Table of Contents

According to Anna Coulling, there is nothing new in financial market. Things that are happening in the market has happened before and will happen again in the market. The same applies with candlestick pattern. However, their reliability is questioned by various traders. Candlestick patterns can appear anywhere on charts but not all patterns are reliable. For selecting the authentic one, a careful analysis is performed.

Hammer candlestick is easy to identify on the chart but when it comes to which one is authentic and reliable, we employ other factors to confirm its authenticity. It can not lead the market to immediate reversal but can be served as an early indication of market trend reversal. As a trader, we are advised not to trade on the basis of candlestick only. This article explores its structures and formation, psychology, and key consideration of the hammer candlestick.

Hammer Candlestick Pattern

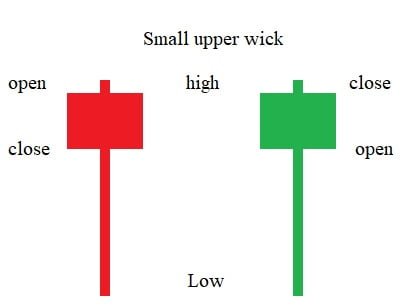

The hammer candlestick pattern is a technical analysis indicator used in trading to signal potential reversals in the market. It’s a single candle pattern that can appear in both uptrends and downtrends. A hammer candlestick has a small body at the upper end of the trading range, with a long lower shadow and little to no upper shadow. The body can be either bullish (white or green) or bearish (black or red), but the key feature is the long lower shadow.

This pattern often appears after a downtrend and signals a potential reversal or support level. It indicates that while the market sold off during the session, it was able to recover and close near the opening price. To strengthen the reliability of the hammer pattern, traders usually look for confirmation in the following candlestick. A bullish confirmation would be a strong bullish candle that follows the hammer, suggesting a reversal and a possible buying opportunity.

Structure and Formation of Hammer Pattern

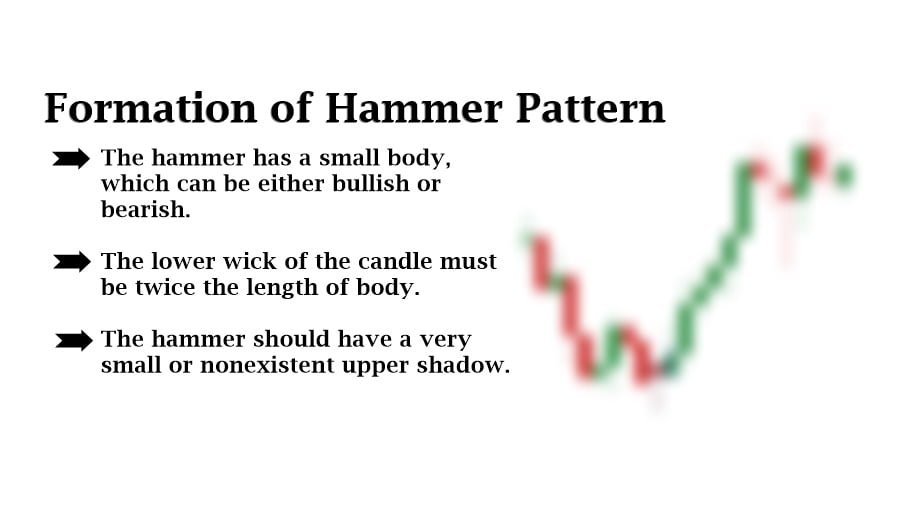

It’s easily recognizable. It is a single candle pattern and can be find on anywhere on chart. The following are the things necessary to look for in a hammer pattern:

- Body: The hammer candlestick has a small body, which can be either bullish (white or green) or bearish (black or red). The body is located at the upper end of the candlestick.

- Lower Shadow: The lower shadow is the critical feature of the hammer. It should be at least twice the length of the body. This long lower shadow indicates that the price fell significantly during the trading period but then rebounded to close near the opening price.

- Upper Shadow: Ideally, the hammer should have a very small or nonexistent upper shadow. If present, it should be minimal compared to the length of the lower shadow.

This is the basics of the structure and there are multiple other things that can be used in combination with candlestick pattern.

Psychology Behind Hammer Pattern

The hammer candle is the same like hanging man. The important things is the market trend. If it appears after a downtrend, it will be referred hammer pattern. So, the appearance of the candle indicative the weakness of the trend. If there is a strong volume associated with the candle, it is viewed as a first sign of change of trend.

Market is a combination of Institutions and a constant struggle between the “Big Money”, that is why trading on the basis of one single candle is not preferred. Here is a detailed approach to market psychology:

- Initial Drop: During the formation of the hammer, the price typically drops significantly from the open. This reflects strong selling pressure and a bearish sentiment at the start of the trading session. Sellers are initially in control, driving the price down.

- Reversal Effort: Despite the strong selling pressure, buyers begin to step in as the price falls. This intervention is crucial, as it demonstrates that there is enough demand to counteract the selling and push the price back up. The long lower shadow illustrates this struggle, showing that the price was able to recover from its lows.

- End of Session Balance: By the close of the session, the price has recovered to a level close to the opening price, forming a small body near the top of the candle. This balance indicates that, by the end of the session, there is less selling pressure and more buying interest. The small body signifies a reduction in bearish sentiment and a potential shift towards bullish sentiment.

- Psychological Shift: The hammer pattern reflects a psychological shift from bearish to bullish sentiment. Traders may interpret the pattern as a sign that the downward momentum is weakening, and buying interest is gaining strength. This shift can lead to a broader market reversal or a bounce at the support level where the hammer appears.

Key Considerations

Steve Nison emphasized on collecting multiple confirmation when it come to hammer pattern. It’s preferred trading style is dug deeply in traditional system of trading. Although, it reflects some sort of market psychology that is why still considered.

First thing that he insisted upon is that there should be gapping down, and the second thing was the increased volume and support area. Gapping down with increased volume can serve as a sign of strength for trend reversal.

Now, there are other things as well that are recommended by traders. The following are the things necessary to consider:

- Support Levels (Demand Zones): The hammer pattern is more significant when it appears at a well-established support level or demand zone. If the hammer forms at a price level where the stock has historically found buying interest, it reinforces the potential for a reversal.

- Prior Trend: The hammer is most reliable when it appears after a downtrend. This context increases the likelihood of a reversal. In an uptrend, the pattern could be a hanging man, which suggests a potential bearish reversal instead.

- Follow-Up Candle: The next candlestick after the hammer should ideally be a strong bullish candle that confirms the reversal. This confirmation increases the likelihood that the hammer is signaling a true change in market direction.

- Volume During Hammer Formation: While not always necessary, higher volume during the formation of the hammer can strengthen the pattern. It indicates that the market participants are engaged and that the pattern might have a more substantial impact.

- Volume Confirmation: A follow-up candle with increased volume compared to previous candles can further validate the pattern and the reversal signal.

- Overall Market Conditions: Consider the broader market environment and news that could affect the asset. Market-wide events or economic reports can influence the effectiveness of technical patterns.

- Relative Strength Index (RSI): If the RSI is in the oversold region when the hammer appears, it can further confirm the potential for a bullish reversal. An RSI moving away from oversold conditions can signal strengthening bullish momentum.

- Hammer Size: The length of the lower shadow relative to the body is crucial. A longer lower shadow is generally more significant. Ensure the hammer has a clear and pronounced lower shadow to indicate stronger buying interest.

After careful consideration of these additional factors, you can enhance your Technical Analysis and make more informed trading decisions.

Concluding Remarks

The hammer candlestick pattern is a crucial tool in technical analysis for identifying potential market reversals. Formed by a small body at the top of the trading range with a long lower shadow, the hammer signifies that despite significant selling pressure during the session, buyers were able to drive the price back up, suggesting a potential shift in market sentiment.

What is a hammer candlestick pattern?

The hammer candlestick pattern is a technical analysis signal indicating a potential reversal in the market. It features a small body at the upper end of the trading range, a long lower shadow, and little to no upper shadow. It suggests that despite significant selling pressure, buyers managed to push the price back up by the end of the session.

Where does the hammer pattern appear most effectively?

The hammer pattern is most effective when it appears after a downtrend. This context enhances its significance as a potential bullish reversal signal. It can also appear at established support levels to strengthen the signal.

How can I confirm the hammer pattern?

Confirmation is crucial for the hammer pattern’s reliability. Look for a strong bullish candlestick following the hammer, indicating a continuation of buying interest. Increased volume during and after the formation of the hammer adds further confirmation.

Can the hammer pattern be used in all markets?

Yes, the hammer pattern can be used in various markets, including stocks, forex, commodities, and cryptocurrencies. However, its effectiveness may vary depending on market conditions and the asset being analyzed.

I’m Abdullah Shah, a content writer with three years of experience in crafting engaging and informative content. My background in market analysis complements my work, allowing me to create content that resonates with audiences. I’m also a seasoned practitioner in the forex and crypto markets, with a strong foundation and deep interest in finance. My passion for the financial world drives me to produce content that is both insightful and valuable for those interested in understanding market trends and financial strategies.