Table of Contents

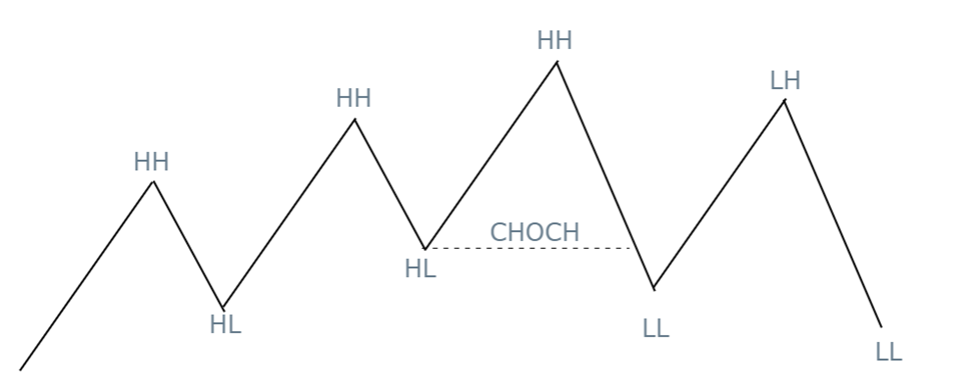

Market moves by creating higher highs and higher lows, or by creating lower lows and lower highs. This shows trend continuation. Just like break of structure for continuation, Change of Character (CHOCH) occurs for a trend reversal. It represents the moment when the market shifts from a bullish to a bearish trend, or vice versa, indicating a potential reversal. This shift is often used by traders to identify high-probability trade setups. This article explores its understanding in trading, appearance in bearish and bullish market, and additional consideration.

Understanding Change of Character in Trading (CHOCH)

Market movement is fractal in nature. This allows market to move higher by creating higher highs and higher lows in uptrend (bullish market), and move lower by creating lower lows and lower highs. Valid Pullback and corrections are the reality of the market. SMC and ICT traders analyze each move of the market in order to identify traps in the market.

Change of Character (CHOCH) is the sign of reversal of existing trend. The change of character aids in identifying reversals in market trends and provides opportunity to trade against the existing trend. It signals potential trend reversal. It enables traders to find new opportunities in the market.

Change of character occurs in both uptrend and downtrend. In uptrend, change of character occurs by breaking the previous higher low. In downtrend, change of character occurs by breaking previous lower high.

Change of character in Bearish Market (Downtrend)

Change of character in bearish market is referred to as bullish change of character. In downtrend, market creates lower lows and lower highs. A change of character from bearish to bullish is a critical moment. It is because market signals a potential reversal. It occurs in the following way:

- As the bearish trend continues, there comes a time when the price fails to create a new lower low. This is an indication of weakening of selling pressure. This weakening of selling pressure sometime leads to a change of interest and market for a moment go sideways (Wyckoff referred to the phases as accumulation or distribution phases).

- First sign of a potential reversal happens when the price fails to respect the previous lower high. This is also referred to as “Break of structure in opposite direction.” Price breaks above this lower high, creating a Higher High. This break is significant in market structure because it represents that buyers are gaining strength.

- After that price retraces back but fails to drop below the previous lower low. On the contrary, it creates a Higher low. This confirms the bullish structure. If price form another higher high, it indicates potential strength in trend reversal. This is the end of bearish trend phase and continuation of the bullish one.

A bullish Change of Character is a critical concept in technical analysis, indicating a trend reversal from bearish to bullish. By breaking the structure of Lower Highs and forming a Higher High, the market signals that the downward momentum is weakening, and buyers are gaining control. For traders, recognizing this shift can provide lucrative opportunities to enter long positions in the early stages of a new bullish trend.

Change of character in Bullish Market (Uptrend)

Change of character in bullish market is referred to as bearish change of character. In uptrend, market creates higher highs and higher lows. A change of character from bullish to bearish is a critical moment. It is because market signals a potential reversal. It occurs in the following way:

- As the bullish trend continues, there comes a time when the price fails to create a new higher high. This is an indication of weakening of buying pressure. This weakening of buying pressure sometime leads to a change of interest and market for a moment go sideways (Wyckoff referred to the phases as accumulation or distribution phases).

- First sign of a potential reversal happens when the price fails to respect the previous higher low. This is also referred to as “Break of structure in opposite direction.” Price breaks below this higher low, creating a Lower Low. This break is significant in market structure because it represents that sellers are gaining strength.

- After that price retraces back but fails to breaks above the previous higher high. On the contrary, it creates a lower high. This confirms the bearish structure. If price form another lower low, it indicates potential strength in trend reversal. This is the end of bullish trend phase and continuation of the bearish one.

A bearish Change of Character is a critical concept in technical analysis, indicating a trend reversal from bullish to bearish. By breaking the structure of Higher Lows and forming a Lower Lows, the market signals that the upward momentum is weakening, and sellers are gaining control. For traders, recognizing this shift can provide potential opportunities to enter short positions in the early stages of a new bearish trend.

Trading Change of Character in SMC and ICT Context

There are other concepts of SMC and ICT that can be integrated with CHOCH. Addition of the concepts can give strength to our analysis of market structure.

- Order Blocks are the first among our additional considerations. Order Blocks are areas where meaningful institutional buying or selling occurs. In ICT and SMC, these zones are often critical in determining market structure. Beware of inducement zones. At first sight, these zones are identified as order block. That is traders recommend to use premium and discount zones for buying and selling.

- Looking for Liquidity in SMC and ICT analysis is key. Liquidity is the fuel of the market. Liquidity pools are areas where clusters of stop=loss or pending orders are expected to be triggered. ICT emphasizes on liquidity runs. These moves often precedes a CHOCH, as the market takes out the weak hands before establishing a new trend.

- Fair Value Gaps (FVGs) or Imbalances occur when there’s an unevenness in buying and selling pressure, leaving a price gap on the chart. The price often returns to fill these gaps before a ChoCH occurs. For instance, in a bullish trend, the price might fill an FVG and then break the last Higher Low, signaling a bearish ChoCH. In contrast, in a bearish trend, the price might fill an FVG and then break the last Lower High, indicating a bullish ChoCH.

- Multiple Time Frame Analysis is crucial in both ICT and SMC strategies, as it helps traders align higher time frame trends with lower time frame entries. A ChoCH on a higher time frame (e.g., daily or weekly) carries more significance and is more reliable than one on a lower time frame (e.g., 1-hour or 15-minute). Traders often wait for a higher time frame ChoCH before looking for entries on lower time frames.

These are the few of the concepts. Combining Change of Character (ChoCH) with ICT and SMC concepts offers a powerful foundation for identifying and trading trend reversals with precision.

Final Note

Change of Character (ChoCH) trading strategies, combined with ICT and SMC concepts, offer powerful tools for identifying market reversals. However, they carry inherent risks. Not all ChoCH signals lead to sustained trends, and market conditions can change rapidly. Always practice prudent risk management, use stop-losses, and never risk more than you can afford to lose. Continuous learning and disciplined execution are essential for long-term success in trading.

Frequently Asked Questions (FAQs)

What is a Change of Character (ChoCH) in trading?

A Change of Character (ChoCH) signifies a shift in market trend, typically from bullish to bearish or vice versa. It occurs when the market breaks its current structure, such as breaking a Lower High in a bearish trend or a Higher Low in a bullish trend, indicating a potential trend reversal.

How does ChoCH relate to market structure?

ChoCH is closely tied to market structure. It represents the point where the established sequence of Higher Highs and Higher Lows (in an uptrend) or Lower Lows and Lower Highs (in a downtrend) is disrupted, signaling a potential reversal in the market trend.

How does multiple time frame analysis enhance ChoCH trading?

Multiple time frame analysis allows traders to align higher time frame trends with lower time frame entries. A ChoCH on a higher time frame is more significant and reliable, and traders often use lower time frames to refine their entries within the context of the higher time frame ChoCH.

I’m Abdullah Shah, a content writer with three years of experience in crafting engaging and informative content. My background in market analysis complements my work, allowing me to create content that resonates with audiences. I’m also a seasoned practitioner in the forex and crypto markets, with a strong foundation and deep interest in finance. My passion for the financial world drives me to produce content that is both insightful and valuable for those interested in understanding market trends and financial strategies.