Table of Contents

In ICT trading, analyst often look for manipulation before executing a trading decision. ICT Power of 3 is a concept associated with manipulation by institutions and market makers. This helps us to avoid institutional traps. In this article, we will explore the use of accumulation, manipulation and distribution. It helps to follow the foot prints of institutions and market makers.

Understanding ICT Power of 3 (AMD Setup)

It is also referred to as AMD setup. It a trading approach in ICT concepts that breaks down the typical daily price movement into three phases. Timing is crucial to consider. It is combined with three major sessions to derive a better trading strategy. ICT power of 3 helps traders align their strategies with the behavior of “smart money”.

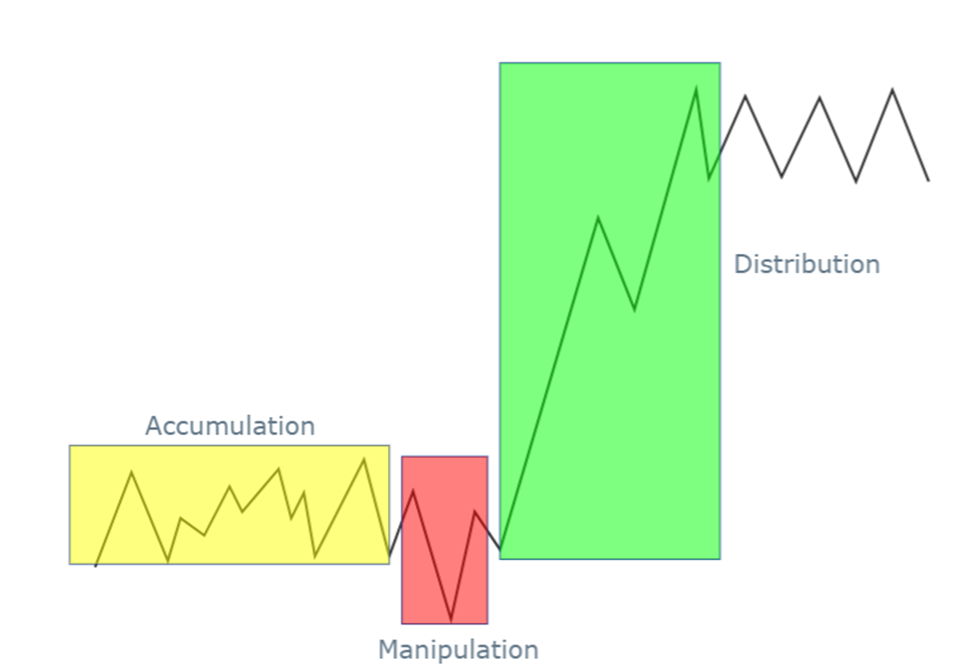

Wyckoff, in his studies, emphasizes especially on Accumulation phase of the market. ICT trading does the same in their understanding of the market. This phase usually happens at the beginning of the trading day, especially when market is ranging in specific zone (with no clear trend). During the time, BIG MONEY is accumulating their positions. It sets the ground for the next phases.

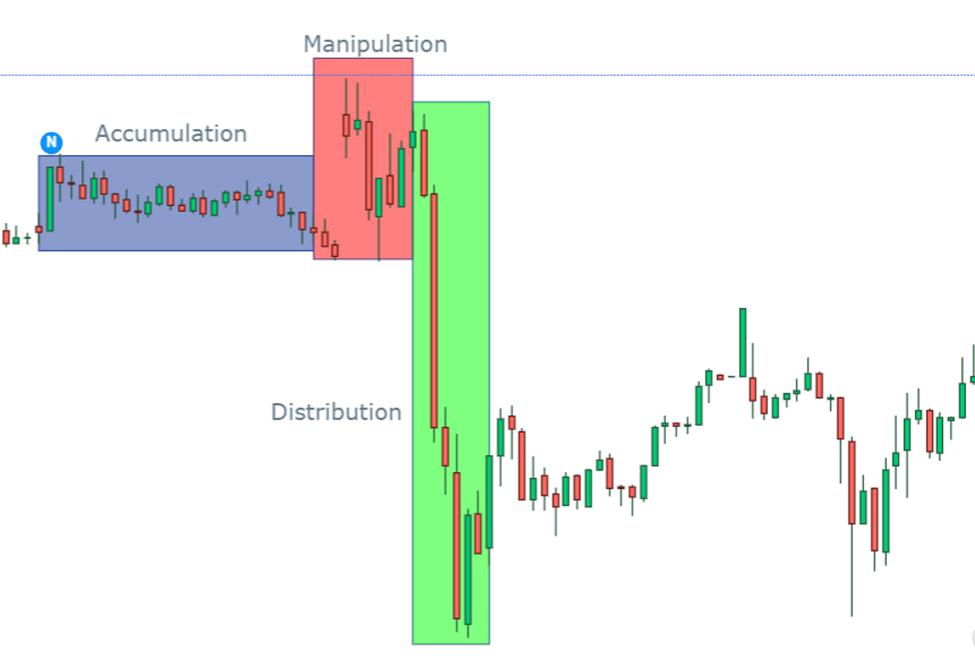

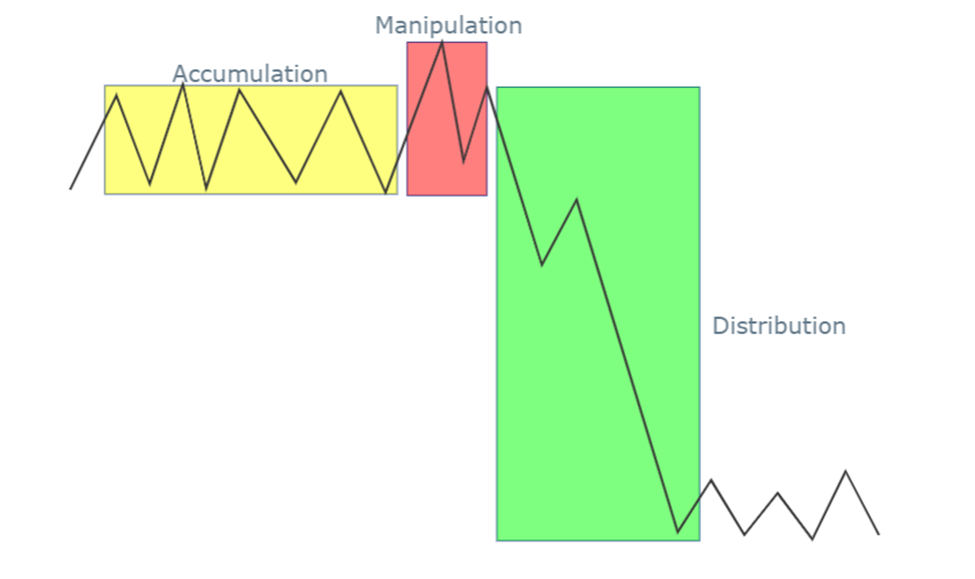

Retailers are mostly unaware about the traps of the market. Manipulation phase occurs when institutions and market makers move the market in opposite direction. Trap moves are designed to target stop-losses near the level.

In bullish market, it appears with a sudden down move. In bearish market, manipulation phase appears with a sharp upward move. The movement is designed by tricking retail traders into thinking that market is going bullish. The goal of this phase is to grab liquidity by triggering stop-losses and enticing retail traders to enter positions in the wrong direction.

Distribution phase is the last and completes AMD setup. ICT traders wait for the movement of the phase and capitalize of it. After manipulating retail traders, institutions and market makers cause the market to move in the intended direction.

If market is manipulated upward, the next move would be the downtrend. If market is manipulated downward, the next move would be the uptrend movement. This phase usually carries the most momentum and defines the overall market direction for the day.

Power of 3 In Bullish Market

At the start of the trading session, prices often range near the opening price, indicating that smart money is accumulating buy positions. In this phase, marking is calm with no clear indication of trend movement. This phase is a phase of confusion for retail traders. They hesitate to make decision.

Institutions and big money then manipulate the market by creating a sharp sell move below the opening price. This downward spike is designed to induce retail traders into thinking that the market is reversing or breaking out to the downside. The price drops below old lows, which many retail traders mark as potential support levels.

Retail traders view this sudden move as a breakout to the downside. They believe the price will continue to drop, they enter short positions (sell positions) in the market. Retail traders with assets bought in the accumulation phase have their stop-loss orders triggered as the price dips below old lows, which neutralizes their buy positions. This action provides liquidity to the smart money.

With liquidity now engineered and price at a discount, smart money begins to buy heavily. This buying pressure causes the market to reverse direction and move upwards, starting the distribution phase.

The smart money’s target is the old highs, where stop-loss orders from retail traders who went short earlier are likely sitting. Once the price reaches this level, it sweeps these stops, triggering a final burst of upward momentum as retail sellers cover their positions.

Power of 3 in Bearish Market

As the day begins, prices accumulate near the opening price. In accumulation phase, smart money is building their sell positions. Market is consolidated in tight range giving no trend. Institutions are quietly accumulating their sell positions, anticipating a downward move later in the day. They are aware that liquidity (stop losses) lies above key levels like previous highs.

After the accumulation phase, smart money initiates a sharp bullish move above the opening price. This false move is designed to manipulate retail traders into thinking that the market is breaking out to the upside.

Retail traders with short positions now see their stop-loss orders (buy stops) triggered as the price goes above old highs. This neutralizes their sell positions and provides additional liquidity to smart money.

Institutions engineers this fake out above the opening price. They target the old highs and tricks retail trader into buying of an asset. Once liquidity has been gathered, smart money steps in to sell at a premium, and capitalize on market movement.

As institutions adds to their sell positions, the market starts its distribution phase. In this phase, the market reverses direction and moving in the real bearish trend. The move accelerates as more retail traders who were trapped in long positions are forced to sell, driving the price down further.

By recognizing these phases in real time, traders can better time their entries and exits, and avoid being caught on the wrong side of the market. This strategy also emphasizes how institutional players control price movements by exploiting retail traders’ emotions and stop-losses.

Final Note

Trading financial markets, including forex, stocks, and other assets, carries a significant level of risk and may not be suitable for all investors. Market conditions can be volatile, and there is always the possibility of sustaining substantial losses, potentially exceeding your initial investment. It’s crucial to only trade with money you can afford to lose.

Frequently Asked Questions (FAQs)

What is the ICT Power of 3 strategy?

The ICT Power of 3 strategy, also known as the AMD Setup, refers to a method of analyzing daily market movements based on three phases: Accumulation, Manipulation, and Distribution. It focuses on how smart money (institutional traders) influences price action by first accumulating positions, then manipulating retail traders through false moves, and finally distributing positions in the real direction of the trend.

What are the three phases in the ICT Power of 3 strategy?

Accumulation: At the beginning of the trading day, smart money builds positions near the opening price in a range-bound market.

Manipulation: Smart money initiates a false move (upward on a bearish day or downward on a bullish day) to trap retail traders and trigger stop-loss orders.

Distribution: Smart money adds to its positions and pushes the price in the real direction (downward on a bearish day, upward on a bullish day), profiting from the market move while retail traders are left on the wrong side.

Does the ICT Power of 3 work in all market conditions?

While the ICT Power of 3 strategy is effective in many market conditions, it is not foolproof. It works best in trending markets where smart money is actively influencing price action. In highly volatile or choppy markets, the phases may not be as easily recognizable.

I’m Aatiq Shah, a dedicated forex and crypto market practitioner with three years of hands-on experience. Currently, I’m working as a Financial Manager. My journey in the world of finance has equipped me with the skills and knowledge needed to navigate the complexities of the forex and crypto markets.