Table of Contents

Introduction

In the realm of technical analysis, candlestick patterns serve as essential tools for traders and investors aiming to predict market movements. One of the prominent patterns that signal potential reversals in an uptrend is Evening Star candlestick pattern. Recognized for its reliability, the Evening Star provides clear insights into the shift in market sentiment from bullish to bearish. This pattern, composed of three distinct candlesticks, heralds a warning for traders to consider taking profits or initiating short positions.

In this article, we will delve into the intricate details of the Evening Star candlestick pattern, exploring its structure, understanding, psychology, and practical application in trading. Whether you are a novice trader or an experienced investor, mastering the Evening Star pattern can provide you with a powerful edge in navigating the complexities of the financial markets.

Evening Star Candlestick Pattern

“Evening star pattern is the bearish counterpart of the morning star pattern. The name is given because the evening star appears just before darkness sets in.” This pattern is a top reversal pattern. The first candle is the strong bullish candle. This is a sign that buyers are in control and have the ability to drive price up. The second candle is the small body candle (sometimes gaps up and sometime there is no gap). Third candle is strong bearish candle and denotes change of interest.

Structure of an Evening Star

The Evening Star candlestick pattern is a technical analysis indicator used to predict the reversal of an uptrend in the price of a financial asset, commonly found in stock, forex, and cryptocurrency markets. Here is a detailed explanation of the Evening Star pattern:

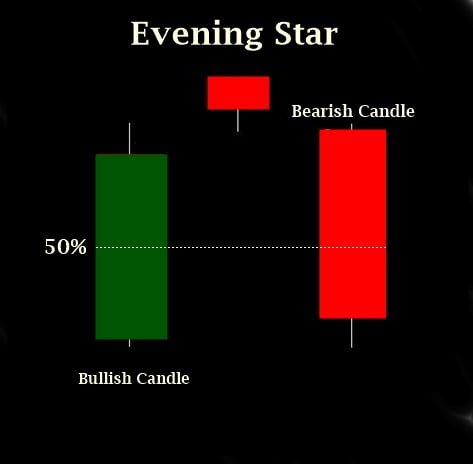

- There is a strong uptrend. Then a strong bullish candle appears. It would be better if the first candle has both upper and lower shadows. This suggests strong bullish pressure. If there is a prior supply and demand zone, it would increase confidence of a trader.

- The second candle opens with a gap up from the first candle’s closing price. It has a small body, indicating indecision in the market. Gapping is not common in intraday trading. That is why having no gap has no effect on the pattern. This candle suggests that the bullish momentum is weakening, and the market is indecisive.

- Confirmation takes place in third candle which is strong bearish candle. It is necessary for the candle to eat fifty percent of the first candle. This indicates strong selling pressure and a shift in market sentiment from bullish to bearish.

Market psychology in Evening Star

It is important for a trader to understand the behavior of market movement. Candlestick Analysis helps in understanding the psychology behind the market move. Evening Star, in this case, also tell us enough related to upcoming market move.

- With the arrival of first strong candle, it is difficult to predict that this setup will going to be the evening star pattern. Candlestick patterns are all the time seen in market but, as a trader, we just focus on important points. Just like if there is a supply or demand zone or the oversold zone of RSI. This will help us filter unusual appearance of candlestick patter.

- In strong uptrend and appearance of strong bullish candle, there is strong buying pressure, with bulls confident about the continued upward movement of the asset’s price. This confidence is reflected in the long bullish candlestick, which indicates that buyers are firmly in control, pushing prices higher. Optimism prevails, with more buyers entering the market, further drive the price up.

- The second candle is important and alert traders. However, the second candle has a small body, indicating indecision. This reflects a balance between buyers and sellers, suggesting that bullish momentum is waning. Traders are becoming cautious, and some are starting to take profits. The market is uncertain, as the battle between bulls and bears becomes more balanced. This indecision can be due to overbought conditions, external news, or psychological resistance at a certain price level.

- The third candle opens lower than the previous close, indicating that bearish sentiment is starting to take hold. The long bearish candle shows that sellers have taken control, pushing prices down significantly. This shift indicates a reversal in sentiment, with many traders and investors now expecting the uptrend to end and a downtrend to begin. Fear and pessimism start to dominate, with traders rushing to sell their positions to lock in profits or avoid potential losses.

Remember, appearance of candlestick pattern does not guarantee reversal or continuation of any sort. There is only one thing a trader should look for and that is weakness of the market. If such sort of pattern shows the weakening of the market, then further technical and fundamental analysis will help trader to derive conclusion and execute trade.

Additional consideration:

- Market Context: Always consider the broader market context and use other technical indicators to confirm signals from the Evening Star pattern.

- False Signals: Like all technical patterns, the Evening Star can sometimes produce false signals, especially in volatile markets. It’s important to use proper risk management techniques.

How to Trade Evening Star Pattern

The following steps we follow in order to trade evening star:

- It essential for a trader to identify the pattern with multiple confirmations. These confirmations tell us that whether the pattern appears on the right place or not. Volume and use technical indicators help in this regard.

- Entry should be the opening of the fourth candle. It is necessary to maintain risk/reward ratio.

- Lastly, monitor your trade ad exit the trade when find necessary.

Trading candlestick is profitable but the evolution in trading demands multiple confirmations. These confirmations increase confidence of a trade. Professional of the field suggest that derive logic behind your trade. If there is no logic to trade then it will be considered as gambling.

Conclusion

The Evening Star candlestick pattern is a powerful tool in the arsenal of traders looking to identify bearish reversals in the market. By understanding its formation, the underlying market psychology, and how to trade it effectively, traders can make informed decisions and improve their trading outcomes. While the Evening Star is a reliable indicator, it should always be used in conjunction with other technical analysis tools and market context to enhance its accuracy.

Incorporating risk management strategies, such as setting appropriate stop-loss levels and profit targets, is crucial to safeguard against potential losses. Mastering the Evening Star pattern, along with a comprehensive trading strategy, can provide traders with a significant edge in navigating the complexities of financial markets.

FAQs

How can the Evening Star pattern’s reliability be improved when trading in highly volatile markets?

In highly volatile markets, the Evening Star pattern might produce false signals due to frequent price fluctuations. To improve reliability:

Use Multiple Time Frames: Confirm the pattern on higher time frames to reduce noise.

Combine with Other Indicators: Use additional technical indicators such as Moving Averages, Bollinger Bands, or the Average True Range (ATR) to confirm the trend reversal.

Volume Analysis: Higher trading volume on the third candle adds credibility to the pattern.

Wait for Confirmation: Rather than acting immediately on the pattern, wait for additional confirmation from subsequent price action.

How does the Evening Star pattern perform in different market conditions (e.g., trending vs. ranging markets)?

Trending Markets: In a strong uptrend, the Evening Star can be a powerful reversal signal, especially if it appears near resistance levels or after an extended rally.

Ranging Markets: In a sideways or ranging market, the pattern may produce more false signals due to frequent price reversals. It is less reliable in such conditions and should be used with caution.

Market Sentiment: The pattern is more effective when market sentiment is shifting from bullish to bearish due to external factors such as economic data, geopolitical events, or earnings reports.

How do institutional traders use the Evening Star pattern differently compared to retail traders?

Institutional traders might use the Evening Star pattern as part of a broader, more sophisticated strategy:

Algorithmic Trading: Institutions often incorporate the Evening Star pattern into algorithmic trading models that factor in multiple technical indicators, price action, and volume data.

Order Flow Analysis: Institutional traders analyze order flow and market depth to confirm the pattern, gaining insights into the actions of other large market participants.

Risk Management: Institutions employ advanced risk management techniques, including dynamic hedging and options strategies, to manage exposure when trading the pattern.

Contextual Analysis: Institutions combine technical patterns like the Evening Star with fundamental analysis, macroeconomic trends, and proprietary research to make more informed decisions.

I’m Aatiq Shah, a dedicated forex and crypto market practitioner with three years of hands-on experience. Currently, I’m working as a Financial Manager. My journey in the world of finance has equipped me with the skills and knowledge needed to navigate the complexities of the forex and crypto markets.