Table of Contents

ICT Intraday trading requires an in-depth understanding of market structure, liquidity sweeps and market protractions. For better intraday trading in London trading session, Micheal J. Huddleston presented ICT Intraday Profiles. These profiles are based on Central Bank Dealers Range and Asian range liquidity sweep. These concepts are help traders identify key moments when liquidity is engineered and provides opportunities for high-probability trade entries.

This article explores understanding of ICT intraday profiles, its types and its usage in bullish and bearish markets.

Understanding of ICT Intraday Profiles

Normally, there are three key phases that are involved in the formation of ICT Intraday profiles. Initial phase includes CBDR and Asian Range formation. This phase establishes the key trading range for the upcoming session. The upper and lower area of the trading range is considered as sensitive and expected liquidity zones where price might react.

The second phase is the formation of market protraction or judas swing. Remember, intraday profiles are time sensitive. Market protraction or judas swing, in this case, is the liquidity sweep. Liquidity Sweep often occurs between 12:00 AM and 2:00 AM (New York time). Price creates a false breakout above or below CBDR before reversing. This protraction move is designed to trap early traders before trending in the Smart money intended direction.

Last phase is the continuation of market in its intended direction. After capturing stop losses of early traders, price trends in its intended direction. This trap move is against the daily directional bias. So, the continuation of the trend in its intended direction align market with its directional bias.

For an ICT intraday profile to be valid, there are conditions that should be met. First the CBDR range should be less than 40 pips. Secondly, the Asian range should be between 20-30 pips. Judas swing should occur after 12:00 AM.

ICT Intraday Sell Profile

In intraday sell profiles, we usually are aimed at finding two types of sell profiles: London Normal Protraction Sell Profile, and London Delayed Protraction Sell Profile.

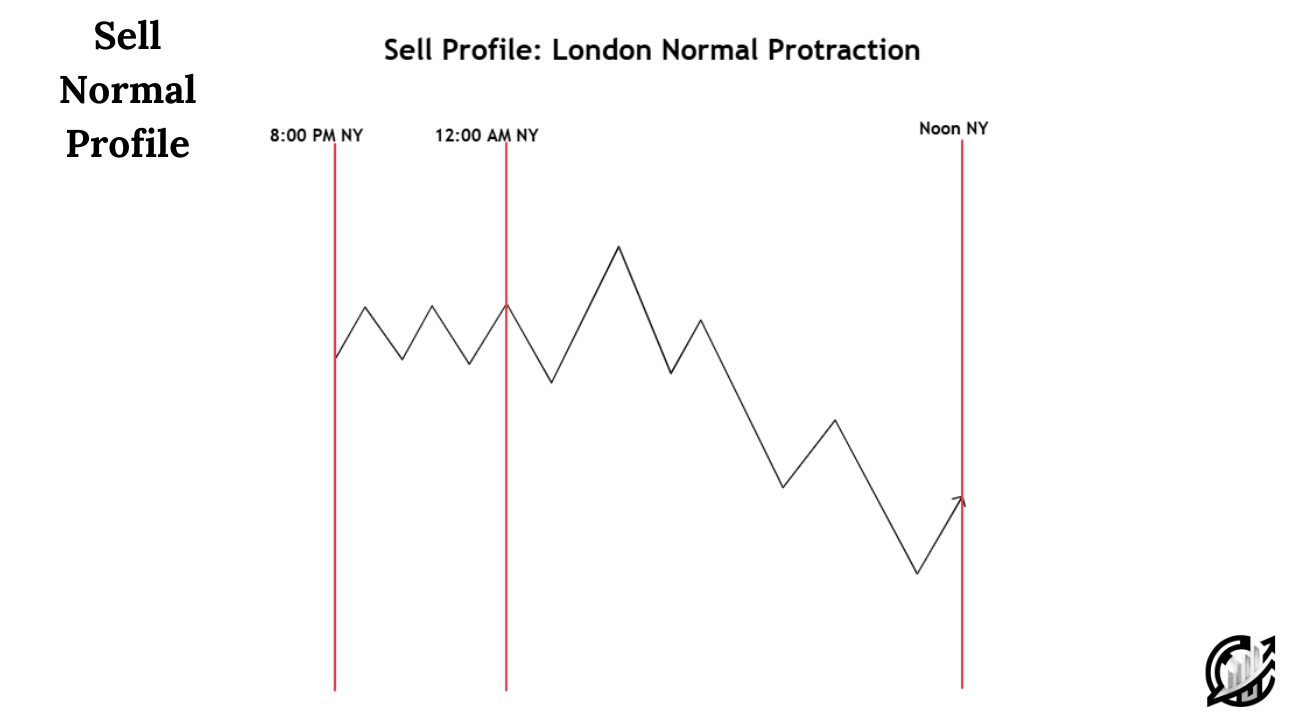

London Normal Protraction Sell Profile

This type of sell profile follows a structured movement. For the profile to be considered as valid our intraday market structure should be bearish, One must confirm the bearish directional bias for the day. In the sell profile, price rallies after 12:00 AM. This rally forms a judas swing price move.

This judas swing price movement is a market protraction. The protraction buy move should not exceed 2-3 standard deviations of CBDR. Traders anticipate price reversal from the area to the opposite side and continue price movement in its intended direction.

Trading with London Normal Protraction Sell Profile

This covers the following steps:

- Confirm the bearish market structure and the bearish directional bias on the daily chart.

- Ensure that the CBDR is less than 40 pips and the Asian Range is 20-30 pips.

- Watch for the price to rally after 12:00 AM but before 2:00 AM. All the timing referred in this article is New York Local time.

- Once price reaches a premium zone, look for a Market structure shift on a lower timeframe. It would be better to use 3 or 1-minute chart for trade entries.

- Enter a sell trade at a premium price and place a stop loss above the London session high.

- Your take profit target should be near a discount PD array or sell-side liquidity.

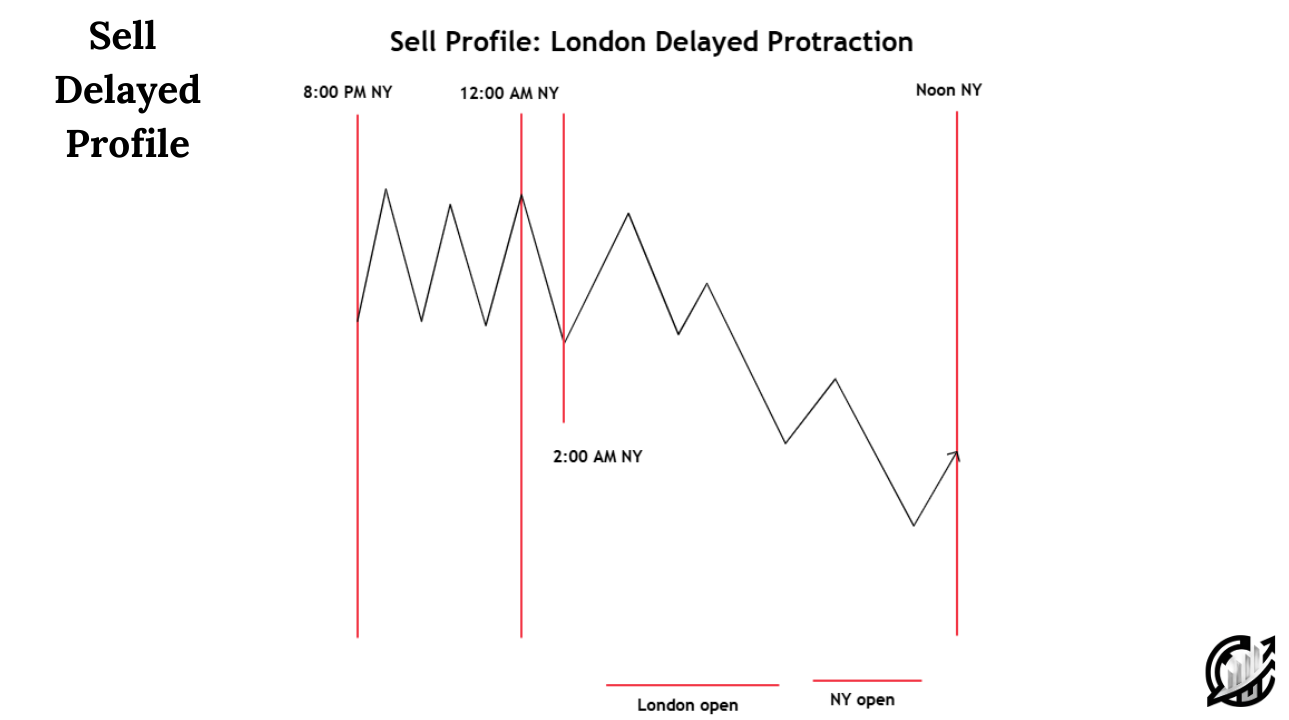

London Delayed Protraction Sell Profile

This type of sell profile follows a structured movement but with. For the delayed protraction sell profile to be considered as valid our intraday market structure should be bearish, One must confirm the bearish directional bias for the day. In the sell profile, price does not rally after 12:00 AM.

In simple words, protraction is delayed and the market may or may not have a favorable CBDR. It is advised to look for intraday premium PD Arrays to short on retracement.

Trading with London Delayed Protraction Sell Profile

This covers the following steps:

- Wait for the Price to rally after 12:00 AM.

- Confirm the bearish market structure and the bearish directional bias on the daily chart.

- There is no Judas swing like formation. It become crucial for traders to mark ICT dealing range and identify intraday premium zone.

- Wait for the price to reach premium zone PD array before entering a short trade.

- Once price reaches a premium zone, look for a Market structure shift on a lower timeframe. It would be better to use 3 or 1-minute chart for trade entries.

- Enter a sell trade at a premium price and place a stop loss above the ICT dealing range.

- Your take profit target should be near a discount PD array or sell-side liquidity.

ICT Intraday Buy Profile

In intraday sell profiles, we usually are aimed at finding two types of Buy profiles: London Normal Protraction Buy Profile, and London Delayed Protraction Buy Profile.

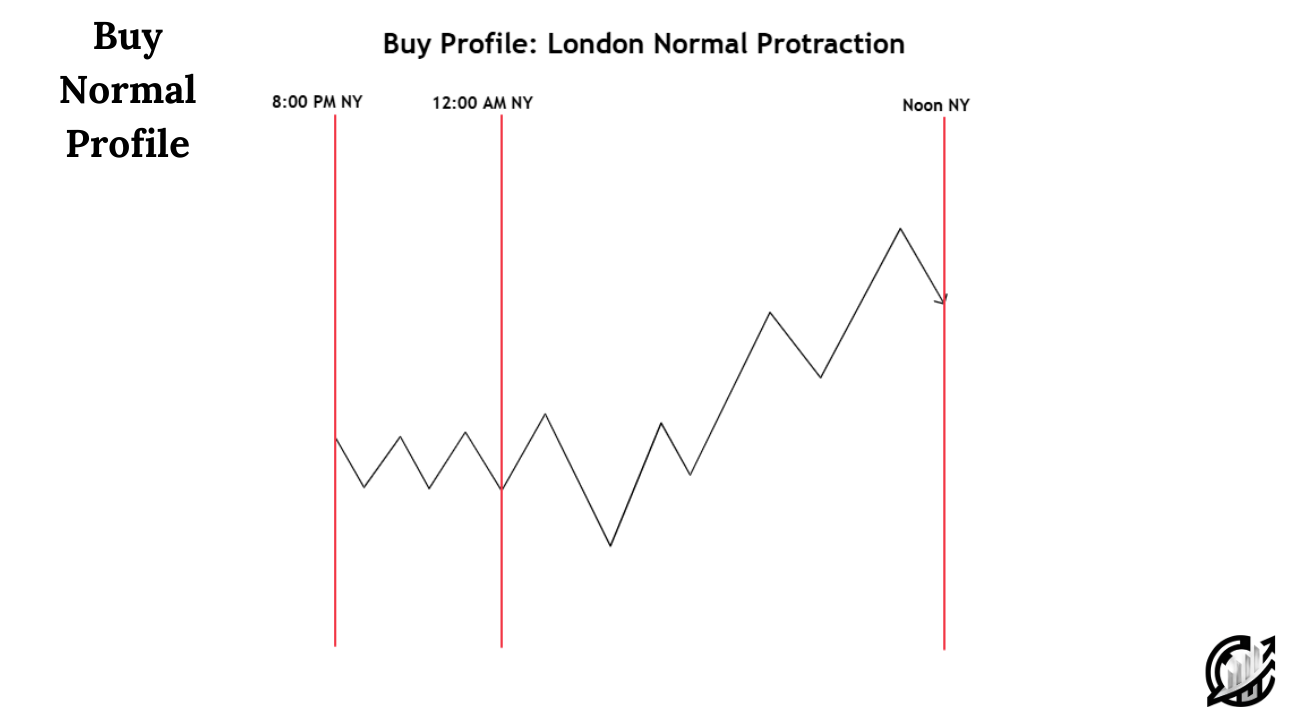

London Normal Protraction Buy Profile

This type of Buy profile follows a structured movement. For the profile to be considered as valid, our intraday market structure should be bullish, One must confirm the bullish directional bias for the day. In the buy profile, price trends down after 12:00 AM. This down move forms a judas swing price move.

This judas swing price movement is a market protraction. The protraction sell move should not exceed 2-3 standard deviations of CBDR. Traders anticipate price reversal from the area to the opposite side and continue price movement in its intended bullish direction.

Trading with London Normal Protraction Buy Profile

This covers the following steps:

- Confirm the bullish market structure and the bullish directional bias on the daily chart.

- Ensure that the CBDR is less than 40 pips and the Asian Range is 20-30 pips.

- Watch for the price to form down move after 12:00 AM but before 2:00 AM. All the timing referred in this article is New York Local time.

- Once price reaches a discount zone, look for a Market structure shift on a lower timeframe. It would be better to use 3 or 1-minute chart for trade entries.

- Enter a buy trade at a discount price and place a stop loss below the London session low.

- Your take profit target should be near a premium PD array or buy-side liquidity.

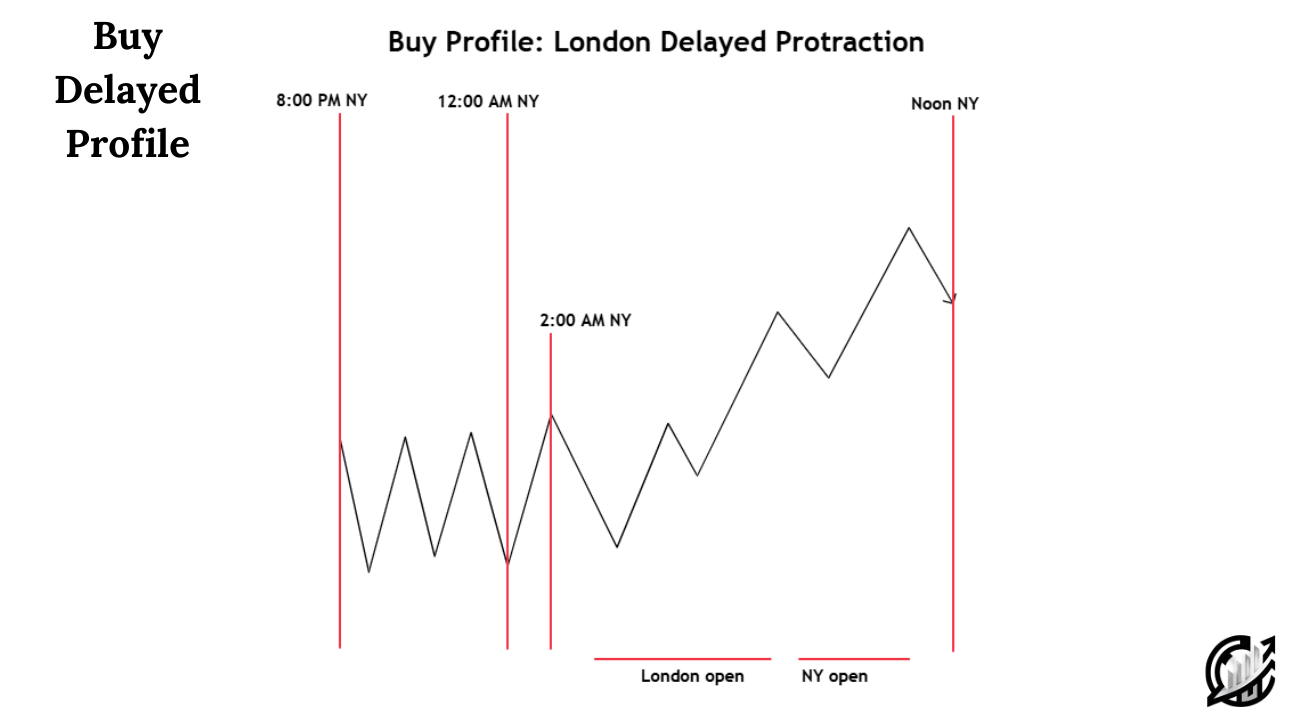

London Delayed Protraction Buy Profile

This type of Buy profile follows a structured movement. For the delayed protraction Buy profile to be considered as valid, our intraday market structure should be bullish. One must confirm the bullish directional bias for the day. In the buy profile, price does not trend down or form judas swing after 12:00 AM.

In simple words, protraction (fake price move which is not the smart money intended direction) is delayed and the market may or may not have a favorable CBDR. It is advised to look for intraday discount PD Arrays to take long trade on retracement.

Trading with London Delayed Protraction Buy Profile

This covers the following steps:

- Wait for the Price to move down after 12:00 AM.

- Confirm the bullish market structure and the bullish directional bias on the daily chart.

- There is no Judas swing like formation. It becomes crucial for traders to mark ICT dealing range and identify intraday discount zone.

- Wait for the price to reach discount zone PD array before entering a long trade.

- Once price reaches a discount zone, look for a Market structure shift on a lower timeframe. It would be better to use 3 or 1-minute chart for trade entries.

- Enter a buy trade at a discount price and place a stop loss below the ICT dealing range.

- Your take profit target should be near a premium PD array or buy-side liquidity.

Final Note

In ICT trading, trading with the profiles provides structured way of trading. However, like any other ICT techniques and strategies, this provides good results but also has certain limitations. In general, success in trading depends upon discipline, and proper risk management. It is advised to back test these London profiles in those pairs that has good reputation with GBP. Forex trading carries significant risk. It may not be suitable for all investors. It is advised to trade with the funds that you can afford to lose. Remember, past price action can help in getting insights for future price action but does not guarantee accurate results. All the writings are for educational purposes.

FAQs

What are ICT Intraday Profiles?

ICT Intraday Profiles are structured trading setups based on the ICT Central Bank Dealers Range (CBDR) and ICT Asian Range liquidity sweep. These profiles help traders identify high-probability trade setups using liquidity engineering, Judas Swings, and market structure shifts.

How to determine the directional bias for ICT Intraday Profiles?

Directional bias is determined using higher timeframes (Daily/4-Hour), key liquidity zones, and ICT concepts like Break of Structure (BOS) and Market Structure Shift (MSS).

Can ICT Intraday Profiles be used for markets other than forex?

Yes, these concepts were first tested on indices (Nasdaq 100, E-mini S&P 500) but have been successfully applied to forex pairs (EUR/USD, GBP/USD, USD/JPY) and metals (Gold, Silver).

I’m Abdullah Shah, a content writer with three years of experience in crafting engaging and informative content. My background in market analysis complements my work, allowing me to create content that resonates with audiences. I’m also a seasoned practitioner in the forex and crypto markets, with a strong foundation and deep interest in finance. My passion for the financial world drives me to produce content that is both insightful and valuable for those interested in understanding market trends and financial strategies.