Table of Contents

Anticipating market move for a day is an important task for day traders while analyzing market. The only thing that matters for intraday traders is finding correct bias for the day. Anticipating market direction is a complex task. ICT and SMC teachings help us to assume direction of the day (whether the market will be bullish or bearish).

This article explores its definition, checklist, identification and its use for taking trading decision.

ICT Daily Bias

In the realm of trading and investing, ICT bias refers to the anticipated market price direction for a day. It can serve as a roadmap for aligning intraday trades with the market’s higher probability path. Accurately predicting the direction of the market is a central thing in ICT methodology. Every setup could get failed if the identified bias is wrong. Along with that it could lead to emotional and psychological breakdown.

Identification of the bias starts with higher timeframe analysis. For the purpose, trader should clearly internalize the concept of market structure. The daily chart provides the clearest view of market structure. It gives us the understanding of whether the market is bullish, bearish or consolidating. In market structure, we observe the formation of higher high and lows for bullish bias and lower highs and lows for bearish bias.

Essentials of Trading Daily Bias

Micheal J. Huddlestone emphasizes that teaching daily bias is not about predicting the exact bias for every trading day from Monday to Friday. Instead of being reluctant in the prediction of market direction, teaching daily bias is about equipping traders with tools and concepts to independently determine bias across various markets.

Huddlestone highlights the importance of core concepts such as daily timeframe institutional order flow, imbalances and liquidity draws along with liquidity sweeps. These concepts provide a foundation for understanding how institutions influence price movements. He emphasizes that these concepts are not all and all in market analysis. There are number of things that can be done to get a better opinion about the next day market direction.

Identification of ICT Daily Bias

For true identification of ICT Daily Bias, we must follow the guidelines outlined by Michael Huddleston. The element described by Micheal allows us to align our trades with institutional order flow.

Daily Timeframe Order Flow and market structure

It is the cornerstone of identification of ICT Daily bias. It allows to look broader institutional order flow. According to Micheal, Banks and Institutional players rely primarily on the daily chart to execute large traders effectively and efficiently. Traders are advised to observe market structure on daily chart.

- Bullish order flow is characterized by higher highs and higher lows. This type of structure signals upward momentum.

- On the other hand, Bearish order flow is defined by creating lower highs and lower lows. It indicates downward momentum. By carefully analyzing the daily chart, traders can find out whether the market is trending, consolidating or preparing to reverse its direction.

Rebalancing the Imbalances

Price move for two reasons, one of which is to rebalance imbalances in the market. Imbalances, such as Fair Value Gaps (FVGs), are areas on the chart where price moved too quickly, leaving inefficiencies between buyers and sellers.

- To identify imbalances, look for large, untested gaps in price caused by aggressive institutional orders.

- Price often seeks these areas to rebalance, providing high-probability zones for potential reversals or continuations. Traders should monitor whether the market is gravitating toward an imbalance above or below the current price. This behavior offers clues about the next likely price direction.

Draw on Liquidity

The other second reason of price movement is the hunt for liquidity. Institutions target liquidity pools. These liquidity pools can be buy stops, sell stops and other types of pending orders in the market.

ICT Bullish Daily Bias

Having a Bullish Daily Bias indicates that the anticipated price movement for the day is to the upside. This bias is often driven by two primary factors: Bullish order flow or the next draw on liquidity. These factors signal that price is likely to rise as it seeks liquidity or rebalances an imbalances

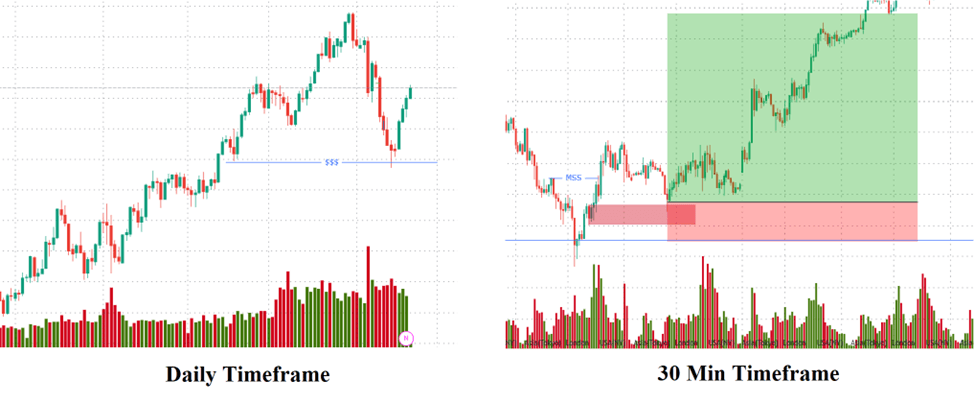

After the bullish bias is confirmed, the step is to shift in lower timeframe and market Point of interest (POIs) on the chart. These POIs can be Order Blocks, Breaker Blocks, and FVGs. These are Key POIs and can act as potential zones where price may react favorably for trade setups.

To Execute a trade, Drop to a lower timeframe. Lower timeframe can be a 30 min or 15 min chart. Wait for the price to create MSS and then test your chosen POI and show an entry confirmation. Once the confirmation is evident, you can execute a buy trade. Your first target should be the next liquidity area.

This method allows traders to trade with flow of the trend and helps traders to trade with higher timeframe bias.

Here is the Example:

ICT Bearish Daily Bias

Having a Bearish Daily Bias indicates that the anticipated price movement for the day is to the down side. This bias is often driven by two primary factors: Bearish order flow or the next draw on liquidity. These factors signal that price is likely to decline as it seeks liquidity or rebalances an imbalances

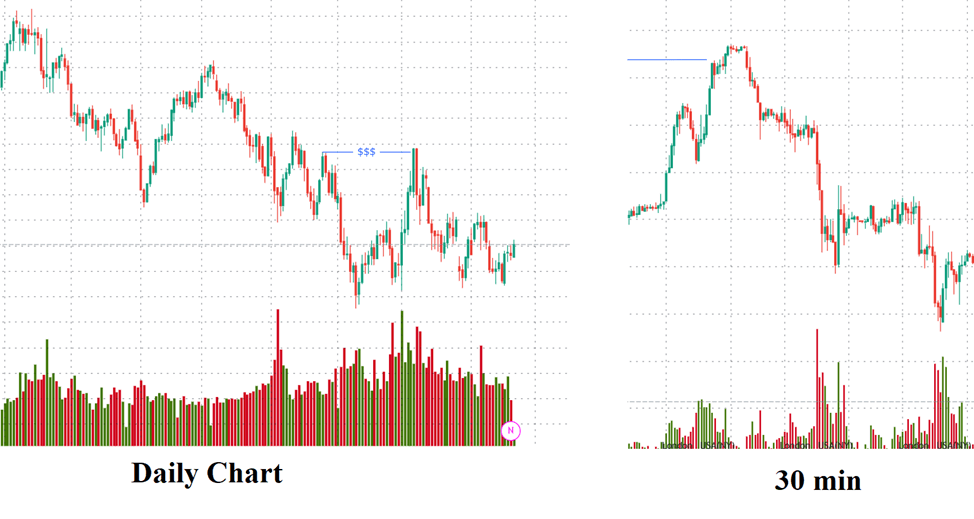

After the bearish bias is confirmed, the step is to shift in lower timeframe and market Point of interest (POIs) on the chart. These POIs can be Order Blocks, Breaker Blocks, and FVGs. These are Key POIs and can act as potential zones where price may react favorably for trade setups.

To Execute a trade, Drop to a lower timeframe. Lower timeframe can be 30 min or 15 min chart. Wait for the price to create MSS (Market Structure Shift) and then test your chosen POI and show an entry confirmation. Once the confirmation is evident, you can execute a sell trade. Your first target should be the next liquidity area.

This method allows traders to trade with flow of the trend and helps traders to trade with higher timeframe bias. Sometime market just sweeps the liquidity resting above the old highs and reverse its directions.

Here is the Example:

Final Note

Trading based on daily bias requires skill, patience, and adherence to proven strategies. While concepts like order flow, liquidity, and key levels can significantly improve trade precision, no strategy guarantees success. Always use proper risk management, such as setting stop-loss orders and limiting position sizes, to protect your capital.

Risk Disclosure: Trading forex, crypto, or other markets involves substantial risk and may not be suitable for all investors. Past performance is not indicative of future results. Only trade with money you can afford to lose, and consider seeking advice from a financial professional before engaging in live trading.

Frequently Asked Questions (FAQs)

What is ICT Daily Bias?

ICT Daily Bias is the anticipated direction of daily price movement based on higher timeframe analysis, order flow, liquidity levels, and imbalances. It helps traders align their trades with institutional market flow.

What are points of interest (POIs) for Bias?

Key Point of Interests are Order Blocks, Breaker Blocks, Fair value gaps or any other supply/demand areas.

Which timeframes are best to use for trade execution?

For execution, shift to lower timeframes, such as the 15-minute or 30-minute chart, to refine entries near POIs.

What confirmation signals to look for?

Always look for Market Structure Shifts (e.g., break of resistance or higher lows), and rejections or reactions at the marked POIs.

How to manage risk in bullish or bearish bias trades?

It is crucial to use stop-loss orders and risk only a small percentage (e.g., 1-2%) of your account per trade.

I’m Aatiq Shah, a dedicated forex and crypto market practitioner with three years of hands-on experience. Currently, I’m working as a Financial Manager. My journey in the world of finance has equipped me with the skills and knowledge needed to navigate the complexities of the forex and crypto markets.