Table of Contents

In the context of technical analysis, liquidity is the concern of sharp traders. Liquidity is a simple concept. It refers to buy and sell orders in the market. Institutions requires large amount of liquidity to enter and exit positions. SMC and ICT trader look for the footprints of smart money in the market.

Buy side and sell side liquidity in crucial concept in SMC and ICT trading concept. It allows traders to understand the bias of the market. This article covers the understanding, and components of buy side and sell side liquidity. Along with that, we will look its predictive nature in technical analysis.

Understanding Buy Side and Sell Side Liquidity

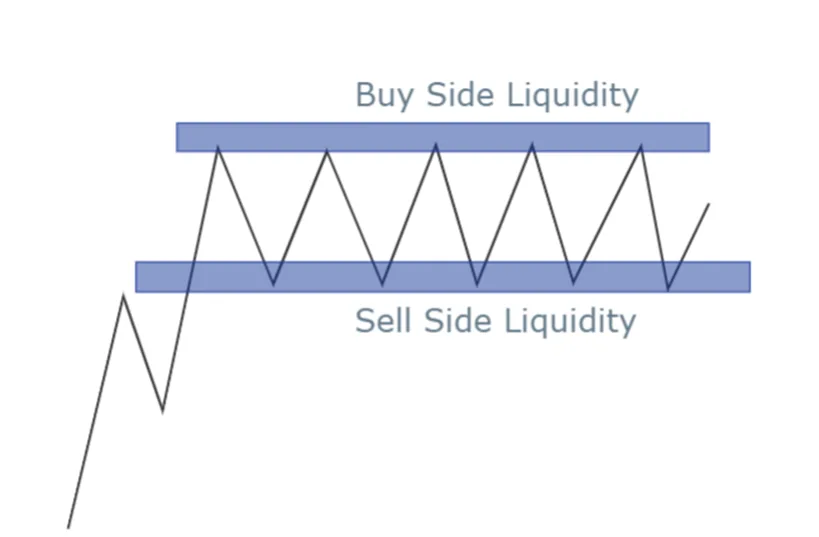

Buy side liquidity refers to a pool of buy orders. These orders are often stop-loss orders placed by traders who are holding short positions. These orders are usually located above key resistance levels. Above the swing high or above top of ICT dealing range, the resting liquidity is referred to as buy side liquidity. When market approaches the levels, institutions may drive price higher. This triggers the stop-loss orders of retail trader. This creates liquidity for institutions. The result of this liquidity grab is immediate reversal in the market.

Sell side liquidity works the same in opposite scenario. It refers to a pool of sell orders. These orders are often stop-loss orders placed by traders who are holding long positions. These orders are usually located below key support levels. Below the swing low or below the low of ICT dealing range, the resting liquidity is referred to as sell side liquidity. When market approaches the levels, institutions may drive price lower. This triggers the stop-loss orders of retail trader. This creates liquidity for institutions. The result of this liquidity grab is immediate reversal in the market.

Above the high of ICT dealing range area is referred to as buy side liquidity, and the resting liquidity below the low of ICT dealing range is sell side liquidity. It is also possible that market may sweep the liquidity before continuing its trend.

Trading With Buy-Side Liquidity

Buy Side liquidity in SMC and ICT represents an important concept related to market movement. The concept explores the institutional way of market movement. Buy-Side Liquidity refers to the volume of pending orders. These orders are mostly Buy stops which are placed by retail traders to protect their short position. These orders are placed above the significant price levels such as previous highs or equal highs.

Mechanics of Buy-Side Liquidity

When traders execute a sell order, they often want to hedge against the possibility of the market moving against them. This is where buy stops come in. If a trader is short, they will place a buy stop at a level higher than the current market price to protect their position. In other words, if the price moves above a certain level, the buy stop will trigger automatically, closing the short position and preventing further losses. These buy stops rest above key highs, such as:

- Previous swing highs: High points on the chart where price previously reversed.

- Daily or weekly highs: Significant because many traders use these timeframes to place their stop orders.

- Equal highs: When two or more highs are at the same level, creating a cluster of buy stops.

Because retail traders tend to place buy stops at predictable levels, these areas become liquidity pools. For large institutions, which need substantial liquidity to fill their large sell orders, these pools of stop orders are highly attractive.

Liquidity Hunts and Market Manipulation

Liquidity hunts refer to a strategic move by institutional traders to grab pending orders and buy stops. This happens by pushing the price above key resistance area (swing high) where these stops are placed. Their aim is to trigger these orders. These orders are converted into market buy orders once activated.

Here is how the hunts typically occur:

- Institutions drive the price toward buy side liquidity area. The break of the area may be viewed as break out by retail traders above a significant high.

- Stop orders get triggered and convert pending orders into market orders.

- Price reverse often stop hunt and continue the intended direction.

Buy-Side Liquidity and Key Levels

In ICT and SMC, certain price levels are considered magnets for liquidity. These include:

- Old highs: Weekly, daily, or hourly highs serve as natural targets for liquidity hunts.

- Equal highs: When the market creates two or more identical highs, liquidity builds up at that level as traders place stop orders just above the highs.

Market makers exploit these levels to orchestrate liquidity hunts, triggering buy stops before reversing the price direction.

Trading With Sell-Side Liquidity

Sell Side liquidity in SMC and ICT represents an important concept related to market movement. The concept explores the institutional way of market movement. Sell-Side Liquidity refers to the volume of pending orders. These orders are mostly Sell stops which are placed by retail traders to protect their long positions. These orders are placed below the significant price levels such as previous swing low or equal lows.

Mechanics of Sell-Side Liquidity

When traders execute a buy order, they often want to hedge against the possibility of the market moving against them. This is where sell stops come in. If a trader is long, they will place a sell stop at a level lower than the current market price to protect their position. In other words, if the price moves below a certain level, the sell stop will trigger automatically, closing the long positions and preventing further losses. These sell stops rest below key lows, such as:

- Previous swing Lows: Low points on the chart where price previously reversed.

- Daily or weekly Lows: Significant because many traders use these timeframes to place their stop orders.

- Equal Lows: When two or more Lows are at the same level, creating a cluster of Sell stops.

Because retail traders tend to place Sell stops at predictable levels, these areas become liquidity pools. For large institutions, which need substantial liquidity to fill their large buy orders, these pools of stop orders are highly attractive.

Liquidity Hunts and Market Manipulation

Liquidity hunts refer to a strategic move by institutional traders to grab pending orders and sell stops. This happens by pushing the price below key support area (swing low) where these stops are placed. Their aim is to trigger these orders. These orders are converted into market sell orders once activated.

Here is how the hunts typically occur:

- Institutions drive the price toward sell side liquidity area. The break of the area may be viewed as breakdown by retail traders below a significant low.

- Stop orders get triggered and convert pending orders into market orders.

- Price reverse often stop hunt and continue the intended direction.

Buy-Side Liquidity and Key Levels

In ICT and SMC, certain price levels are considered magnets for liquidity. These include:

- Old lows: Weekly, daily, or hourly highs serve as natural targets for liquidity hunts.

- Equal lows: When the market creates two or more identical lows, liquidity builds up at that level as traders place stop orders just above the highs.

Market makers use these levels to orchestrate liquidity hunts, triggering sell stops before reversing the price direction.

Reasons to target Buy-Side and Sell-Side Liquidity

Market makers and institutional traders need liquidity to fulfill their large positions, and they know that retail traders place orders at predictable levels. By manipulating the market to grab this liquidity, they gain several advantages:

- Ample liquidity: Large sell orders can be executed with minimal slippage when buy-side or sell-side liquidity is available. These stop-loss orders provide the necessary market orders to fill institutional traders’ sell and buy positions.

- Profit from retail traders: Once the liquidity is hunted and the market reverses, many retail traders are caught on the wrong side of the trade. Those who were short and had their buy stops triggered may take losses as the market reverses, benefiting institutions that are on the opposite side of the trade.

- Market structure manipulation: By inducing retail traders to take long positions at breakout levels, market makers create an environment where the majority of the market participants are trapped, allowing them to move the market in the opposite direction with reduced resistance.

Final note

Buy-Side Liquidity (BSL) and Sell-Side Liquidity (SSL) represent pools of stop orders above highs or below lows. Retail traders are at risk of falling into these traps, especially when placing stop-loss orders at predictable levels. Trading liquidity hunts involves high risk, including market manipulation, false breakouts, and unexpected volatility. Traders should avoid predictable stop-loss levels, practice proper risk management, and be cautious of over-leveraging, which can magnify losses during liquidity hunts.

Frequently Asked Questions (FAQs)

What is Buy-Side Liquidity (BSL)?

Buy-Side Liquidity refers to a pool of pending buy stop orders placed by traders above key highs (swing highs, resistance levels). These orders are targeted by institutional traders to generate liquidity for large sell orders, often leading to a price reversal after the buy stops are triggered.

What is Sell-Side Liquidity (SSL)?

Sell-Side Liquidity refers to a pool of sell stop orders placed below key lows (swing lows, support levels). Market makers drive the price lower to trigger these sell stops, creating liquidity for large buy orders, followed by a reversal upward.

Why do market makers target Buy-Side and Sell-Side Liquidity?

Institutions and Market makers need large volumes of liquidity to execute their big trades. By triggering buy or sell stop orders from retail traders, they convert pending orders into market orders, creating the liquidity necessary for their trades without causing significant price slippage.

I’m Abdullah Shah, a content writer with three years of experience in crafting engaging and informative content. My background in market analysis complements my work, allowing me to create content that resonates with audiences. I’m also a seasoned practitioner in the forex and crypto markets, with a strong foundation and deep interest in finance. My passion for the financial world drives me to produce content that is both insightful and valuable for those interested in understanding market trends and financial strategies.