Table of Contents

In ICT trading, premium and discount levels are used to find 50% of an impulse move. This highlights the importance of 50% retracement in trading. Similarly, in ICT PD Array, we are focused on finding 50% levels of an Order Block, or Fair Value Gap. Two different terms are used for such concept: Consequent Encroachment and Mean Threshold.

This article explores its understanding, identification of ICT Consequent Mean Threshold and trading with concept.

Consequent Encroachment and Mean Threshold

Along with other logical and psychological concepts, Inner Circle Trader (ICT) is also focused on precise trade executions. It is a common that traders miss trades while waiting for a FVG or Order Block to be filled completely. ICT uses concepts like Consequent Encroachment and Mean Threshold for precise trade entries. These concepts are centered around inefficiencies and PD Arrays.

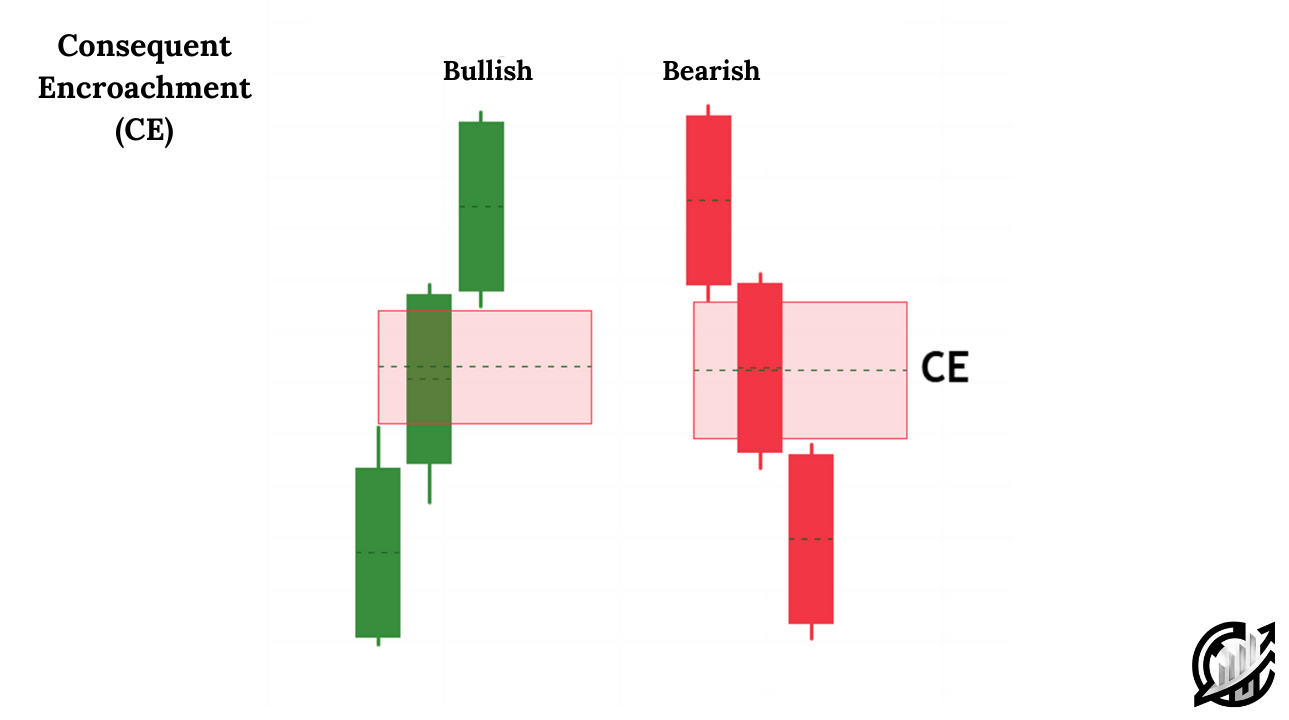

In ICT Trading, Consequent Encroachment refers to the 50% level of an ICT Fair Value Gap (FVG). In realm of ICT trading, 50% level is considered as the most important level for buying and selling of an asset. An FVG is an imbalance (a gap) between wicks of consecutive candles. Instead of waiting for the price to fully mitigate, ICT direct us to focus on the Consequent encroachment level. This level is considered as high probability zone for price reaction and reversal.

In ICT Trading, Mean Threshold is the 50% level of an Order Block or its types. Just like FVGs, there is a possibility of unfilled Order Block, Mean Threshold is used to determine the equilibrium of these zones. This serves as a key level for trade execution or confirmation.

Things in market analysis never ends there. There are multiple other things to consider. Traders often shift in smaller timeframes for Market Structure Shift (MSS) or Change of Character (CHOCH) which indicates trend reversal.

Identification of Consequent Encroachment

Identification of Consequent Encroachment takes the following steps:

- Identify an FVG within an ICT Dealing Range. FVG indicates areas where liquidity was not fully matched. It is represented in one-sided price movement.

- Second step includes determining the FVG Range. In Bullish FVG, imbalance can be counted from the upper wick of first candlestick to a lower wick of a third candlestick. In Bearish FVG, imbalance can be counted from the lower wick of first candlestick to an upper wick of a third candlestick.

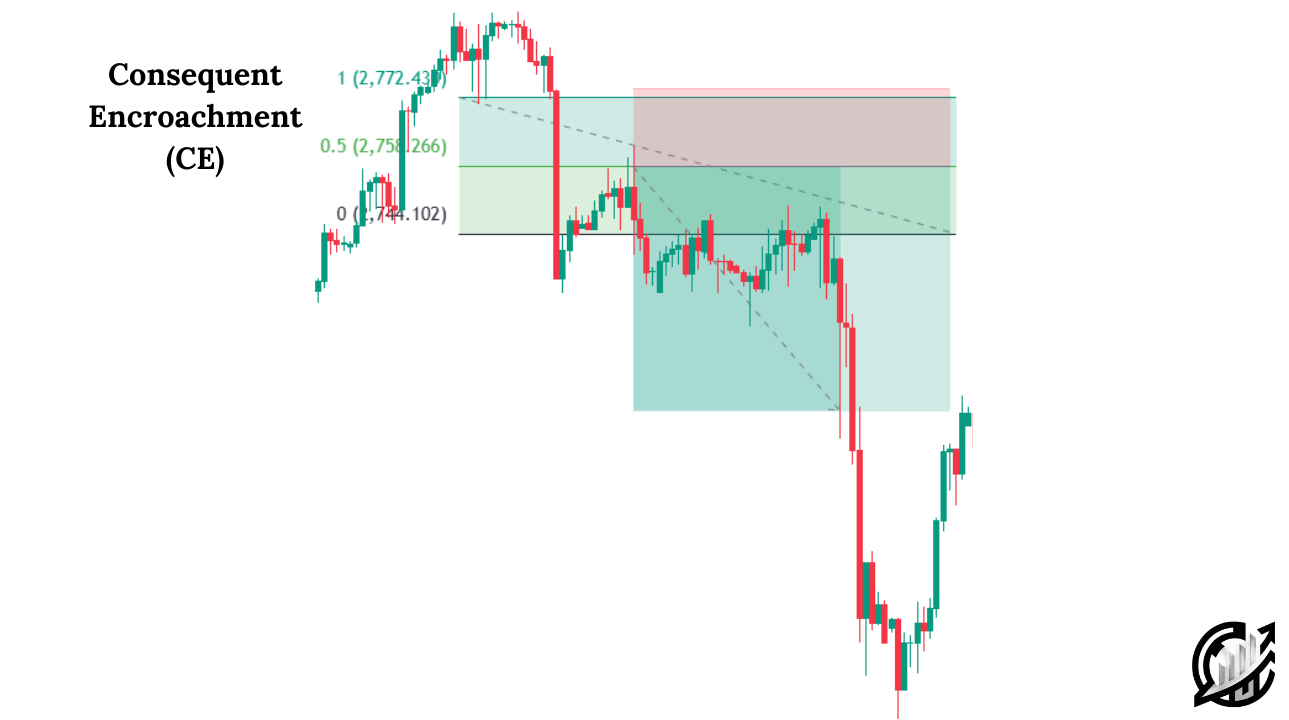

- Third step includes the placement of Fibonacci tool. Fib tool is drawn from 0 to 1.

- Lastly, we set the 0.5 level on Fibonacci tool. This mid-point is the 50 percent level of the whole range. This mid-point represents Consequent Encroachment level.

For further clarity, you can market the level on chart and remove the fib tool. This marks the chart clean and easy to understand. While mitigating FVG, price often reacts to the level.

Identification of Mean Threshold (MT)

Although the concept of CE and ME, at first, sounds similar but there is a little difference in both of them. Mean Threshold is the 50% level of an Order Block or Breaker Block.

Mean threshold is used for determining the equilibrium of these zones. Equilibrium level can be used for trade execution and confirmation.

Key Considerations for Trade Execution

The following are the key points that can be used for trade execution:

- Many traders wait for complete mitigation of PD arrays like FVG, OB or breaker block. This often leads to missed opportunities if price only partially mitigates these zones. By focusing on Consequent Encroachment and Mean Threshold, traders can capture setups even when price does not fully retrace to the extreme boundaries.

- As Michael emphasizes that complete mitigation is not always necessary to take a trade. ME and CE provides better accuracy and alignment with the flow of institutional order flow.

- In trading with Consequent Encroachment, measure the high and low of established fair value gap. Mark the 50% level of FVG as critical point. Wait for the price to reach and react at this level before taking any position. This approach increases the likelihood of aligning with the next directional move.

- In trading with Mean Threshold, measure the range of established order block or breaker block. Mark the 50% level and use it as a decision point for entry or stop-loss placement.

Trading with CE and MT

Trading Consequent Encroachment

The following are the points that should be followed before taking any position:

- Identify an imbalance where price moves aggressively. Imbalances can be in the form of bullish or bearish FVG. Mark the highest and lowest points of the FVG.

- Place the Fibonacci from the high to low of the FVG (for Bullish) or from low to high (for bearish). Identify the 50% level as the key reaction zone.

- If price reaches to the FVG, wait for the signs of rejection. In ICT trading, it is advised to look for Market Structure Shift. Enter in trade based on lower timeframe confirmations.

- Set your take profits and stoploss targets accordingly. You can set your stop loss below or above the FVG. You can target liquidity zones, previous highs and lows, or next institutional level as take profit areas.

In bullish trade setups, price creates a bullish FVG. It is advised not to wait for full mitigation of FVG. Enter into the trade when price retraces to the CE of the FVG and confirm a bounce.

In bearish trade setups, price creates a bearish FVG. Just like the previous one, do not wait for the complete mitigation of the FVG. Confirms rejection signs and place your trade accordingly.

Trading Mean Threshold

The following are the points that should be followed before taking any position:

- Identify an order block or breaker block where price moves aggressively. Order Blocks can be bullish or bearish. Mark the highest and lowest points of the blocks.

- Place the Fibonacci from the high to low of the OB (for Bullish) or from low to high (for bearish). Identify the 50% level as the key reaction zone.

- If price reaches to the OB, wait for the signs of rejection. In ICT trading, it is advised to look for Market Structure Shift. Enter in trade based on lower timeframe confirmations.

- Set your take profits and stoploss targets accordingly. You can set your stop loss below or above the FVG. You can target liquidity zones, previous highs and lows, or next institutional level as take profit areas.

In bullish trade setups, price often retraces to the bullish order block. It is advised not to wait for full mitigation of OB. Enter into the trade when price retraces to the Mean Threshold of the OB and confirm a bounce.

In bearish trade setups, price often retraces to the bearish order block. Just like the previous one, do not wait for the complete mitigation of the OB. Confirms rejection signs and place your trade accordingly.

Final Note

Consequent Encroachment and Mean Threshold are two concepts used to filter trades entries. It can be combined with your existing trading strategy. Remember, it is crucial to collect signs of rejection before placing entries in the market. Like other trading strategies, it does not guarantee consistent results but may improve trader entries. Use it as a confluence rather than all-and-all strategy.

Trading in financial markets carries risk and may not be suitable for all investors. It is advised to consult certified financial advisor before trading or investing in the financial markets. Never trade with the capital that you cannot afford to lose. Manage you risk according to your capital.

FAQs

What is ICT Consequent Encroachment?

In ICT Trading, Consequent Encroachment refers to the 50% level of a Fair Value Gap. This concept can be applied to other types of FVGs. It can be combined with existing ICT trading strategies to filter trade execution.

How to mark consequent encroachment of an FVG?

It all starts with placing the Fibonacci tool from the high to low of the FVG (for Bullish) or from low to high (for bearish). Identify the 50% level as the key reaction zone. Market often reaches to the 50% of the level and then continue its intended direction.

What is Mean Threshold in Trading?

In smart money trading, mean threshold refers to the 50% level of an order block or breaker block. This concept can be applied to all types of order blocks like rejection blocks, vacuum blocks or propulsion block. This concept is used as confluence with existing trading strategies.

How to mark mean threshold of an order block?

For this purpose, place Fibonacci tool from the high to low of the order block (for bullish) or from low to high (for bearish). Identify the 50% level as the key reaction zone. Maret often reaches to the mid of an order block and then continue its intended direction.

I’m Aatiq Shah, a dedicated forex and crypto market practitioner with three years of hands-on experience. Currently, I’m working as a Financial Manager. My journey in the world of finance has equipped me with the skills and knowledge needed to navigate the complexities of the forex and crypto markets.