equilibrium level. ICT and institutional traders are more inclined to buy rather than selling. They look for ICT PD arrays in discount level. In a downtrend, premium zone is above the equilibrium level. ICT and institutional traders are more inclined to sell rather than buying. They look for ICT PD array in premium zone.

Liquidity pools are those areas on chart where large number of stop-loss order and pending orders reside. The liquidity zones often lie at internal high and low within the dealing range. This is the reason structure mapping and multi-timeframe structure analysis in crucial.

Identification of ICT Dealing Ranges

As it is discussed how to identify swing high and swing low, there is one more way to recognize swing high and swing low. We can employ reversal candlestick patterns and ICT CRT concept in identifying dealing ranges.

Reversal patterns (like Engulfing patterns, Pin bars, and doji) are used to identify highs and lows. In downtrend, reversal pattern like bullish engulfing, piercing pattern etc are used to identify swing low. The reverse applies to uptrend. However, this is considered as authentic method.

Marking swing high (in uptrend) and swing low (in downtrend) is quite easy. It is confirmed when price retraces and break recent and first pullback. First pullback is often referred to as inducement level. Breaking of the level confirms swing high and swing low.

Trading with Dealing Ranges in an Uptrend Market

In an uptrend market, after creating higher high (swing high), price often move withing the dealing range. Here, ICT trader marks important zones and levels in discount zones. ICT trader identify the discount area below the equilibrium area and highlight other ICT tools.

ICT PD array in discount zone during an uptrend provide potential buy entries. Order Block and FVGs are highlighted within the areas and target premium zone for take profits. Traders often shifts in lower timeframe in order to get more clarity for liquidity that market hunts in order to move upward.

Let’s say the market is bullish, and you’ve identified a significant swing high and swing low forming a dealing range. If price retraces to the discount area below the equilibrium, you can look for other ICT tools for sniper entries and confirm it on smaller timeframes. Once price enters the premium area, you can consider taking profits as liquidity is likely to be hunted near the previous swing high.

Trading with ICT Dealing Ranges in a Downtrend

In a downtrend market, after creating lower low (swing low), price often moves withing the dealing range. Here, ICT trader marks important zones and levels in premium zones. ICT trader identify the discount area below the equilibrium area and highlight other ICT tools.

ICT PD array in premium zone during a downtrend provides potential sell entries. Order Block and FVGs are highlighted within the premium zone and target discount zone for take profits. Traders often shift in lower timeframe in order to get more clarity for liquidity that market hunts in order to move downward.

Let’s say the market is bearish, and you’ve identified a significant swing high and swing low forming a dealing range. If price retraces to the premium zone above the equilibrium, you can look for other ICT tools for sniper entries and confirm it on smaller timeframes. Once price enters the discount zone, you can consider taking profits as liquidity is likely to be hunted near the recent swing low.

Final Note

ICT Dealing Range offers valuable insights for market analysis, it is not without risks. Price can deviate from anticipated ranges due to unforeseen market conditions, such as economic news or geopolitical events. Traders should practice risk management, including stop-loss orders and position sizing, to protect against large drawdowns. Past performance does not guarantee future results, and using this method requires careful analysis and real-time monitoring. It is recommended to test this strategy on a demo account before applying it to live markets.

Frequently Asked Questions

What is the ICT Dealing Range?

The ICT (Inner Circle Trader) Dealing Range refers to the price movement between a defined high and low within a specific time frame. Traders use this range to anticipate where price may reverse or continue its trend.

Can ICT Dealing Ranges be used in forex trading?

Yes, ICT Dealing Ranges are frequently used in forex trading to help traders identify potential reversal zones and areas of liquidity within specific currency pairs.

Can I combine the ICT Dealing Range with other trading strategies?

Absolutely. Many traders combine it with other techniques such as support and resistance levels, market structure, or indicators like moving averages to increase the accuracy of their trades.

I’m Aatiq Shah, a dedicated forex and crypto market practitioner with three years of hands-on experience. Currently, I’m working as a Financial Manager. My journey in the world of finance has equipped me with the skills and knowledge needed to navigate the complexities of the forex and crypto markets.