Table of Contents

In SMC and ICT Trading, we need areas where institutions are interested in accumulating orders in the market. Order Blocks work as supply and demand zones from where market reacts differently in different market scenarios. Order Blocks (along with its types) are zones where institutions place their orders. There are different types of order blocks used in trading financial markets. An ICT Breaker Block is a failed order block that causes shift in market structure.

This article explores its understanding, identification in bullish and bearish breaker blocks and the confluences that we can use to improve success ratio in trading.

ICT Breaker Block

Michael Huddleston in his ICT mentorship describes different types of Order Blocks. One of them is Breaker Block. Breaker Block is essentially a failed order block that becomes an important zone when market breaks its structure (from bullish to bearish or bearish to bullish). It often forms after a Market Structure Shift. In ICT trading, Breaker Block forms when an Order Block fails and results in a sharp price movement that traps traders.

Institutions use the breaker block with dual intent. Firstly, they trap traders and caught them on the wrong side of the market. Secondly, the same area becomes a potential area for the price to revisit before continuing in its new direction. This happens in both bullish and bearish markets. Once identified correctly, it serves as a support or resistance zone for future price action (depending upon market structure).

Breaker Blocks are used to pinpoint high probability trade setups during price retracements. This concept, like any other ICT concept, is not used alone. It is used with other ICT concepts. Even we can employ technical indicators and candlestick patterns with breaker blocks.

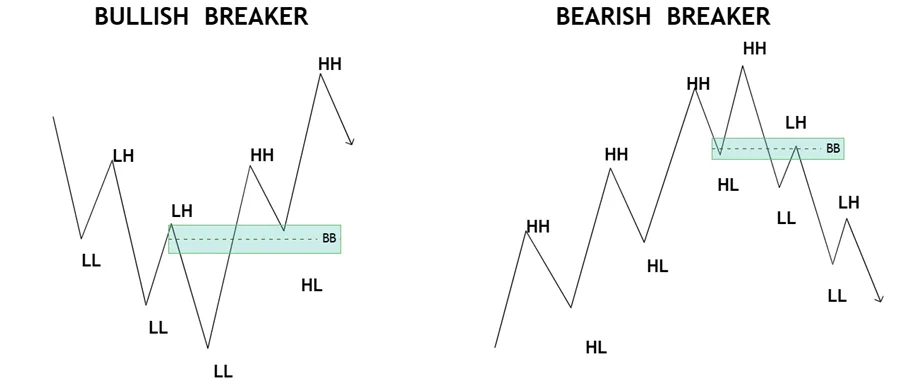

ICT Bullish Breaker Block

A bullish breaker block represents a failed order block. It is a critical reversal structure that becomes a support zone. Market structure is crucial. Market is moving downward and the Bearish Order fails to respect the retracement of price and breaks above it. It provides traders with high-probability setups for buying opportunities.

Formation of a Bullish Breaker Block

Invalidation of Bearish order block results in the formation of Bullish breaker block by closing above the high of Bearish order block. This results in a shift in market sentiment and signals a move to the upside. The zone of Bearish OB act as resistance, but closing above the zone turns this into a support zone.

In ICT methodology, a bullish breaker block is a bullish range or up-close candle in the most recent swing high prior to an old low being violated. The sellers that sold this low and later see this same swing high violated. Michael Huddleston considers the return of price to the zone “a bullish trade setup worth considering”.

Key characteristics of a valid Bullish Breaker Block

Checking the validity of ICT concepts cannot be ignored because a single mistake can make the whole analysis incorrect. In order to ensure the validity and reliability of Bullish breaker block, the following conditions must be met:

- If there is liquidity hunt above the swing high or swing low, it provides fuel for the price to move higher.

- Presence of a valid bearish order block in ICT dealing range. Price must break above the Bearish order block which act initially as resistance but then converted into support. This confirms that the market sentiment has shifted to bullish.

- A bullish breaker block should coincide with a significant change in market structure. It signals the transition from a bearish to a bullish trend.

Trading with Bullish Breaker Block

After identification of a bullish breaker block, ICT traders wait for the price to retrace to into the zone. This zone act as support zone. Traders can place their entries at the edge of the breaker block. Stop-losses can be placed below the zone to manage risk. Take profits targets typically align with significant highs or liquidity pools.

ICT Bearish Breaker Block

A bearish breaker block represents a failed bullish order block. It is a critical reversal structure that becomes a resistance zone. Market structure is crucial. Market is moving upward and the bullish Order Block fails to respect the retracement of price and breaks below it. It provides traders with high-probability setups for sell opportunities.

Formation of a Bearish Breaker Block

Invalidation of Bullish order block results in the formation of bearish breaker block by closing below the low of Bullish order block. This results in a shift in market sentiment and signals a move to the downside. At First, the zone of bullish OB act as support, but closing below the zone turns this into a resistance zone.

In ICT methodology, a bearish breaker block is a bearish range or down-close candle in the most recent swing low prior to an old high being violated. The buyers that buy this high and later see this same swing low being violated will look to mitigate the loss. Michael Huddleston considers the return of price to the zone “a bearish trade setup worth considering”.

Key characteristics of a valid Bullish Breaker Block

Checking the validity of ICT concepts cannot be ignored because a single mistake can make the whole analysis incorrect. In order to ensure the validity and reliability of Bearish breaker block, the following conditions must be met:

- If there is liquidity hunt above the swing high or below the swing low, it provides fuel for the price to move lower.

- Presence of a valid bullish order block in ICT dealing range. Price must break below the bullish order block which act initially as support but then converted into resistance. This confirms that the market sentiment has shifted to bearish.

- A bearish breaker block should coincide with a significant change in market structure. It signals the transition from a bullish to a bearish trend.

Trading with Bearish Breaker Block

After identification of a bearish breaker block, ICT traders wait for the price to retrace to into the zone. This zone act as resistance zone. Traders can place their entries at the edge of the breaker block. Stop-losses can be placed above the zone to manage risk. Take profits targets typically align with significant lows or liquidity pools.

Final Note

Breaker Blocks are powerful tool in SMC and ICT Trading. These Blocks offer high-probability entry points when used with proper confluences. Although ICT provides better success ratio, but, remember, no trading strategy guarantees success in realm of trading and investing. It is advisable to confirm setups with additional market structure and liquidity analysis.

Trading involves significant risk. It is not suitable for all investors. It is advisable to understand risk before investing capital in financial markets. Having an understanding of the risks involved and a well-defined trading plan helps manage risk. Do not invest the capital the capital that you cannot afford to lose.

Frequently Asked Questions (FAQs)

What is a Breaker Block?

A Breaker Block is a failed Order Block that becomes an important zone in the market. Breaker Block act as a key support or resistance level. It forms after a liquidity sweep or key structural break (BOS or CHOCH). When price retrace to the breaker block and reacts strongly, this signifies that traders are more inclined towards new trend direction.

How a Breaker Block is different from regular Order Block?

A Breaker Block is a failed Order Block that becomes support after price invalidates it. In contrast, a regular order block represents unfilled institutional orders and acts as a reversal or continuation zone.

What is a Bullish Breaker Block?

A Bullish Breaker Block is a failed Bearish Order Block that transitions into a support zone. It forms when the price closes above the high of a Bearish Order Block, indicating a shift in market structure to the upside.

What is a Bearish Breaker Block?

A Bearish Breaker Block is a failed bullish order block that transitions into a resistance zone. It forms when the price closes below the low of a bullish order block. This indicates a shift in market structure to the downside.

I’m Abdullah Shah, a content writer with three years of experience in crafting engaging and informative content. My background in market analysis complements my work, allowing me to create content that resonates with audiences. I’m also a seasoned practitioner in the forex and crypto markets, with a strong foundation and deep interest in finance. My passion for the financial world drives me to produce content that is both insightful and valuable for those interested in understanding market trends and financial strategies.