Table of Contents

Analysis of Market structure helps traders to find out trending and trading ranges. There are potential opportunities in market that needs to be uncovered in both trending and trading ranges. In an ongoing trend (both uptrend and downtrend), traders find opportunities of trend continuation. Break of Structure (BOS) confirms the continuation of the trend. Traders look for opportunities of trend continuation in between swing high and swing low. This article explores one of the components of ICT and SMC market structure, Break of Structure, and trading break of structure in bullish and bearish market.

Understanding Break of Structure (BOS)

Market in uptrend moves by creating higher highs and higher lows. In Downtrend, market moves by creating lower lows and lower highs. As we know that market is fractal in nature and cannot move straight in one direction. Pullbacks and corrections are the reality of the market. SMC and ICT trader scrutinize each pullback and correction moves in order to identify inducement in the range.

Break of structure (BOS) is basically the continuation of the trend. The Break of Structure aids in identifying market trends and provides opportunities to enter continuation trades. It signals potential trend continuation, enabling traders to align with the prevailing direction and capitalize on ongoing market momentum.

Break of Structure occurs in both uptrend and downtrend. Continuation of uptrend occurs with the break previous higher high. In reverse, continuation of downtrend occurs with the break of previous lower low.

Break of Structure in Uptrend (Bullish Market)

In a bullish market, the market continuously forms higher highs, meaning each new peak surpasses the previous one. This consistent breaking of prior highs indicates strong upward momentum, and this pattern is referred to as a bullish Break of Structure. It reflects the market’s ability to sustain its upward trajectory, with each new high confirming the strength of the ongoing trend.

Understanding market structure requires true identification of Break of Structure (BOS). It is obvious that Bullish break of structure is incomplete without identification of inducement within the recent impulse move. Market grabs the inducement (Liquidity) and then continue its upward movement.

If the price breaks a previous high without taking inducement, it’s considered a minor Break of Structure. In this scenario, a new higher low isn’t established, leaving the overall market structure unchanged. The minor break suggests a temporary move rather than a significant trend continuation, indicating that the underlying bullish structure remains intact despite the brief price action.

Real market example of break of structure with inducement being grabbed.

Break of Structure in Downtrend (Bearish Market)

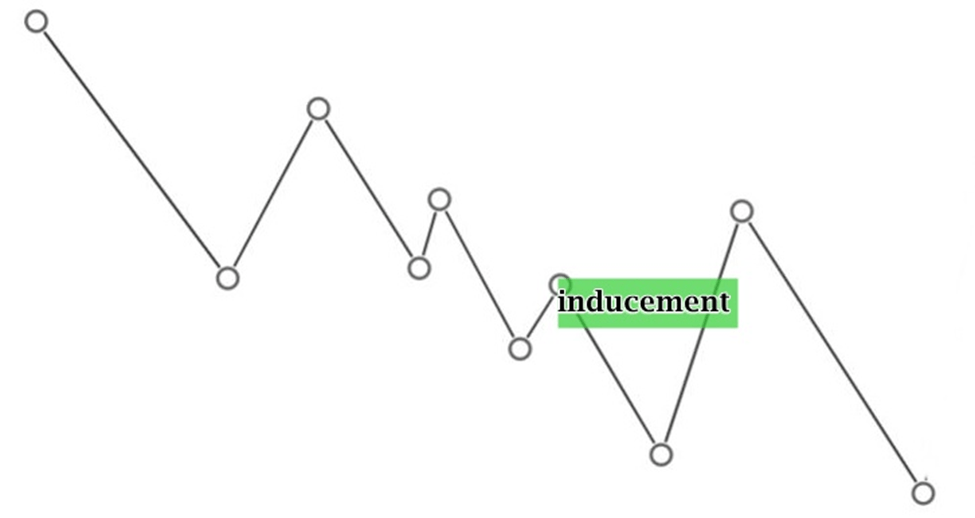

In a bearish market, the market continuously forms lower lows and lower highs, meaning each new low surpasses the previous one. This consistent breaking of previous lower lows indicates strong downward momentum, and this pattern is referred to as a bearish Break of Structure. It reflects the market’s ability to sustain its downward trajectory, with each new low confirming the strength of the ongoing trend.

Understanding market structure requires true identification of Break of Structure (BOS). It is obvious that bearish break of structure is incomplete without identification of inducement within the recent downward move. Market grabs the inducement (Liquidity) and then continue its downtrend movement.

If the price breaks a previous lower low without taking inducement, it’s considered a minor Break of Structure. In this scenario, a new lower high isn’t established, leaving the overall market structure unchanged. The minor break suggests a temporary move rather than a significant trend continuation, indicating that the underlying bearish structure remains intact despite the brief price action.

Trading With Bullish Break of Structure

Trading continuation of the trend requires understanding of market structure and trend context. We can trade bullish break of structure in the following way:

- In a bullish market, the price forms higher highs and higher lows. This indicates a strong uptrend. A BoS occurs when the price breaks above a previous high, signaling continued bullish momentum.

- After BOS, we can mark our first pullback or other liquidity zone as inducement zone. It is possible that market may approach the zone and grab liquidity. Inducement refers to a price level that entices traders into taking positions, often leading them into traps. When the market breaks a structure and creates a new high, it might leave behind unfilled orders or liquidity at certain levels, often below the most recent pullback.

- After marking the inducement, wait for the price to retrace back to this level. This retracement often occurs because the market seeks to fill unfilled orders or grab liquidity left behind.

- Once the price grabs the inducement, you can start looking for buy trades. However, it’s essential to confirm the entry using additional signals. Look for a shift in market structure, such as the formation of a higher low on a lower time frame, which indicates the resumption of the bullish trend.

Trading with Bearish Break of Structure

We can trade the bearish continuation in the same way:

- In a bearish market, the price generally makes lower highs and lower lows, reflecting a downtrend. A BoS occurs when the price breaks below a previous low, indicating continued bearish momentum.

- Similar to a bullish market, after a structure break, certain price levels may act as inducements where the price could retrace. These are often levels above the most recent lower high, where liquidity or unfilled orders exist. Mark these levels as inducement zones, as they are likely areas where the price will retrace before continuing its downward movement.

- After marking the inducement zone, wait for the price to retrace back to this level. The retracement is the market’s way of grabbing liquidity before continuing its downward trend. When the price retraces and grabs the inducement, it’s a strong indication that the bearish trend is ready to resume.

- Once the price grabs the inducement, you can look for sell trades, but like in the bullish scenario, you need confirmation. Look for a shift in market structure on a lower time frame, such as the formation of a lower high, indicating the continuation of the bearish trend.

Final Note

In trading, understanding Break of Structure and inducement is crucial for strategic entries. However, these concepts should be used alongside thorough analysis and confirmation signals. Always consider the risk of false signals and unexpected market movements. Trading involves significant risk, and it’s essential to use proper risk management strategies, such as setting stop-losses and position sizing, to protect your capital. Only trade with money you can afford to lose.

Frequently Asked Question (FAQs)

What is a Break of Structure (BoS) in trading?

A Break of Structure (BoS) occurs when the price violates a key level in the market structure, such as breaking above a previous high in an uptrend or below a previous low in a downtrend. It often signals a potential change or continuation of the trend.

How does inducement relate to Break of Structure?

After a BoS, the price often retraces to an inducement zone where unfilled orders or liquidity are located. This retracement is typically a precursor to the continuation of the trend, providing an opportunity for traders to enter the market.

What time frames are best for observing BoS and inducement?

BoS and inducement can be observed on various time frames. Higher time frames (daily, 4-hour) provide stronger signals, while lower time frames (1-hour, 15-minute) are useful for confirming entries and finding precise trade setups.

Is it necessary to wait for price retracement to the inducement zone?

While waiting for a retracement to the inducement zone increases the probability of a successful trade, it’s not always necessary. Some traders may choose to enter after a strong BoS with other confirming factors, but this approach carries higher risk.

I’m Abdullah Shah, a content writer with three years of experience in crafting engaging and informative content. My background in market analysis complements my work, allowing me to create content that resonates with audiences. I’m also a seasoned practitioner in the forex and crypto markets, with a strong foundation and deep interest in finance. My passion for the financial world drives me to produce content that is both insightful and valuable for those interested in understanding market trends and financial strategies.