Table of Contents

This concept is not a complex concept to understand. For better understanding of ICT breakaway gap, one must have a basic understanding of Fair Value Gaps, ICT inversion FVGs, and ICT balanced price range. This is because Breakaway gap is simply a Fair Value Gap like them but left unmitigated.

This article explores its core concept, identification of ICT breakaway gap, and its formation in bullish and bearish scenarios.

ICT Breakaway Gap

In ICT methodology, a breakaway is a simple fair value gap that is left unmitigated. This unmitigated FVG is formed after a strong price move. This gap occurs when price breaks through a significant swing high or swing low with momentum and continues to move in that direction without retracing the FVG. The term “breakaway” highlights the price’s decisive movement away from the breakout level. This signifies a structural shift.

ICT breakaway can be aligned with Break of Structure (BOS), Change of character (CHOCH), and Market Structure Shift (MSS). This confirms that a new trend has emerged. This area remains unmitigated. This reflects a strong imbalance between supply and demand. This imbalance indicates institutional buying or selling pressure.

ICT traders observe these areas as critical area of interest. This unmitigated FVG (breakaway gap) reinforces the likelihood of continued movement in the direction of the break.

ICT Bullish Breakaway Gap

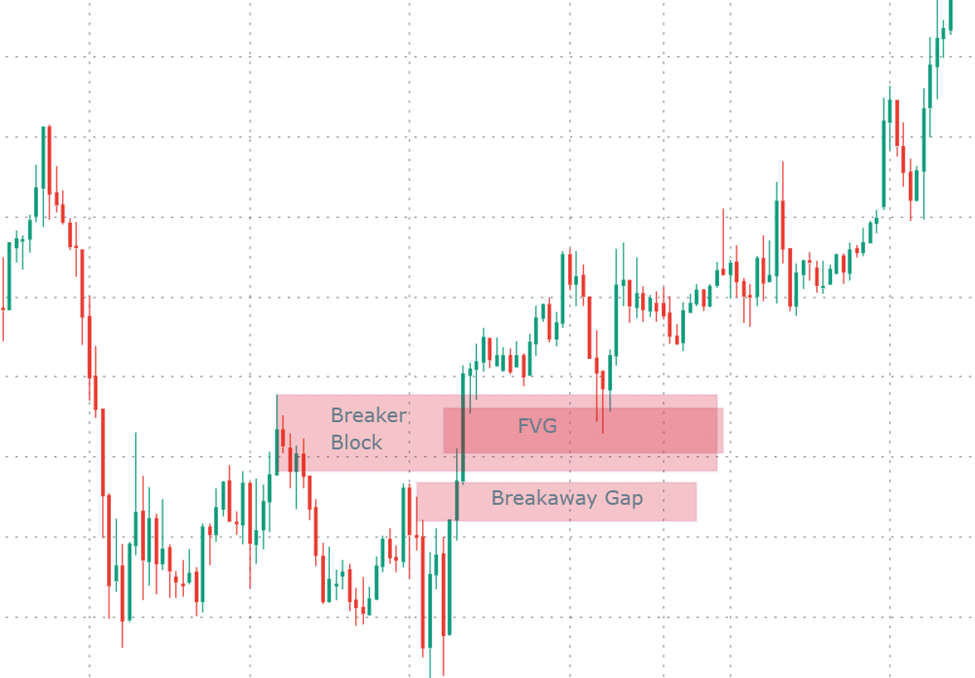

Breakaway gaps are formed in both bullish and bearish markets. A bullish breakaway gap is essentially a Buy-Side Imbalance and Sell-Side Inefficiency formed near a swing high. After that price breaks above that swing high with strong upward momentum. This gap represents an imbalance in price action where aggressive buying overwhelms selling.

Normally, traders expect and wait for the price to retrace and fill the inefficiency in the BISI. This is because market retraces in order to balance liquidity. However, the case is different here. Price does not retrace to mitigate this area. Instead of retracing to this area, market continues to move upward and leave he gap unmitigated.

The formation of Bullish breakaway gap signals a significant structural shift in the market. This happens because of smart money aggressively entering the market. This causes the surge in demand that pushes the market higher without returning to the gap. This imbalance reflects strong bullish intent by buyers, and also reflects no interest by institutions in revisiting the area.

Reasons of a Bullish Breakaway Gap

The following are the reasons which indicate that price will not retrace to fill the bullish breakaway gap:

- One of the reasons is the ICT breaker block. Breaker Block forms when price breaks a swing high and pushes to the upside. When retracement occurs, the first demand zone will be the breaker block. This area act as level of support that reflects institutional intent to protect liquidity captured during the breakout. The breaker block prevent price from deep retracement. This leaves BISI unmitigated and effectively creates a breakaway gap.

- Inverse Fair value gap is another reason for breakaway gap. When market moves upward, it breaks bearish FVG. After the breakout, the bearish FVG becomes bullish Inverse fair value gap. This IFVG also works as support zone by absorbing selling and preventing further down move.

- One last crucial concept is the ICT Balanced Price Range. By breaking through a bearish FVG and simultaneously creating a bullish FVG. The overlapping area between these FVGs is called the BPR. This region represents equilibrium, where both buying and selling pressures are balanced. Upon retracement, the BPR serves as a robust support level. Price often respects this range and fails to move lower, leaving the BISI unmitigated.

Here is the example:

ICT Bearish Breakaway Gap

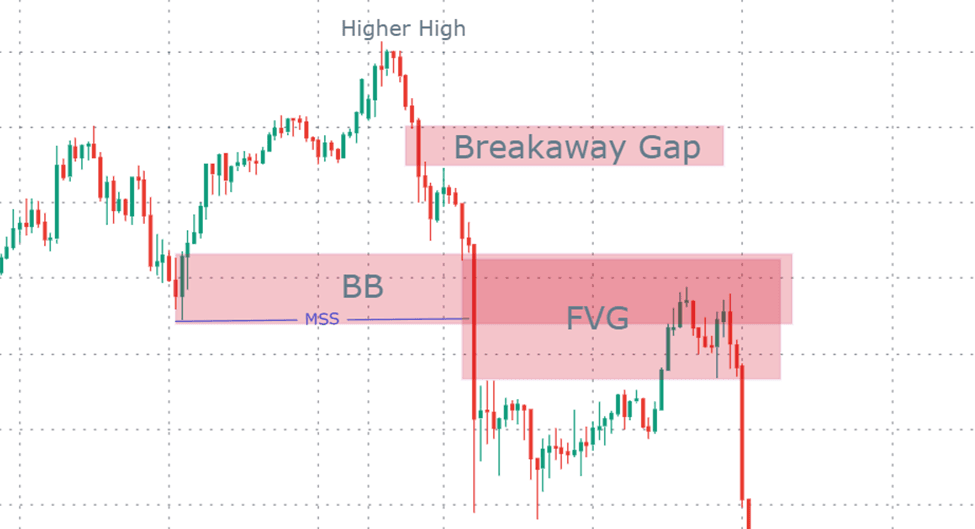

A bearish breakaway gap is essentially a Sell-side Imbalance and Buy-side Inefficiency formed near a swing low. After that price breaks below that swing low with strong downward momentum. This gap represents an imbalance in price action where aggressive selling overwhelms buying.

Normally, traders expect and wait for the price to retrace and fill the inefficiency in the SIBI. This is because market retraces in order to balance liquidity. However, the case is different here. Price does not retrace to mitigate this area. Instead of retracing to this area, market continues to move downward and leave he gap unmitigated.

The formation of bearish breakaway gap signals a significant structural shift in the market. This happens because of smart money aggressively selling the market. This causes the surge in supply that pushes the market lower without returning to the gap. This imbalance reflects strong bearish intent by sellers, and also reflects no interest by institutions in revisiting the area.

Reasons of a Bearish Breakaway Gap

The following are the reasons which indicate that price will not retrace to fill the bearish breakaway gap:

- One of the reasons is the ICT breaker block. Breaker Block forms when price breaks a swing low and pushes to the down side. When retracement occurs, the first supply zone will be the breaker block. This area act as level of resistance that reflects institutional intent to protect liquidity captured during the breakout. The breaker block prevent price from deep retracement. This leaves SIBI unmitigated and effectively creates a breakaway gap.

- Inverse Fair value gap is another reason for breakaway gap. When market moves downward, it breaks bullish FVG. After the breakout, the bullish FVG becomes bearish Inverse fair value gap. This IFVG also works as resistance zone by absorbing buying and preventing further up move.

- One last crucial concept is the ICT Balanced Price Range. By breaking through a bullish FVG and simultaneously creating a bearish FVG. The overlapping area between these FVGs is called the BPR. This region represents equilibrium, where both buying and selling pressures are balanced. Upon retracement, the BPR serves as a robust support level. Price often respects this range and fails to move higher, leaving the SIBI unmitigated.

Here is the example:

Final Note

The concepts discussed, including Breakaway Gaps, Breaker Blocks, Inverse Fair Value Gaps (IFVG), and Balanced Price Ranges (BPR), are advanced tools rooted in ICT methodology for understanding institutional price action. While they offer valuable insights into market behavior and trading setups, no strategy guarantees success.

Trading in financial markets carry significant risk. Sometime, this leads to potential loss of capital. The use of leverage in forex and crypto markets amplifies both profits and losses. It is important to back-test strategies, manage risk appropriately, and ensure a comprehensive understanding of these concepts before applying them in live markets. It is advised not to trade with the capital that you cannot afford to lose, and seek professional advice before investing in volatile markets like Forex.

Frequently Asked Questions (FAQs)

What is a Breakaway Gap in ICT methodology?

A Breakaway Gap is an unmitigated Fair Value Gap (FVG) formed after a strong price move, typically following a break of a swing high or swing low. Price does not retrace to this gap, and the market continues moving in the same direction, signifying a strong trend continuation.

What is the difference between a regular Fair Value Gap and a Breakaway Gap?

A regular FVG is often mitigated as price retraces to balance liquidity. In contrast, a Breakaway Gap remains unmitigated because strong market forces, such as Breaker Blocks, Inverse Fair Value Gaps (IFVG), or Balanced Price Ranges (BPR), prevent price from returning to the gap.

Can Breakaway Gaps appear in both bullish and bearish markets?

Yes, Breakaway Gaps can occur in both bullish and bearish markets. A Bullish Breakaway Gap forms above a swing high, while a Bearish Breakaway Gap forms below a swing low, with corresponding tools like breaker blocks or IFVGs preventing retracement.

I’m Abdullah Shah, a content writer with three years of experience in crafting engaging and informative content. My background in market analysis complements my work, allowing me to create content that resonates with audiences. I’m also a seasoned practitioner in the forex and crypto markets, with a strong foundation and deep interest in finance. My passion for the financial world drives me to produce content that is both insightful and valuable for those interested in understanding market trends and financial strategies.