Table of Contents

Market moves from balanced state to an imbalanced state, and then an imbalanced state to a balanced state. Imbalances are common in trading. In SMC and ICT, imbalances are known as Fair Value Gap. There are two types of imbalances in financial market: BISI and SIBI. BISI (Buy-side imbalance and sell side inefficiency) appears in bullish price movement. SIBI (Sell side imbalance and buy side inefficiency) appears in bearish price movement.

This article explores understanding of BISI and SIBI, and identification and trading with BISI and SIBI. Having an understanding of BISI and SIBI allows us marks actual Fair Value Gap.

Buy-side Imbalance Sell Side Inefficiency (BISI)

In ICT and SMC trading, BISI is a strong one directional bullish price movement. It highlights an area of Fair Value Gap (FVG) created by an upward impulse price movement. This price movement is dominated by buyers, and there is a limited sell-side activity. This imbalance signals strong buying pressure and inefficient participation from sellers.

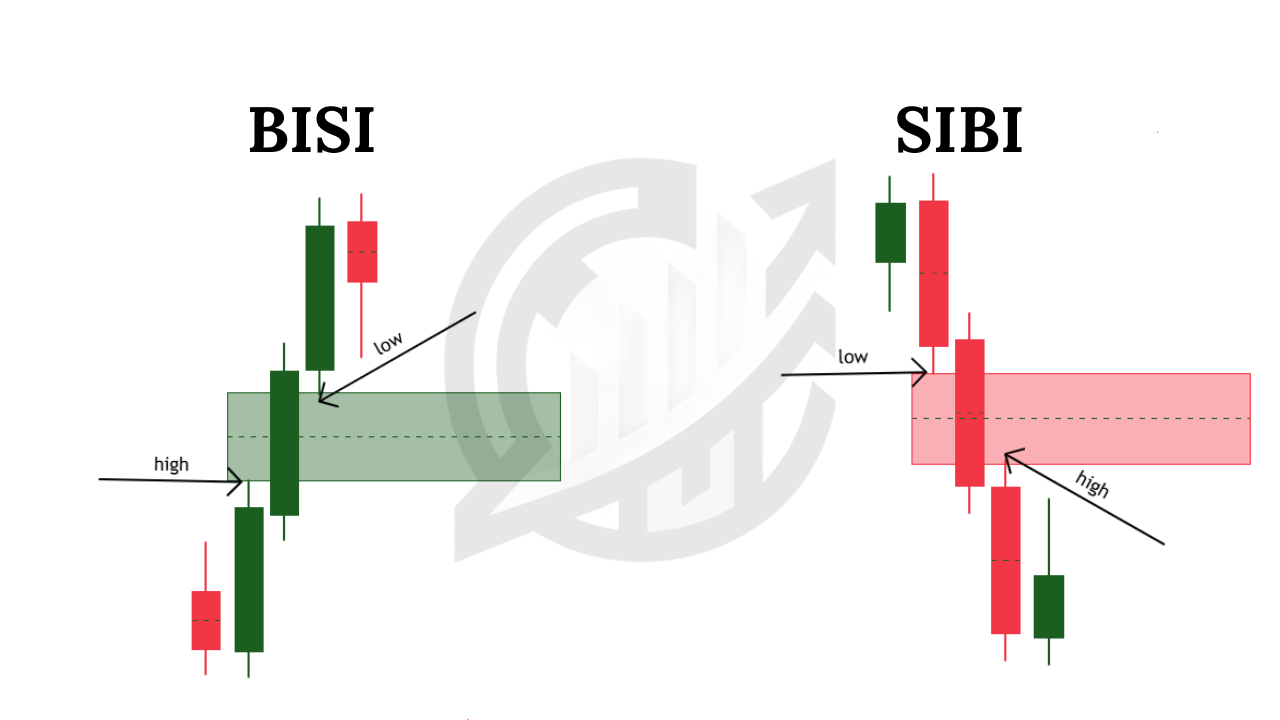

BISI is a type of Fair Value Gap (FVG) form by three candlesticks. Each candlestick is composed of large bodies from minimal to no wick. This reflects a sustained upward price move. This imbalance occurs when a gap is created between the high of the first candle and the low of the third candle.

This formation of Buy-side imbalance and Sell-side inefficiency is important for us because it tells us about the presence of institutional activity. These imbalances occurs when large buy orders are executed. These large buy orders become fuel for abrupt price movement towards upside. The zones of BISI is an area of interest for traders because price often retraces to fill all the pending orders reside inside this area before continuing its bullish trend.

BISI is a valuable concept used in trading along with other SMC and ICT tools. It allows traders to align their strategies with institutional order flow and capitalize on high-probability opportunities. Most important thing is that BISI signifies the dominance of buyers which provides clear edge in market analysis.

Sell side Imbalance Buy side Inefficiency (SIBI)

In ICT and SMC trading, SIBI is a strong one directional bearish price movement. It highlights an area of Fair Value Gap (FVG) created by a downward impulse price movement. This price movement is dominated by sellers, and there is a limited sell-side activity. This imbalance signals strong selling pressure and inefficient participation from buyers.

SIBI is a type of Fair Value Gap (FVG) form by three candlesticks. Each candlestick is composed of large bodies from minimal to no wick. This reflects a sustained downward price move. This imbalance occurs when a gap is created between the low of the first candle and the high of the third candle.

This formation of Sell-side imbalance and Buy-side inefficiency is important for us because it tells us about the presence of institutional activity. These imbalances occurs when large sell orders are executed. These large sell orders become fuel for abrupt price movement towards downside. The zones of SIBI are an area of interest for traders because price often retraces to fill all the pending sell orders reside inside this area before continuing its bearish trend.

SIBI is a valuable concept used in trading along with other SMC and ICT tools. It allows traders to align their strategies with institutional order flow and capitalize on high-probability opportunities. Most important thing is that SIBI signifies the dominance of sellers which provides clear edge in market analysis.

Trading with SIBI and BISI

BISI and SIBI is a useful and powerful concept in trading. It is advisable not to trade using these until you get confirmation by using confluence of other ICT concepts. Traders align BISI and SIBI with other ICT concepts like PD Array, Premium and discount zones, order block and market structure shifts. This helps traders devising better trading strategy with ICT trading.

Using SIBI in Trading

Sell side imbalance buy side inefficiency (SIBI) can be used as an entry confirmation for sell traders. Probability increases when SIBI is combined with Market Structure Shift or Break of structure (BOS). After MSS or BOS, price forms a SIBI zone and retraces into it, traders should look for bearish confirmation signals like rejection candles or liquidity sweeps.

SIBI can act as a strong resistance. This zone prevents price from moving higher. This area becomes an area of interest for institutional traders. Institutional traders aggressively take short positions, it becomes a liquidity zone where price struggles to break through. If price retraces into a SIBI zone and fails to close above it, it signals bearish momentum.

Risk management comes first when it comes to trade execution. A well-placed stop-loss is the foundational factor of risk management. SIBI, in this case provides an ideal reference. The safest stop-loss placement is above the high of the first candle in the SIBI structure. This can protect our trade from liquidity hunts.

Using BISI in Trading

Buy side imbalance Sell side inefficiency (SIBI) can be used as an entry confirmation for buy trades. Probability increases when BISI is combined with Market Structure Shift or Break of structure (BOS). After MSS or BOS, price forms a BISI zone and retraces into it, traders should look for bullish confirmation signals like rejection candles or liquidity sweeps.

BISI can act as a strong support area. This zone prevents price from moving lower. This area becomes an area of interest for institutional traders. Institutional traders aggressively take long positions, it becomes a liquidity zone where price struggles to break through. If price retraces into a BISI zone and fails to close below it, it signals bullish momentum.

Risk management comes first when it comes to trade execution. A well-placed stop-loss is the foundational factor of risk management. BISI, in this case provides an ideal reference. The safest stop-loss placement is above the low of the first candle in the BISI structure. This can protect our trade from liquidity hunts.

Final Note

BISI and SIBI is a valuable concept in SMC and ICT trading. Imbalances and inefficiencies are foundational concepts in smart money trading, especially ICT trading. This provides insights into institutional order flow. We use concepts like these for trade execution and exit. Remember, BISI and SIBI must be used alongside other ICT concepts like MSS and liquidity analysis.

Trading involves huge risk for small capital investors, and is not suitable for all investors. These writings are used for educational purposes and cannot be used alone for crafting trading strategies. Always use proper risk management and seek professional advice before trading or investing in the market.

FAQs

What is a Buy side Imbalance Sell side Inefficiency (BISI)?

In ICT concepts, BISI is a type of fair value gap. It is a Bullish Fair value Gap. In BISI, price moves up aggressively with minimal seller participation. This price movement is dominated by buyers, and there is a limited sell-side activity. This imbalance signals strong buying pressure and inefficient participation from sellers.

What is a Sell side Imbalance Buy side Inefficiency (SIBI)?

In ICT concepts, SIBI is a type of fair value gap. It is a Bearish Fair value Gap. In SIBI, price moves down aggressively with minimal buyers participation. This price movement is dominated by sellers, and there is a limited buy-side activity. This imbalance signals strong selling pressure and inefficient participation from buyers.

How do BISI and SIBI help in trading?

BISI and SIBI indicate price inefficiencies where institutions left unfilled orders. Price often retraces to these levels before continuing the trend. These levels are useful for trade entries.

How to use BISI and SIBI in Trading?

Remember, these concepts are useful but cannot be used along in trading. First, analyze market structure. This helps in finding trend reversal or continuation. Secondly, concepts like MSS, Order Block and liquidity can be used as confluence in building trading strategies.

I’m Abdullah Shah, a content writer with three years of experience in crafting engaging and informative content. My background in market analysis complements my work, allowing me to create content that resonates with audiences. I’m also a seasoned practitioner in the forex and crypto markets, with a strong foundation and deep interest in finance. My passion for the financial world drives me to produce content that is both insightful and valuable for those interested in understanding market trends and financial strategies.